Is seamless payment processing crucial for your business? Comprehensive financial solutions are paramount for growth.

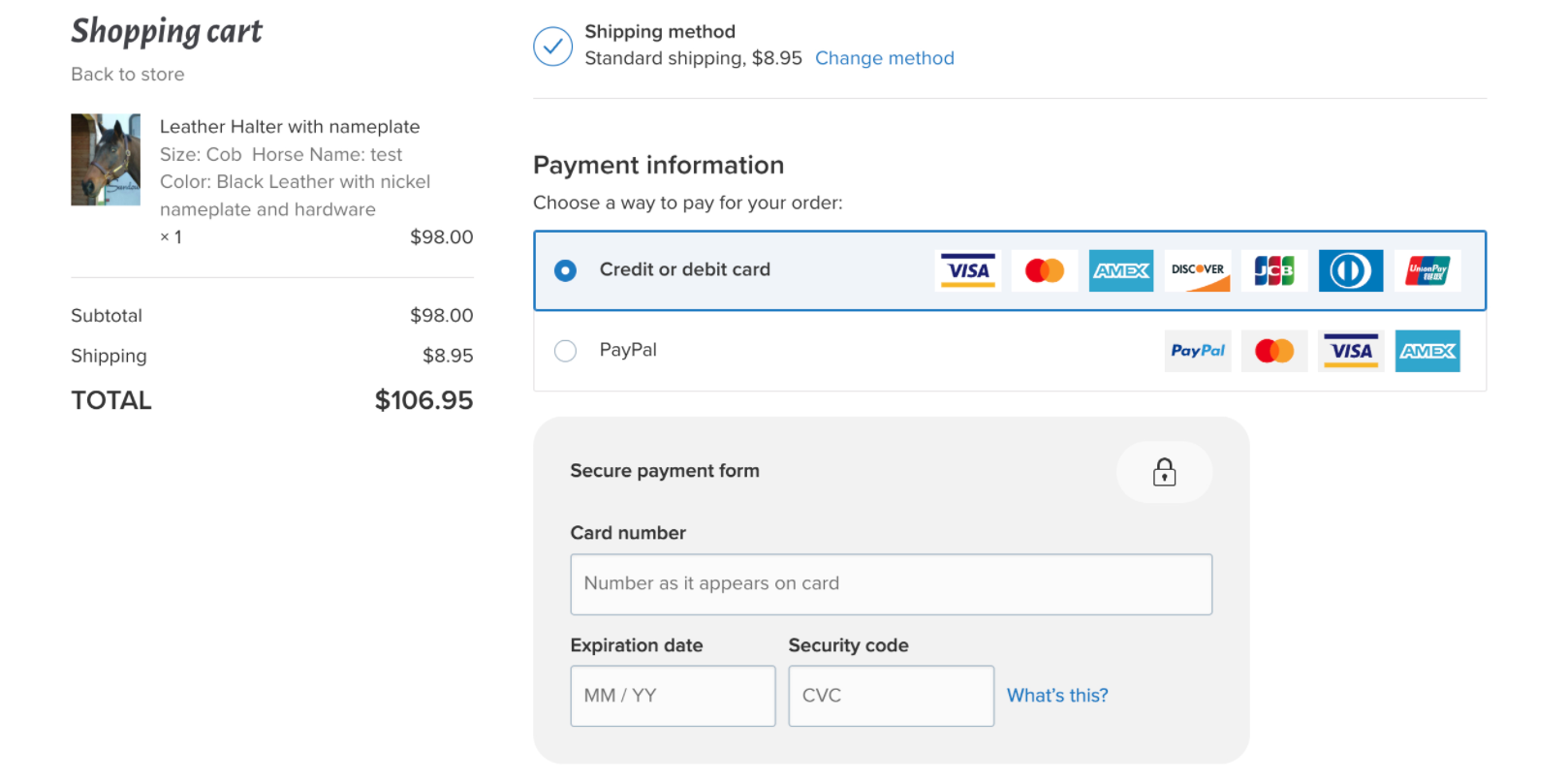

Financial transaction support systems are vital for businesses accepting various payment methods. These systems facilitate the handling of transactions, from initial authorization to final settlement. They typically include features such as fraud prevention, reporting and reconciliation, and potentially dispute resolution. Examples of these systems might include those handling credit card processing, bank transfers, and other online payment options. Robust support for these systems is essential to ensuring smooth, efficient, and secure transactions, thereby minimizing risks for both businesses and customers.

