What is this emerging digital asset, and why is it gaining attention?

This digital asset represents a novel approach to decentralized finance, potentially offering unique features and functionalities. It leverages blockchain technology and may incorporate specific mechanisms for user interaction and asset management. Its exact form, whether it's a cryptocurrency, token, or other type of digital asset, needs further elucidation.

The potential benefits of this new digital asset depend heavily on its specific implementation. Favorable characteristics might include increased transparency, greater security, improved accessibility to financial services, or streamlined transaction processes. Its historical context would likely include developments in the blockchain space and emerging trends in decentralized finance, revealing the motivations and innovations driving its creation.

Further exploration into the technical details, market analysis, and use cases for this digital asset is necessary to fully understand its significance and implications.

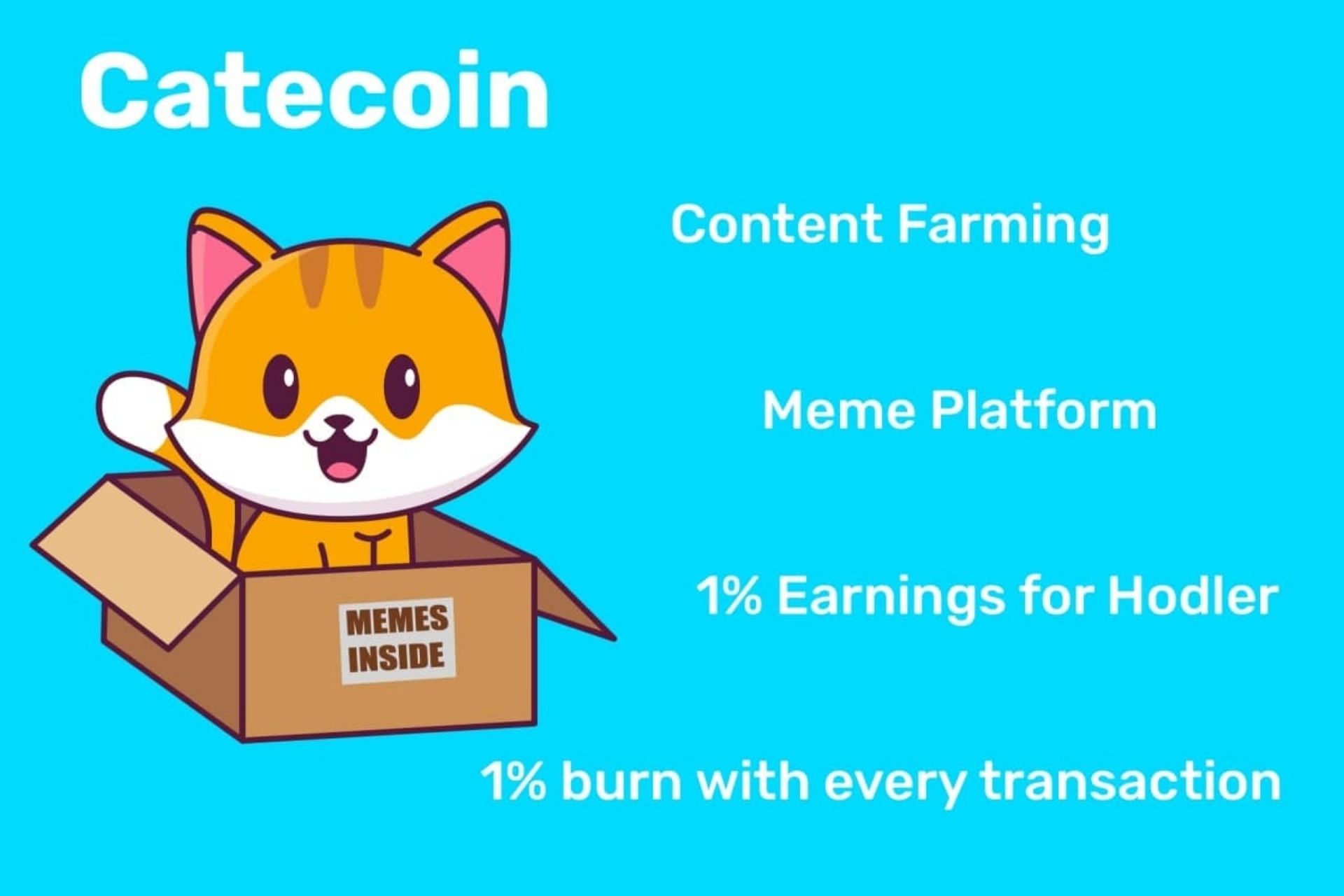

catecoin

Understanding the multifaceted nature of "catecoin" requires examining its core components and contextual significance.

- Decentralized finance

- Blockchain technology

- Digital asset

- Potential use cases

- Market analysis

- Security considerations

- Regulatory framework

These seven aspects collectively contribute to the evolving understanding of "catecoin." Decentralized finance and blockchain technology underpin the foundational principles of the digital asset. Potential use cases range from streamlined transactions to novel financial instruments. Thorough market analysis informs investment decisions, while security considerations address inherent risks. Recognizing a regulatory framework is critical to establishing responsible implementation and long-term viability. Analyzing these elements provides a comprehensive framework for future discussions, especially those relating to the practical application and future prospects of the digital asset. For example, the security considerations for a digital asset should take into account the risks associated with hacks and vulnerabilities unique to blockchain-based systems, further highlighting the complexity of this topic.

1. Decentralized Finance

Decentralized finance (DeFi) represents a significant shift in financial systems, potentially altering how individuals and organizations interact with money and assets. Its relationship with "catecoin" lies in the potential for "catecoin" to be a component or facilitate specific functionalities within a DeFi ecosystem. Understanding DeFi's core principles provides crucial context for analyzing the potential implications of "catecoin."

- Decentralized Exchanges (DEXs)

