What constitutes a wager with a significant investment? How does the commitment level impact the outcome?

A wager involving a substantial investment of assets or resources is a crucial element in various contexts, including gambling, financial transactions, and even strategic decision-making. The commitment of capital, time, or effort directly influences the potential rewards and risks associated with the outcome. For instance, a significant financial investment in a startup company represents a substantial wager on its future success. Similarly, in horse racing, a bet on a horse with a substantial monetary stake carries a higher potential for both profit and loss.

The importance of such wagers stems from the potential for substantial returns. The magnitude of the invested resources elevates the stakes, intensifying the anticipation and consequences. This form of commitment can act as a motivator, pushing participants to meticulously assess risks and potential outcomes. Conversely, the high-stakes nature can lead to heightened emotional involvement and greater vulnerability to significant losses. The historical prevalence of such bets across cultures underscores their enduring appeal as a means of both entertainment and financial pursuit.

Moving forward, this analysis will delve into the various facets of high-stakes ventures, exploring the factors driving investment decisions and the resulting consequences.

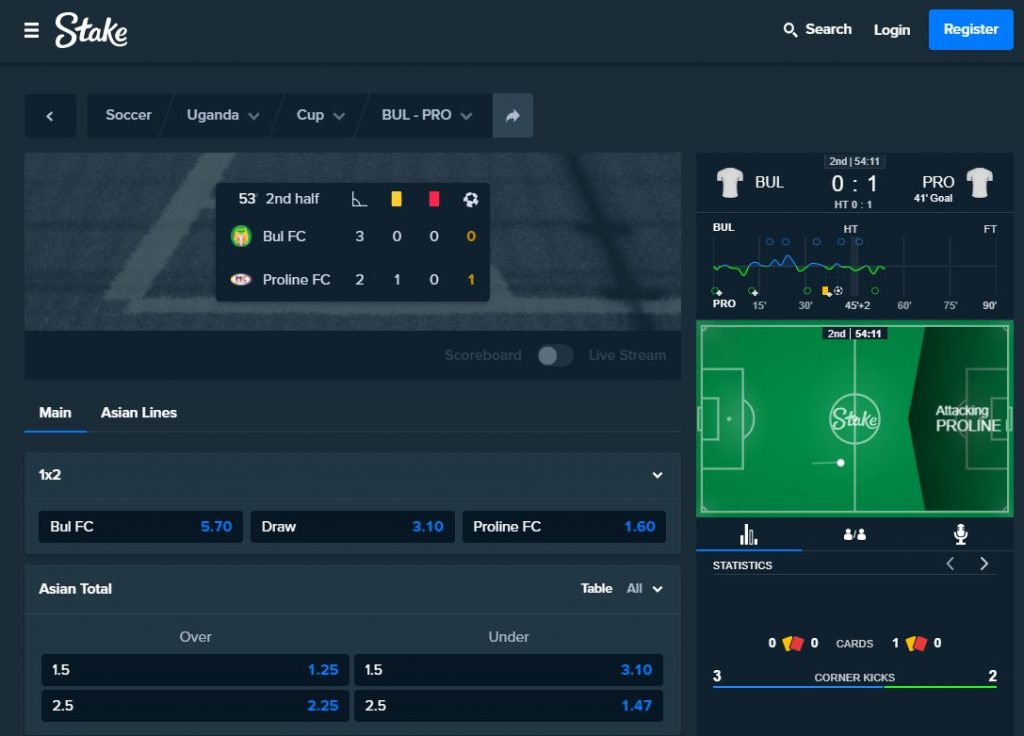

Stake Bet

Understanding the intricacies of a "stake bet" necessitates examining its various facets. The commitment inherent in such a wager dictates its impact, both positive and negative. This analysis explores key aspects of the subject.

- Risk assessment

- Potential reward

- Financial commitment

- Probability analysis

- Decision-making

- Emotional investment

- Outcome analysis

- Strategic planning

A "stake bet" is a wager with significant financial or resource investment. Risk assessment precedes any decision, weighing potential reward against the financial commitment. Probability analysis plays a crucial role in anticipating possible outcomes. Emotional investment can cloud judgment. Strategic planning helps manage resources. Outcome analysis provides insights, contributing to informed decision-making in future endeavors. For instance, a high-stakes venture capital investment requires meticulous risk assessment, careful probability calculations, and strategic planning. These interconnected elements underpin the importance of evaluating all relevant aspects before making a significant financial commitment.