The importance of robust transaction support cannot be overstated. Efficiency in handling payments allows businesses to focus on core operations. Accurate record-keeping and reporting facilitate financial analysis. A well-functioning system also protects the business from potential financial loss and reputational damage through built-in fraud mitigation and dispute resolution tools. The adoption of such systems reflects a commitment to secure and transparent financial dealings, a key factor for customer trust and business growth. The history of payment systems demonstrates a continuous evolution towards speed, security, and ease of use for all parties involved.

This exploration will now delve into the specific features and functions of these comprehensive payment processing platforms.

Stripe Support

Effective support is crucial for a robust payment processing platform. Reliable assistance minimizes disruptions and maximizes efficiency.

- Customer service

- Troubleshooting

- Documentation

- Technical assistance

- Security protocols

- Fraud prevention

Comprehensive support encompasses a range of services, from resolving immediate issues to offering ongoing guidance. Excellent customer service ensures user satisfaction. Thorough documentation streamlines onboarding and problem-solving. Prompt technical assistance addresses complex issues. Robust security protocols safeguard sensitive financial data. Proactive fraud prevention measures protect against financial losses. Each aspect contributes to a secure and reliable platform, ultimately fostering trust and encouraging user adoption. For instance, clear documentation minimizes customer support requests, freeing up agents to handle more complex queries. A strong security framework demonstrates commitment to users' financial safety.

- Former President Trumps Signature Authentic Examples Analysis

- Sms Valet Portal Manage Your Texting Effortlessly

1. Customer service

Effective customer service is integral to a robust payment processing platform like Stripe. Prompt and helpful assistance directly impacts user satisfaction, system adoption, and ultimately, the success of businesses utilizing the platform. A well-structured support system can quickly resolve issues, prevent costly delays, and build trust in the platform's reliability.

- Accessibility and Responsiveness

Customer support channels must be readily available and respond promptly to inquiries. This encompasses multiple avenues, such as phone support, email correspondence, and live chat options. Quick resolution times reduce frustration and downtime for users experiencing difficulties with transactions, account management, or technical issues. Efficient communication ensures users feel supported and valued.

- Proactive Guidance and Problem-solving

Support staff should go beyond simply addressing user complaints. Proactive guidance, through comprehensive documentation and helpful tutorials, can prevent issues from arising in the first place. Anticipating potential problems, such as common transaction errors or account setup challenges, allows for preemptive solutions and improved user experience. Expert problem-solving, particularly in complex technical situations, demonstrates commitment to user success and the platform's robustness.

- Comprehensive Knowledge Base and Documentation

A thorough and easily searchable knowledge base is invaluable. Detailed documentation about features, functionalities, troubleshooting steps, and common errors empowers users to resolve issues independently. This minimizes reliance on support staff and ensures users can effectively manage their accounts and transactions. Clear and concise instructions facilitate efficient use of the platform, ultimately reducing the need for costly external assistance.

- Personalized Support and Solutions

Users often have unique needs and challenges. Personalized support that recognizes these individual requirements can lead to more efficient problem-solving. Adapting support responses to specific user situations fosters trust and rapport. Support teams tailored to understand nuanced business requirements further optimize user experience and ensure tailored solutions are available. This level of care distinguishes a high-quality support system and fosters customer loyalty.

In summary, robust customer service within a payment processing platform like Stripe is not merely a desirable feature, but a crucial element for success. Effective communication channels, proactive problem-solving, comprehensive documentation, and personalized support all contribute to a positive user experience and ultimately increase user satisfaction, platform adoption, and business growth. A strong support system builds trust and confidence in the platform, thus minimizing potential risks and enhancing user reliance.

2. Troubleshooting

Troubleshooting forms a critical component of comprehensive payment processing support, such as Stripe. Effective troubleshooting directly influences the reliability and user experience of a payment platform. A well-developed troubleshooting process minimizes disruption to transactions, reduces customer frustration, and enhances the platform's overall efficiency. Rapid identification and resolution of issues are paramount to maintaining customer confidence and ensuring business continuity.