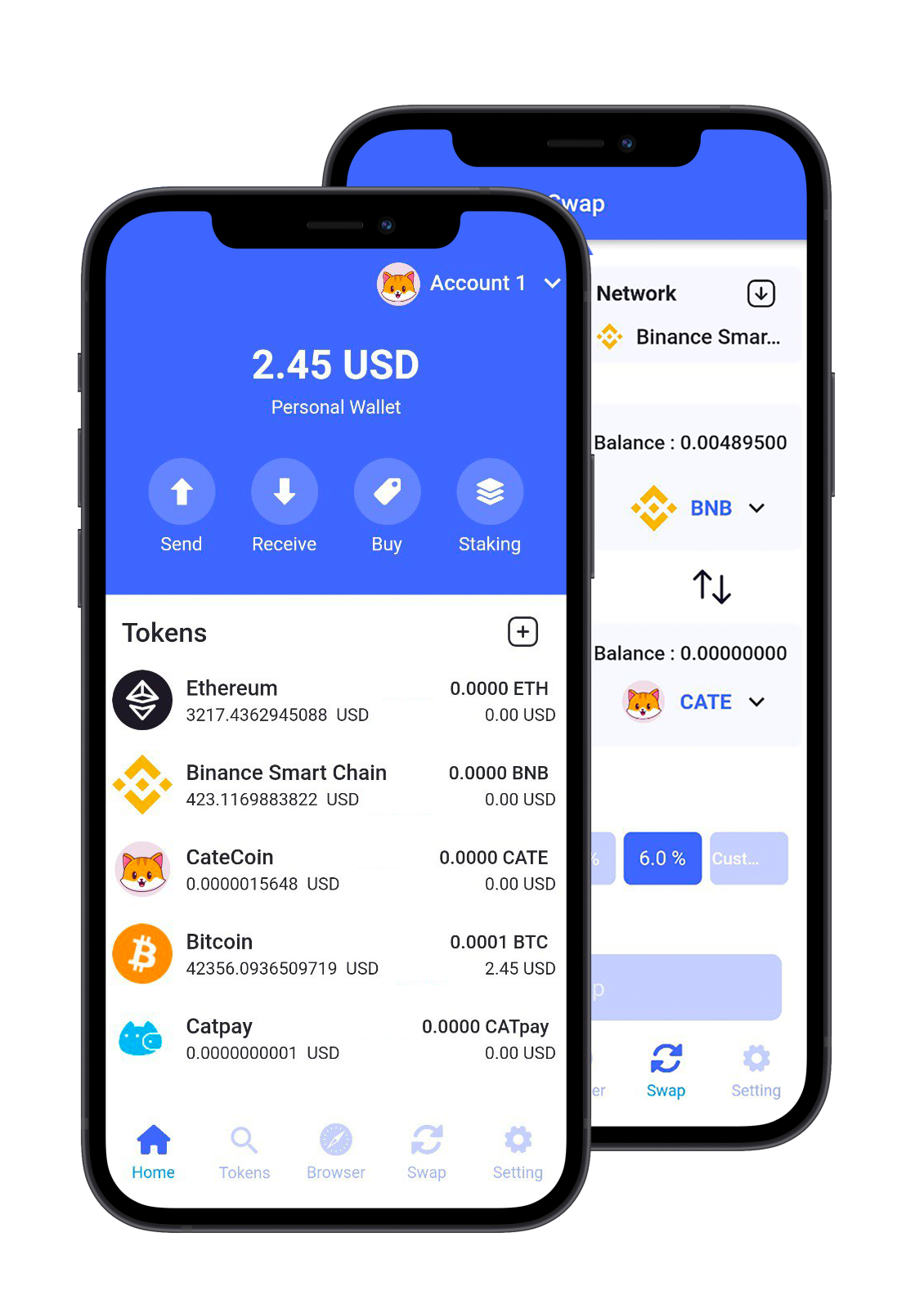

DEXs are crucial components of DeFi, enabling peer-to-peer trading without intermediaries. Their role in "catecoin" could encompass facilitating trading, borrowing, or lending operations with this digital asset. Examples of established DEXs illustrate the operational capabilities of such platforms. Implications for "catecoin" include the possibility of trading volume, liquidity provision, and development of a robust trading environment.

- Decentralized Lending & Borrowing Platforms

DeFi platforms enable borrowing and lending using digital assets, including cryptocurrencies. If "catecoin" is used on such a platform, it could function as collateral or a loanable asset. Real-world examples demonstrate the potential for increased liquidity and novel lending opportunities. This aspect for "catecoin" hinges on its market value, security, and reputation.

- Automated Market Makers (AMMs)

AMMs automate trading by using a mathematical formula, often based on supply and demand. If "catecoin" interacts with AMMs, it could contribute to a more dynamic trading environment and potentially create arbitrage opportunities. This integration would require a well-defined tokenomics model for "catecoin," and examples of AMM usage with other cryptocurrencies demonstrate the functionality.

- Yield Farming & Staking

DeFi allows users to earn interest by providing liquidity or staking digital assets. "Catecoin" participating in these programs could reward users with additional tokens or yield based on its utility and overall network participation. Examining yield farming and staking models for similar cryptocurrencies provides a template for evaluating the potential mechanisms within the "catecoin" ecosystem.

The connection between DeFi and "catecoin" is multifaceted. The successful integration of "catecoin" into the DeFi ecosystem hinges on its compatibility with existing protocols and its ability to fill a perceived need or enhance existing functionalities. Analyzing the potential use cases and features within these frameworks highlights the potential impact on the future of both the DeFi landscape and "catecoin."

2. Blockchain Technology

Blockchain technology forms the bedrock of "catecoin." Its decentralized and secure nature is fundamental to the functionality and potential value proposition of this digital asset. Transactions are recorded immutably across a distributed ledger, enhancing transparency and security. This characteristic impacts "catecoin" by potentially reducing fraud risks and ensuring accountability in its operations. The underlying cryptographic principles secure the asset's value, potentially leading to trust and stability within the associated ecosystem.