1. Risk Assessment

A critical component of any substantial wager, including those with a significant financial stake, is rigorous risk assessment. This process evaluates potential losses alongside potential gains. The magnitude of the stake directly influences the importance of a comprehensive risk assessment. A small wager might tolerate a simplified evaluation, but a substantial stake demands detailed analysis of potential downsides and contingencies. Failure to properly assess risk in high-stakes scenarios can lead to substantial financial losses or jeopardize the entire endeavor. Consider a company making a major investment in a new technology. A thorough analysis of market competition, technological feasibility, and potential regulatory hurdles is crucial. This level of foresight is indispensable for navigating the complexities of a high-stake bet, ensuring a rational decision rooted in objective evaluation.

The importance of risk assessment extends beyond the initial investment decision. Monitoring and adapting to changing circumstances are equally vital. An ongoing evaluation process permits adjustments in strategy as external factors evolve. The initial risk assessment must not be a static document but a dynamic tool updated regularly. For instance, in a real estate development project, unexpected zoning changes or shifts in market demand necessitate continuous evaluation and recalibration of the initial risk assessment. This adaptive approach is key to mitigating potential setbacks and preserving the viability of a major endeavor. The proactive monitoring of market trends, economic indicators, and competitor actions directly contributes to the overall success of a high-stake wager.

In conclusion, risk assessment is not merely a preliminary step in a high-stake wager; it's a continuous process integral to navigating the complexities of such endeavors. A meticulous evaluation of potential risks, coupled with ongoing monitoring and adaptation, is critical to maximizing the chances of a positive outcome. Without a well-defined and adaptive risk assessment framework, any substantial wager becomes exceptionally vulnerable to unforeseen challenges and losses.

2. Potential Reward

The allure of a "stake bet" frequently hinges on the potential reward. A substantial investment inherently carries the expectation of proportionally higher returns. This correlation between the size of the stake and the anticipated reward is a fundamental driver of many significant decisions. The magnitude of the potential gain acts as a powerful motivator, encouraging risk-taking in ventures with substantial investment. Real-world examples abound: a venture capitalist firm invests heavily in a startup with the potential for substantial market dominance and high returns. Likewise, a gambler might place a large wager on a high-probability event to magnify their payout. The perceived potential reward, coupled with the investment of resources, defines the inherent risk-reward equation crucial to understanding these endeavors.

The importance of realistically assessing the potential reward relative to the stake cannot be overstated. Overestimating potential gains, even with a substantial investment, can lead to costly miscalculations. An entrepreneur may overvalue the return on a risky venture, neglecting the potential for substantial loss. Conversely, accurately gauging the possible reward allows for informed decisions. Understanding potential reward, not just as a financial outcome, but as a measure of strategic or reputational gain, is critical. This allows for a balanced evaluation of the overall investment, preventing impulsive or overly optimistic decisions. A strategic decision-maker evaluates the likelihood of attaining the projected reward alongside the risk of failure, using this balance to guide sound judgment. For example, a company committing resources to R&D expects a future reward in new products and market leadership; this calculated reward expectation directly impacts the initial investment decision.

In conclusion, the potential reward is a critical component of a "stake bet." It fuels the decision-making process but requires a nuanced perspective. Overly optimistic projections can be detrimental, while a realistic assessment allows for informed decisions. Understanding the interplay between investment, risk, and potential return is essential for navigating significant ventures. The key takeaway lies in the thoughtful evaluation of potential gains relative to the investment, allowing decision-makers to approach such endeavors with clarity and precision, fostering a well-balanced risk-reward equation.

3. Financial Commitment

Financial commitment is intrinsically linked to the concept of a "stake bet." The magnitude of the financial investment directly impacts the potential rewards and risks inherent in such ventures. Analyzing this aspect illuminates the crucial role of resource allocation in shaping the outcome of high-stakes decisions.

- Investment Size and Strategy

The size of the financial investment acts as a critical determinant in "stake bets." A substantial investment signifies a greater commitment, increasing the potential for both significant gains and substantial losses. Strategies for allocating resources become paramount in ensuring that the investment aligns with the overall objectives. For example, a venture capital firm allocating a large sum to a new technology startup needs a rigorous investment strategy, meticulously assessing the startup's potential, market viability, and management team. Conversely, a small wager on a sporting event with a comparatively small financial commitment necessitates a different, more focused approach to risk assessment. The strategic approach varies directly with the financial investment.

- Liquidity and Risk Tolerance

The financial resources committed to a "stake bet" influence the liquidity available for unforeseen circumstances or potential shifts in market conditions. A large, illiquid investment, for instance, a substantial investment in an unproven technology, may leave limited options for adjustments in strategy if circumstances necessitate changes. This requires a higher level of risk tolerance and comprehensive planning to address unforeseen problems or market shifts. Conversely, a smaller investment with higher liquidity provides greater flexibility to adapt to dynamic environments. The interplay between liquidity and risk tolerance shapes the strategic considerations for any substantial wager.