The significance of troubleshooting within a payment processing framework stems from its impact on operational stability and user satisfaction. A robust system for addressing technical issuesranging from simple configuration problems to complex security breachesensures smooth and secure financial transactions. Failure to effectively troubleshoot can lead to significant financial losses, reputational damage, and lost revenue for businesses utilizing payment platforms. For example, delayed or failed transactions due to unresolved technical problems can result in lost sales and customer dissatisfaction. Similarly, security breaches requiring extensive troubleshooting efforts can expose sensitive financial data and have catastrophic consequences. Proactive troubleshooting anticipates potential problems, allowing for preventative measures and reducing the likelihood of service disruptions.

In conclusion, troubleshooting is not merely a reactive process; it is a proactive and integral part of robust support infrastructure for payment processing platforms. A well-structured troubleshooting system, effectively integrated into a support framework like Stripe's, ensures stability, security, and user satisfaction. Understanding the cause-and-effect relationship between successful troubleshooting and platform performance is essential for businesses relying on seamless financial transactions.

3. Documentation

Comprehensive documentation is intrinsically linked to effective support for payment processing platforms. Accurate, readily accessible documentation serves as a crucial resource for users, significantly impacting how effectively support functions are utilized. Clear documentation minimizes the need for extensive support interactions, optimizing operational efficiency and reducing costs. A well-structured knowledge base enables users to resolve many issues independently, thus fostering self-reliance and accelerating problem resolution. This, in turn, frees up support personnel to address more complex or nuanced cases, improving overall support effectiveness.

Consider a scenario where a user experiences difficulty setting up a new payment gateway integration. Clear documentation, outlining step-by-step procedures and troubleshooting guides, allows the user to identify and resolve the issue independently. This reduces the burden on support teams, enabling them to focus on more intricate problems. Conversely, inadequate documentation forces users to rely heavily on support, leading to increased response times and potential delays in crucial business processes. Real-world examples abound; poorly documented systems necessitate significant support interactions, potentially increasing operational costs and negatively impacting user satisfaction. In contrast, well-documented systems facilitate self-service, empowering users and optimizing support efficiency.

In conclusion, robust documentation is not merely a supplemental aspect of support but a fundamental component. Efficient support hinges on readily available and comprehensible documentation. A robust understanding of this symbiotic relationship enables optimal platform usage and enhances the overall user experience. Clear and comprehensive documentation reduces support costs, increases user autonomy, and contributes to the long-term success of any payment processing platform, including those like Stripe. The value of effective documentation in streamlining support processes and minimizing customer frustration cannot be overstated. A practical implication is a direct correlation between well-maintained documentation and enhanced platform performance.

4. Technical Assistance

Technical assistance is an indispensable component of comprehensive support for payment processing platforms like Stripe. Effective technical assistance directly impacts the platform's reliability and functionality. Without it, businesses relying on Stripe for financial transactions face significant operational disruptions and potential financial losses. Prompt and accurate technical solutions are crucial for minimizing downtime, ensuring secure transactions, and maintaining customer confidence.

The connection between technical assistance and Stripe support is fundamental. Technical issues can range from simple configuration errors to complex security vulnerabilities. Rapid identification and resolution of these issues are paramount. Real-world examples illustrate this: a faulty API integration can halt all transactions, requiring immediate technical intervention. A security breach necessitates specialized technical support to contain damage and prevent future threats. Similarly, a sudden surge in transaction volume could overwhelm the system if technical support does not adequately scale resources. The effectiveness of Stripe's support, therefore, depends critically on its technical capacity to address such issues swiftly and effectively. This translates into smoother operations and increased customer satisfaction, ultimately driving business success.

Understanding the crucial link between technical assistance and Stripe support has practical implications for businesses. Proactive technical support, anticipating and addressing potential issues before they escalate, is crucial. Well-documented technical solutions and readily available resources empower businesses to independently troubleshoot common problems. A strong emphasis on security protocols, with readily accessible information on best practices, empowers businesses to protect themselves and their customers. This preventative approach reduces the need for extensive, reactive technical assistance, improving efficiency and lowering operational costs. Ultimately, a robust technical assistance framework, interwoven into Stripe support, forms the bedrock of a reliable and secure payment platform.