Practical applications demonstrate the importance of blockchain. Cryptocurrencies like Bitcoin leverage blockchain for secure and transparent transactions. Likewise, "catecoin," by utilizing blockchain, may aim to enhance specific aspects of its functionality. This might include verifiable ownership records, automated processes for transactions, or secure storage of associated data. Examining similar implementations in other digital assets provides a framework for understanding the potential mechanisms and challenges faced by "catecoin." The security features of blockchain are crucial for the long-term viability and trustworthiness of any digital asset.

In summary, blockchain technology is a critical component of "catecoin's" structure. The immutable ledger and cryptographic security are central to establishing trust and transparency. However, challenges such as scalability, regulatory hurdles, and potential vulnerabilities associated with blockchain technologies must be considered in assessing the overall viability and potential of this digital asset. The effectiveness of "catecoin" hinges, in part, on the robustness and efficiency of its underlying blockchain implementation. A thorough analysis of these elements provides a more comprehensive understanding of "catecoin's" potential role in the digital economy.

3. Digital Asset

A digital asset is a representation of value existing in a digital format. "Catecoin," as a digital asset, inherits properties and characteristics inherent to this broader category. The value of "catecoin" hinges on its underlying mechanisms and perceived utility, influencing market demand and investor interest. Real-world examples include cryptocurrencies like Bitcoin, which function as digital assets representing store of value and medium of exchange.

The digital asset framework provides a crucial lens for understanding "catecoin." This understanding encompasses several key areas: technical implementation (blockchain technology, tokenomics), potential utility (applications in various sectors), and market reception. The characteristics of "catecoin" as a digital asset define its potential value proposition and interactions within existing financial systems. Considerations include inherent security risks, liquidity dynamics, regulatory compliance, and potential for integration with other digital assets. Examining successful digital assets provides a basis for assessing "catecoin's" trajectory. The critical role of a digital asset, like "catecoin," is to provide a mechanism for representing value in the digital realm. This characteristic becomes particularly important in the context of decentralized finance (DeFi), where digital assets underpin various interactions and transactions.

In conclusion, "catecoin" is fundamentally a digital asset. Analyzing "catecoin" within the broader context of digital assets illuminates its potential and inherent challenges. Understanding its digital form, associated technologies, and potential applications is critical to evaluating its long-term prospects. Successfully navigating the complexities of the digital asset landscape is essential for assessing the viability and potential impact of "catecoin" on financial systems. Careful examination of other established digital assets provides benchmarks against which to measure "catecoin's" development and potential.

4. Potential Use Cases

The potential use cases for "catecoin" represent a crucial aspect of its overall value proposition. Success hinges on identifying and developing applications where "catecoin" demonstrably enhances existing processes or creates novel solutions. These applications serve as a critical validation of the asset's purpose and market relevance.

Specific potential use cases remain speculative until detailed implementation plans emerge. However, analyzing existing models in decentralized finance (DeFi) provides a framework for potential applications. For instance, "catecoin" might facilitate decentralized exchanges, enabling peer-to-peer trading of various assets. Successful DEX platforms demonstrate the viability of such models. Alternatively, "catecoin" might function as a utility token within a specific ecosystem, offering discounts or access privileges to participants. Analogous systems employing utility tokens in other sectors, such as loyalty programs or gaming platforms, can be considered. Furthermore, if integrated into a decentralized lending platform, "catecoin" could be used as collateral or a loanable asset, potentially increasing access to capital for a specific group. Examining existing DeFi lending platforms reveals the mechanics of this potential application.

Ultimately, the significance of potential use cases for "catecoin" lies in demonstrating a tangible value proposition beyond speculation. Detailed implementation plans and practical demonstrations are essential to gauge market acceptance and investment interest. Identifying clear and compelling use cases will significantly influence the perceived utility and inherent value of "catecoin," establishing its role within the broader digital economy. The development of practical applications is crucial to moving beyond theoretical discussions and firmly establishing "catecoin's" presence in the financial landscape. Addressing potential limitations and challenges in implementation, such as regulatory hurdles or technical feasibility, is equally important in assessing the long-term viability of these proposed applications.