- Financial Resources & Feasibility

The available financial resources often limit the scale of a "stake bet." Companies or individuals considering significant investments must assess the availability and accessibility of capital. A project's feasibility hinges on securing adequate financial resources. For instance, a construction project with a substantial price tag demands a thorough feasibility study, including analysis of financing options and cost projections. Similarly, investors need to consider the availability of funds to support a startup in the initial stages and beyond, as this directly affects the long-term viability of the investment.

- Impact on Future Decisions

A substantial financial commitment in a "stake bet" frequently influences future decision-making processes. Large investments often set precedents for future allocation of resources, shaping overall strategy and operational priorities. The impact extends beyond the immediate investment, influencing resource allocation for future projects and ventures. For example, a successful venture capital investment might create a precedent for future funding priorities, leading to a greater focus on similar sectors or technologies. This impact suggests that financial commitment to a "stake bet" often casts a long shadow, influencing subsequent investment strategies and resource allocation decisions.

In summary, the financial commitment inherent in a "stake bet" is multifaceted. It involves evaluating the size of the investment, considering liquidity and risk tolerance, assessing the overall feasibility, and understanding the profound impact on future decisions. These factors collectively underscore the significant role of financial resources in determining the potential outcomes of such endeavors.

4. Probability Analysis

Probability analysis is indispensable in evaluating "stake bets." Accurate assessment of potential outcomes is paramount when significant resources are at risk. The connection lies in the direct relationship between the predicted probability of success and the decision to commit resources. High-stakes decisions, whether in finance, strategy, or any field requiring substantial investment, demand meticulous probability analysis. Precise estimations of success, coupled with a clear understanding of potential failure, form the bedrock of rational decision-making. Neglecting such analysis can lead to ill-advised allocations of resources. Misjudging the probability of success can lead to substantial losses, potentially jeopardizing the entire endeavor.

Consider a venture capitalist firm evaluating a startup. The firm needs to assess the likelihood of the startup achieving profitability and market dominance. Thorough market research, competitive analysis, and projections of financial performance form the foundation of this analysis. The probabilities of various outcomes, from substantial success to complete failure, are meticulously estimated. This process informs the investment decision. Similarly, a sports team evaluating player acquisition might weigh the probabilities of player performance, considering past statistics, team dynamics, and projected success against potential risks. Probability analysis, in these contexts, translates potential outcomes into numerical values, enhancing decision-making by quantifying the inherent uncertainty. Accurate calculations contribute to rational decisions regarding the allocation of resources.

The practical significance of understanding probability analysis in the context of "stake bets" is profound. It guides resource allocation, enabling informed decisions and mitigating potential losses. By quantifying the likelihood of success and failure, stakeholders can make more calculated judgments, minimizing the risks associated with high-stakes commitments. However, inherent limitations exist. Future events remain inherently uncertain, and probabilities are estimates. Furthermore, external factors, unforeseen events, and complex interactions can dramatically alter the predicted landscape. Despite these limitations, probability analysis remains a vital tool for navigating the complexities of "stake bets," maximizing the potential for positive outcomes while acknowledging the inherent uncertainty inherent in any substantial wager.

5. Decision-Making

Decision-making is inextricably linked to "stake bets." The magnitude of the investment necessitates a profound consideration of various factors, impacting the process significantly. Decisions related to "stake bets" are rarely simple choices; they require a nuanced understanding of potential outcomes, risks, and rewards. The outcomes of these decisions can have far-reaching consequences, impacting individuals, organizations, and even entire industries. A well-considered decision process reduces the probability of poor outcomes in high-stakes scenarios. Conversely, flawed decision-making processes can lead to substantial financial losses or strategic missteps.

Several crucial elements influence decision-making in "stake bets." Foremost is a thorough assessment of risks and potential rewards. Gathering and analyzing datamarket trends, competitor analysis, internal capabilitiesare paramount. Strategic planning, including contingency plans for various potential outcomes, is essential. A realistic appraisal of probabilities is also crucial; an overestimation or underestimation can lead to poor decisions. Human biases, such as optimism or fear, can distort judgment. Therefore, objective evaluation and data-driven insights are indispensable for sound decisions. For example, a company making a significant acquisition requires extensive due diligence on the target company's financials, operational efficiency, and market position. Failing to adequately assess these factors could lead to a poor decision with substantial financial and operational repercussions. Similarly, an investor making a large stock purchase needs in-depth research on the company's financial health, industry trends, and management team. Thorough due diligence is essential to mitigate risks and improve the likelihood of a favorable outcome. This meticulous process fosters confidence and reduces the emotional aspect inherent in high-stakes choices.