5. Security Protocols

Security protocols are integral to payment processing platforms like Stripe. Robust security measures are paramount to safeguarding sensitive financial data and maintaining user trust. The efficacy of these protocols directly correlates to the reliability and security of the entire system. Compromised security protocols can result in significant financial losses, reputational damage, and legal ramifications for businesses and users. The importance of strong security measures cannot be overstated.

- Data Encryption

Data encryption protects sensitive information transmitted between users and the platform. This involves transforming data into an unreadable format, rendering it unusable to unauthorized parties. Secure encryption protocols like TLS (Transport Layer Security) are essential. Without robust encryption, payment details are vulnerable to interception, leading to fraud and significant financial risks. This is a fundamental security layer and is crucial for maintaining user trust.

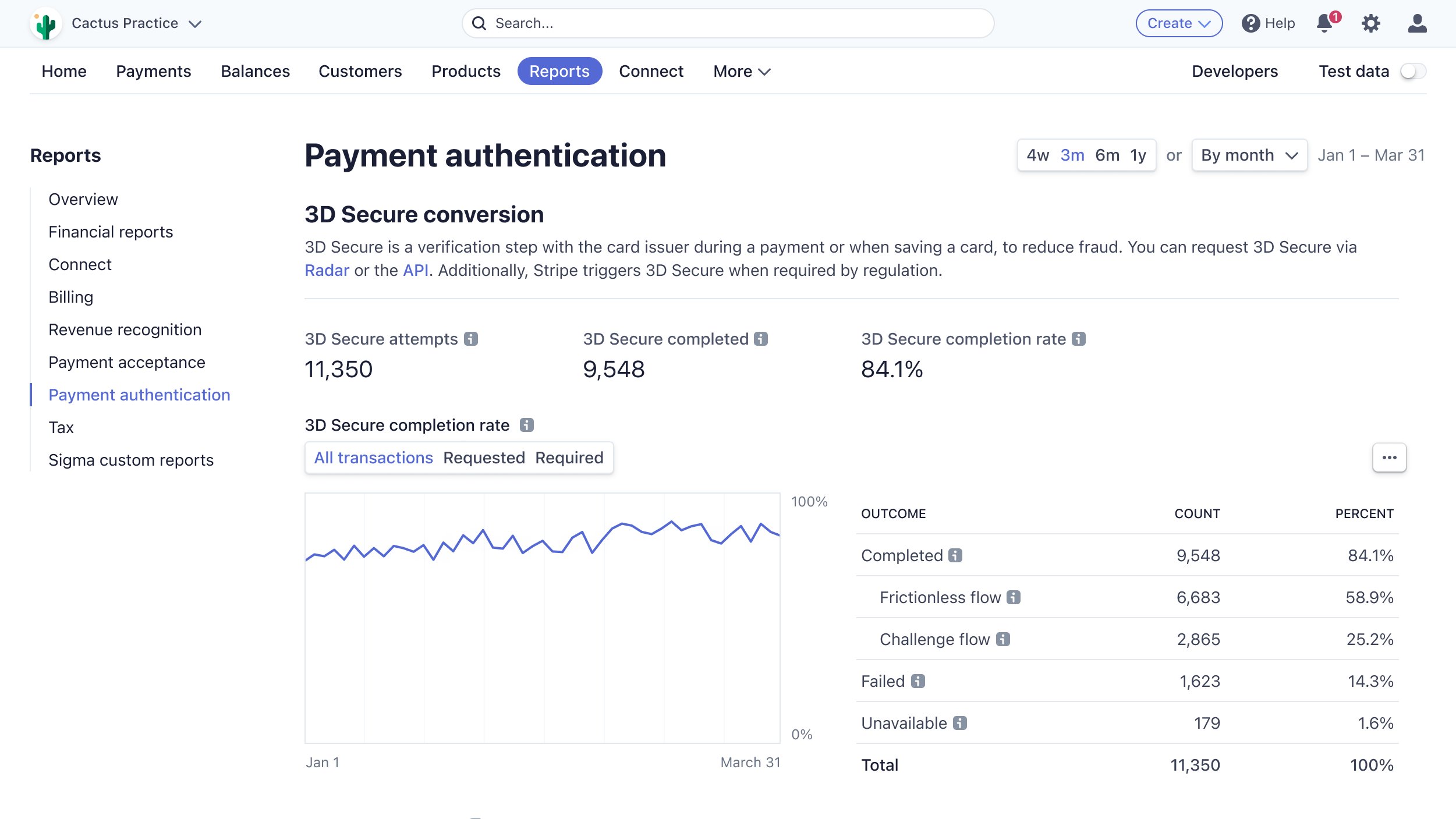

- Fraud Detection and Prevention

Sophisticated algorithms identify and flag suspicious transactions. These systems analyze patterns, transaction history, and user behavior to detect fraudulent activity. Proactive fraud detection mechanisms, working in conjunction with robust security protocols, are vital to reducing losses and ensuring the integrity of transactions. Examples include monitoring unusual transaction volumes, geographical locations, or card details.

- Access Control and Authentication

Strict access controls limit access to sensitive data to authorized personnel. Multi-factor authentication, requiring multiple forms of verification, enhances security further. This ensures that only legitimate users can access critical systems and data, preventing unauthorized access. Strong authentication procedures are indispensable to safeguarding sensitive information and minimizing the risk of unauthorized access.

- Regular Security Audits and Updates

Continuous monitoring and updates of security protocols are crucial. Regular security audits identify vulnerabilities and address weaknesses promptly. Patching security holes and implementing new security measures, especially in the face of evolving cyber threats, is critical for maintaining a robust security posture. Proactive updates to security protocols prevent exploitation by cybercriminals and safeguard against emerging threats.

In conclusion, security protocols are not just aspects of Stripe support; they are fundamental to its functionality. Comprehensive security protocols, encompassing robust encryption, fraud detection, access controls, and regular updates, create a reliable and trustworthy environment for businesses using Stripe for processing payments. A strong emphasis on security protocols is imperative to the overall success and reputation of payment platforms like Stripe. By prioritizing these security measures, the platform fosters user trust and operational stability, ultimately reducing risks associated with financial transactions.