5. Market analysis

Market analysis for "catecoin" is crucial for understanding its potential value and viability. A thorough assessment of market dynamics, including supply and demand, investor sentiment, and competitive landscape, informs investment decisions and strategic planning. Market analysis enables a nuanced understanding of factors influencing "catecoin's" price fluctuations and overall trajectory. Historical data on similar digital assets offers valuable insights. For example, the evolution of Bitcoin's market capitalization demonstrates the influence of various factors on price action, and this analysis can help anticipate potential challenges and opportunities. Accurate market analysis provides a foundation for evaluating the potential of "catecoin" within the context of the existing digital asset market and identifies potential risks and opportunities unique to "catecoin."

Real-world examples illustrate the importance of market analysis for digital assets. The dramatic price fluctuations observed in some cryptocurrencies highlight the dynamic nature of digital asset markets. Analysis of these trends assists in identifying patterns, predicting potential future price action, and anticipating the impact of regulatory changes or technological advancements. This predictive element is crucial for effective investment strategies. Furthermore, thorough market analysis facilitates identification of potential competitors and their strategies. This competitive analysis reveals strengths and weaknesses, informing strategic decisions related to development, marketing, and future growth. By understanding the competitive landscape, "catecoin" can proactively position itself in the market. Understanding past trends allows for the prediction of future market reactions and assists in risk mitigation strategies.

In summary, comprehensive market analysis for "catecoin" is indispensable for informed investment decisions and strategic development. This analysis enables a deeper understanding of the factors driving market behavior, allowing for more accurate predictions of future trends and more effective risk management. Understanding the interplay of market forces, technological advancements, and regulatory frameworks is essential for assessing "catecoin's" potential and longevity. A robust market analysis framework, therefore, provides essential groundwork for assessing the asset's potential against the prevailing market forces and for informed decision-making.

6. Security Considerations

Security considerations are paramount for any digital asset, especially one like "catecoin" operating within the decentralized finance (DeFi) realm. The integrity and value of "catecoin" are directly tied to the robustness of its security protocols. Vulnerabilities can lead to significant financial losses and erode trust in the platform. Examining key security facets is essential for evaluating the overall viability and long-term prospects of the digital asset.

- Cryptographic Security

Robust cryptographic techniques underpin the security of "catecoin." Properly implemented cryptographic algorithms protect transactions and sensitive data. This includes secure hashing algorithms, digital signatures, and encryption methods. Failures in cryptographic implementation leave the asset vulnerable to unauthorized access and manipulation. Examples of past breaches in cryptocurrency systems demonstrate the real-world consequences of inadequate cryptographic protections. Implications for "catecoin" include maintaining strong cryptographic protocols throughout its development cycle, undergoing rigorous security audits, and continuously adapting to emerging threats.

- Smart Contract Security

If "catecoin" interacts with smart contracts, securing these contracts against vulnerabilities is critical. Defects in code can enable malicious actors to exploit loopholes and execute fraudulent actions. Real-world examples of smart contract exploits demonstrate the potential for substantial financial losses. The implications for "catecoin" include rigorous auditing of smart contract code, employing secure development practices, and regular vulnerability assessments to mitigate potential risks. The intricate nature of smart contract code requires specialized expertise and continuous monitoring to ensure its integrity.

- Network Security

The network facilitating "catecoin" transactions must be secured against attacks. This includes protection against denial-of-service attacks, unauthorized access, and manipulation of transaction data. The security of the network infrastructure and the nodes participating in the network significantly influences "catecoin's" operational stability. Examples of network breaches highlight the critical need for robust security measures to prevent unauthorized access, data breaches, and service disruptions. Implications include investment in robust network security infrastructure, implementation of intrusion detection systems, and diligent monitoring of network traffic. A decentralized network necessitates widespread participation and a robust defense mechanism across all participating nodes.