In conclusion, decision-making is the cornerstone of "stake bets." The success or failure of a venture often hinges on the quality of the decision-making process. Thorough preparation, objective evaluation, and strategic planning are essential. Acknowledging and mitigating human biases further strengthens the process. A well-defined framework for decision-making in high-stakes situations is paramount to responsible resource allocation, ultimately improving the probability of positive outcomes. Understanding this connection enables individuals and organizations to approach substantial investments with a measured and strategic approach, optimizing the likelihood of success.

6. Emotional Investment

Emotional investment significantly influences decisions involving substantial financial commitment, or "stake bets." The intensity of personal attachment or involvement often correlates with the level of perceived risk and reward. A deep emotional connection to a venture can either bolster resolve or introduce irrationality. The degree of emotional investment may obscure objective evaluation, potentially leading to poor decisions.

Consider a venture capitalist deeply invested in a particular startup. Personal enthusiasm for the product or the founder's vision might lead to a higher-than-objective valuation of the startup's potential. Conversely, a significant personal loss tied to a past investment could bias future decision-making, leading to avoidance of similar ventures, even if objectively sound. Likewise, a gambler's emotional investment in a winning streak might lead to impulsive decisions that deviate from rational strategies. Similarly, significant emotional investment in a real estate development project could lead to a willingness to accept higher levels of risk to see the vision through, potentially overlooking crucial financial or environmental considerations. In essence, emotional investment can act as a powerful, albeit potentially problematic, catalyst in shaping decisions involving substantial financial risk. Recognizing the interplay between emotion and reason is vital in situations demanding measured judgment.

Understanding the role of emotional investment in "stake bets" is crucial for both personal and professional decision-making. Acknowledging the potential influence of emotions on judgment is vital for navigating situations requiring calculated risk-taking. By proactively recognizing and mitigating the impact of emotional biases, individuals and organizations can improve the objectivity and rationality of decisions involving significant resource allocation. This understanding fosters a more balanced approach to risk management and strategic planning. Ultimately, an awareness of the interplay between emotion and reason is vital to making sound decisions in high-stakes situations. A comprehensive approach to evaluating "stake bets" requires acknowledging the crucial role of emotional factors, alongside financial, strategic, and operational considerations.

7. Outcome analysis

Outcome analysis is integral to understanding "stake bets." The process of evaluating the results of a significant investment, or wager, is crucial for informed decision-making in future endeavors. A thorough analysis of previous outcomes provides valuable insights into the effectiveness of strategies, the viability of ventures, and the potential for future success or failure. A well-executed outcome analysis examines both the tangible and intangible aspects of a "stake bet," including financial returns, strategic gains, and reputational impact.

The practical significance of outcome analysis in the context of "stake bets" lies in its ability to refine strategies and resource allocation. Analyzing past results helps identify successful and unsuccessful strategies. For example, a venture capitalist firm can assess past investments to determine whether certain sectors or industries consistently yield favorable returns. Similarly, a business can examine previous marketing campaigns to understand which strategies resonated with consumers and led to increased sales. Outcome analysis allows for a systematic approach to improving decision-making processes by identifying patterns and trends that were previously obscured. By examining previous outcomes, adjustments can be made in current and future strategies. An outcome analysis is not merely a post-mortem but a proactive tool to refine future investments. A thorough examination of failures, such as misjudged market trends or inadequate product development, allows adjustments to current practices.

In conclusion, outcome analysis provides a crucial link between past and future "stake bets." It facilitates the identification of trends and patterns, leading to more informed decisions in subsequent ventures. By diligently evaluating previous outcomes, stakeholders can refine strategies, improve resource allocation, and enhance the likelihood of future success. Despite the inherent uncertainty surrounding future outcomes, a systematic approach to analyzing past results provides valuable insights, thereby contributing to improved decision-making and minimizing the risks associated with high-stakes commitments. This rigorous analysis helps refine the strategies and ensure future investments are well-informed by the lessons of the past.

8. Strategic Planning

Strategic planning is fundamental to "stake bets." The substantial investment inherent in such endeavors necessitates a well-defined roadmap, encompassing contingencies, risk mitigation, and optimized resource allocation. This structured approach enhances the likelihood of achieving desired outcomes. Failure to develop a robust strategic plan can compromise the entire endeavor, leading to significant loss of resources and potential failure.