6. Fraud Prevention

Fraud prevention is an integral component of comprehensive support systems like Stripe's. The effectiveness of fraud prevention directly impacts the reliability and security of payment transactions. A robust fraud prevention system acts as a critical shield against financial losses and maintains trust in the platform. Failure to effectively prevent fraud can severely damage both the financial health and reputation of businesses reliant on payment processing platforms.

The close connection between fraud prevention and Stripe support lies in the proactive and reactive measures employed to mitigate fraudulent activity. Stripe's support infrastructure must be capable of identifying and responding to suspicious transactions in real-time. This involves scrutinizing transaction patterns, analyzing user behavior, and employing sophisticated algorithms to flag potential fraud attempts. For example, unusual transaction volumes from a single IP address or patterns of chargebacks from a particular geographic location might trigger alerts and prompt intervention by Stripe's support team. These support teams, equipped with the right tools and training, can then investigate suspicious activities and either approve legitimate transactions or promptly decline fraudulent ones. Effective communication between the platform's fraud prevention mechanisms and support teams is essential to avoid delays or misjudgments. Real-life case studies showcase how sophisticated fraud schemes can be thwarted by a well-coordinated system.

Understanding the interplay between fraud prevention and Stripe support highlights its practical significance. Businesses rely on Stripe to process payments securely. Effective fraud prevention ensures the integrity of these transactions and preserves trust between businesses, users, and the platform. A robust support system capable of swift and informed action against fraudulent attempts is critical for maintaining financial stability. This understanding enables businesses to make informed decisions about adopting payment solutions and allows users to feel confident when transacting. The ultimate goal is to create a system where fraud is minimized, and legitimate transactions are facilitated without interruption.

Stripe Support FAQs

This section addresses common questions regarding Stripe support, aiming to provide clarity and facilitate user understanding of the platform's assistance resources.

Question 1: How do I contact Stripe support?

Contacting Stripe support is facilitated through various channels. The Stripe website typically provides a dedicated support portal offering self-service resources, including FAQs, tutorials, and troubleshooting guides. For more complex issues or urgent matters, a phone support option may be available, depending on account type and support plan.