- User Security Practices

User security plays a vital role in mitigating threats. Users must implement strong password practices and adhere to secure online habits to prevent unauthorized access to their "catecoin" holdings. Real-world examples emphasize the need for proactive user education regarding phishing and social engineering tactics. Implications for "catecoin" encompass providing comprehensive user guides, educating users on security best practices, and implementing multi-factor authentication to safeguard user accounts.

Addressing these security considerations is crucial for building trust and ensuring the long-term sustainability of "catecoin." A comprehensive security strategy encompassing cryptographic strength, smart contract integrity, network security measures, and user education forms the bedrock of a resilient and trustworthy digital asset. By proactively addressing potential risks, "catecoin" can establish itself as a reliable participant in the digital economy, promoting user confidence and market stability. Continuous monitoring and adaptation to evolving threats are vital to maintain this security posture.

7. Regulatory Framework

The absence of a clear regulatory framework for digital assets like "catecoin" creates uncertainty and challenges for its development and widespread adoption. Navigating the evolving landscape of digital finance mandates a robust regulatory approach. The potential impact of regulations on "catecoin" hinges on clarity, consistency, and adaptability to the unique characteristics of decentralized technologies. The absence of a defined regulatory framework could hinder or accelerate the asset's progression, depending on how the regulatory environment evolves.

- Jurisdictional Variations

Different jurisdictions adopt varying approaches to regulating digital assets, leading to complexities for cross-border operations. The absence of standardized regulations creates inconsistencies in the treatment of "catecoin" across different regions. The implications for "catecoin" include potential operational limitations, variations in investor protection, and challenges in establishing a uniform market. Different countries have implemented different laws and policies. This includes legal frameworks for securities, cryptocurrencies, or payment systems.

- Security and Fraud Prevention

Clear regulations concerning security and fraud prevention are crucial for protecting investors and maintaining market integrity. The absence of regulatory measures to address fraudulent activities targeting "catecoin" creates a higher risk environment. The potential implications for "catecoin" involve issues of compliance, investor confidence, and market stability. Regulatory frameworks should incorporate measures to combat money laundering and illicit financial activities associated with digital assets.

- Taxation and Reporting Requirements

Defining how digital assets like "catecoin" are taxed and reported is essential to ensure compliance and fairness. The lack of clarity on tax liabilities and reporting requirements for "catecoin" creates uncertainty for both businesses and investors. Implications involve the potential for double taxation in multiple jurisdictions and a lack of transparency surrounding financial transactions. Clear guidelines and standardized reporting requirements are needed for "catecoin" and similar assets.

- Consumer Protection and Investor Education

Robust regulations promoting investor education and consumer protection are essential. The lack of consumer safeguards associated with "catecoin" may expose investors to risks not adequately addressed in traditional finance. The implications for "catecoin" include the potential for investor losses, a decline in investor confidence, and a general lack of trust in the system. Regulatory measures focusing on transparency and investor education can build trust and stability.

In conclusion, a robust regulatory framework is necessary for the responsible development and acceptance of "catecoin." Addressing jurisdictional variations, fraud prevention, taxation, and consumer protection through comprehensive regulations creates a stable environment that fosters trust and long-term growth for "catecoin" and the broader digital asset space. The absence of a comprehensive framework can hinder the widespread adoption of digital assets like "catecoin," creating market instability and uncertainty for investors.

Frequently Asked Questions about "Catecoin"

This section addresses common inquiries regarding "Catecoin," aiming to provide clear and concise answers to common concerns and misconceptions. Questions range from fundamental definitions to more nuanced aspects of the digital asset.

Question 1: What is "Catecoin"?

"Catecoin" is a digital asset, likely utilizing blockchain technology. Precise details, such as its specific function, tokenomics, and intended applications, require further investigation. Understanding its precise nature, whether a cryptocurrency, token, or another form of digital asset, is crucial for evaluating its potential.

Question 2: What is the technical basis of "Catecoin"?