Question 2: What are the typical response times for support inquiries?

Response times for support inquiries vary, dependent on the complexity of the issue and the volume of support requests. Stripe endeavors to offer timely assistance, but users should anticipate response times that may vary. Users are encouraged to utilize self-service resources when possible.

Question 3: What types of issues does Stripe support address?

Stripe support typically addresses issues encompassing account management, transaction processing, billing inquiries, technical problems related to integrations, and security concerns. Users should refer to Stripe's knowledge base for guidance on specific issues to ensure the most effective resolution.

Question 4: Is there a dedicated support team for specific business types?

Stripe might offer specialized support channels for particular business sizes or industry sectors. Account details and support plans can often determine access to specialized support personnel or dedicated resources. Users should review account details for specific assistance.

Question 5: Can I submit support requests outside of regular business hours?

Support availability varies based on the specific support plan. Some tiers might offer 24/7 support, while others may operate on standard business hours. Users should review their subscription details to understand the availability of support services during specific timeframes.

Understanding the resources provided through Stripe support is crucial for effective platform utilization. Self-service tools are an important initial step in seeking answers to queries and resolving common issues. Stripe aims to facilitate a smooth user experience through readily available support mechanisms.

This concludes the FAQ section. The next section will delve into specifics about Stripe's pricing plans and associated benefits.

Conclusion

This exploration of Stripe support reveals its multifaceted role in facilitating smooth financial transactions. Key aspects, including comprehensive customer service, robust troubleshooting procedures, detailed documentation, and secure technical assistance, contribute to a reliable platform. The platform's effectiveness hinges on consistent maintenance of these functions, enabling seamless operations and building trust among users. Effective fraud prevention mechanisms, integral to the system's security, demonstrate a commitment to safeguarding financial data and maintaining platform integrity. A well-structured support system is crucial for the success of businesses utilizing Stripe for payment processing. The exploration underscores the critical importance of a strong support infrastructure in maintaining a secure and user-friendly payment system.

The future of payment processing necessitates a continuously evolving support framework. The demands on platforms like Stripe continue to grow with the increasing complexity of financial transactions and emerging security threats. Staying ahead of these challenges necessitates ongoing investment in sophisticated support systems that adapt to evolving needs. Businesses reliant on payment platforms like Stripe must remain vigilant in assessing the robustness of support structures to ensure financial security and operational efficiency. A robust approach to support is not merely an add-on; it is a critical component in the ongoing evolution of secure and dependable financial transactions.

Detail Author:

- Name : Mrs. Mallie Auer

- Username : ywehner

- Email : phoebe35@bashirian.com

- Birthdate : 1970-08-13

- Address : 51038 Bryce Flat Apt. 033 Reichertside, NY 12079-3069

- Phone : +1-385-577-0355

- Company : Green-Lind

- Job : Ophthalmic Laboratory Technician

- Bio : Est fugiat labore enim hic qui facere dolore. Odit porro voluptas eaque quia. Nihil deserunt sunt doloremque et amet aut. Ex asperiores qui atque eos non. Natus nulla ut dolore maxime quas.

Socials

tiktok:

- url : https://tiktok.com/@dchristiansen

- username : dchristiansen

- bio : Dolorem ullam id nisi est voluptatem consequatur.

- followers : 4398

- following : 1724

twitter:

- url : https://twitter.com/daytonchristiansen

- username : daytonchristiansen

- bio : Aperiam possimus id a adipisci fugiat iste. Distinctio nulla quam occaecati voluptatem quia et. Earum quae pariatur expedita. Sed molestias eligendi quasi.

- followers : 2592

- following : 1644

linkedin:

- url : https://linkedin.com/in/christiansend

- username : christiansend

- bio : Voluptates deleniti quo accusamus alias modi.

- followers : 762

- following : 1446

instagram:

- url : https://instagram.com/christiansend

- username : christiansend

- bio : Maxime sint eius doloremque placeat. Qui unde ducimus iure ut.

- followers : 6696

- following : 2408

facebook:

- url : https://facebook.com/dayton_christiansen

- username : dayton_christiansen

- bio : Perferendis in et voluptates quo. Et reprehenderit veritatis architecto.

- followers : 6342

- following : 1085