The underlying technical foundation of "Catecoin" is critical for assessing its security and scalability. Details regarding the chosen blockchain platform, consensus mechanisms, and smart contracts (if applicable) are necessary to understand its operational architecture and potential vulnerabilities. Knowledge of the specific blockchain technology employed significantly affects estimations of its viability and performance.

Question 3: What are the potential uses of "Catecoin"?

Potential use cases remain speculative without detailed implementation plans. However, analysis of decentralized finance (DeFi) models and successful digital assets suggests possibilities in decentralized exchanges, lending platforms, or other applications. The identification of concrete, viable use cases is essential for demonstrating a value proposition beyond speculative investment.

Question 4: What are the associated risks of investing in "Catecoin"?

As with all investments in digital assets, risk is inherent. Volatility, regulatory uncertainty, technical vulnerabilities, and market speculation pose significant challenges. Careful market analysis and risk assessment are critical before investing in any digital asset, including "Catecoin." Thorough due diligence on the project team, development roadmap, and overall security measures is crucial.

Question 5: What regulatory environment surrounds "Catecoin"?

The lack of a defined regulatory framework for "Catecoin" creates uncertainty. Investors should research and understand the regulatory landscape in relevant jurisdictions. The absence of clear guidelines may lead to operational limitations, tax uncertainties, and challenges in maintaining investor confidence. A thorough review of the regulatory climate in jurisdictions where "Catecoin" operates is vital for risk assessment.

In conclusion, gaining a comprehensive understanding of "Catecoin" requires diligent research and critical evaluation of its technical aspects, potential use cases, associated risks, and regulatory environment. Speculation should be tempered with thorough analysis to make informed decisions about potential involvement with this digital asset.

The subsequent section will delve into the detailed technical specifications of "Catecoin," if available.

Conclusion

This exploration of "Catecoin" reveals a complex landscape. The digital asset's viability hinges on several crucial factors: the robustness of its underlying blockchain technology, the clarity and practicality of its intended applications, the strength of its security protocols, and the emergence of a supportive regulatory environment. Analysis suggests potential for innovative applications within decentralized finance, yet significant challenges remain. The absence of a fully defined regulatory framework underscores a critical area requiring immediate attention for responsible market development. Understanding the interplay between market forces, technological advancements, and legal considerations is essential for evaluating the long-term prospects of "Catecoin." Without clearly articulated use cases and robust security measures, the asset's value proposition remains uncertain.

Moving forward, careful consideration of existing models, rigorous security audits, and detailed implementation plans are vital for establishing "Catecoin's" legitimacy. The ultimate success of this digital asset depends on its ability to overcome inherent challenges and attract substantial, well-informed investment. Investors must conduct thorough due diligence, acknowledging the inherent risks associated with emerging digital assets and actively monitoring developments in the regulatory environment. Furthermore, the development of "Catecoin" should be guided by principles of transparency and accountability to foster public trust and secure long-term sustainability.

Detail Author:

- Name : Thad Mante

- Username : koss.lilly

- Email : kayli.okon@powlowski.com

- Birthdate : 1987-07-28

- Address : 828 Talia Stream Suite 466 Dickinsonberg, HI 48947-2585

- Phone : 952-734-7849

- Company : Bradtke, Konopelski and Champlin

- Job : Custom Tailor

- Bio : Vel nobis unde consequatur vero amet. Quas reprehenderit sunt possimus. Tempore omnis est hic vel reiciendis non veritatis quia. Cupiditate labore in et delectus sapiente facere.

Socials

twitter:

- url : https://twitter.com/julie1053

- username : julie1053

- bio : Nostrum sit laborum recusandae ullam. Iusto quia nemo ut nesciunt. Officia sunt neque qui cumque sapiente dolores.

- followers : 5838

- following : 893

instagram:

- url : https://instagram.com/julie_schimmel

- username : julie_schimmel

- bio : Ipsa voluptatem earum asperiores magnam dolor illum. Alias eius ut quos et molestiae vero cumque.

- followers : 4948

- following : 1009