- Foresight and Proactive Risk Assessment

A comprehensive strategic plan begins with a thorough assessment of potential risks. This proactive approach identifies potential challenges and formulates strategies to address them before they materialize. For instance, a company investing in a new technology platform would analyze existing market conditions, competitive landscapes, and potential regulatory hurdles. This foresight is critical in "stake bets" because anticipating and mitigating risks reduces uncertainty and safeguards invested resources. Proactive analysis becomes a fundamental part of the planning framework, minimizing surprises and optimizing resource utilization. This level of preparedness is essential to navigating the complexities of substantial investment.

- Resource Allocation and Optimization

Strategic planning dictates how resources are allocated to achieve established objectives. A detailed analysis of available resources (financial, human, and material) is paramount to ensuring efficient deployment. A venture capital firm, for example, must determine the most suitable allocation of funding across various investment opportunities, optimizing returns. Prioritization and proper allocation of resources are essential in managing the financial commitments associated with "stake bets" effectively. This optimization aims to maximize the return on investment within the allocated budget and timeframe.

- Contingency Planning for Unexpected Events

Strategic plans must account for unforeseen events. Developing contingency plans allows for flexibility and adaptability in response to changing market conditions, technological advancements, or unforeseen challenges. In a real estate development project, a plan must account for potential fluctuations in market valuations or delays in regulatory approvals. Contingency planning is not merely a backup plan but a vital component of a robust "stake bet" strategy. It demonstrates flexibility and resilience, ensuring a manageable response to disruptive factors.

- Measurable Objectives and Performance Metrics

Strategic plans must outline clear, quantifiable objectives. Establishing measurable performance metrics enables tracking progress, identifying deviations from the plan, and making necessary adjustments. A company investing in renewable energy technology would set specific targets for energy production, cost reductions, and market penetration. Using clear metrics for evaluating success allows for continuous monitoring and adaptation. This feedback loop promotes accountability and ensures the investment remains aligned with its strategic goals.

Effective strategic planning is not merely a document but a living, breathing process. Flexibility and adaptability are critical to navigating the complexities of "stake bets." By incorporating foresight, meticulous resource allocation, contingency planning, and measurable objectives, organizations and individuals enhance the likelihood of favorable outcomes when making substantial investments. Ultimately, a comprehensive strategic plan strengthens the entire framework for successful "stake bets," providing a more robust and resilient approach to substantial investments.

Frequently Asked Questions about "Stake Bets"

This section addresses common inquiries regarding "stake bets," providing clarity and context for individuals and organizations considering such significant investments. The questions below aim to shed light on crucial aspects of this subject.

Question 1: What distinguishes a "stake bet" from a typical wager?

A "stake bet" is characterized by a substantially higher financial commitment compared to a standard wager. The magnitude of the investment directly influences the potential rewards and risks, necessitating a more rigorous assessment of probabilities and potential outcomes.

Question 2: How does risk assessment factor into "stake bets"?

Thorough risk assessment is paramount in "stake bets." This involves a comprehensive evaluation of potential losses alongside potential gains, considering market fluctuations, competitive landscapes, and other external factors. This process goes beyond cursory analysis and necessitates a detailed investigation of possible outcomes.

Question 3: What role does probability analysis play in "stake bets"?

Probability analysis is crucial in "stake bets." It quantifies the likelihood of various outcomes, from success to failure. This analysis helps to assess the relative risk and reward associated with the investment. A reliable analysis often necessitates expert inputs and extensive data gathering.

Question 4: What are the implications of emotional investment in "stake bets"?

Emotional investment can significantly impact decisions surrounding "stake bets." Personal attachment or enthusiasm can cloud judgment, leading to potentially poor choices. A detached, objective assessment, grounded in factual analysis, is critical to mitigating such biases.

Question 5: How does strategic planning support successful "stake bets"?

Strategic planning is essential for managing the complexities of "stake bets." It involves proactive risk assessment, resource optimization, contingency planning, and the establishment of measurable performance metrics. A well-defined plan contributes to a more structured and rational approach to substantial investments.

In summary, "stake bets" demand careful consideration of diverse factors, including financial commitment, risk assessment, probability analysis, emotional investment, strategic planning, and outcome evaluation. Understanding these intricacies is vital for making informed decisions and maximizing the potential for positive outcomes. The application of a comprehensive, analytical framework is indispensable for successful navigation of such significant ventures.

The following section will delve into practical applications of these concepts.

Conclusion

This analysis explored the multifaceted nature of "stake bets," highlighting the significant financial and strategic implications inherent in such commitments. Key elements examined include rigorous risk assessment, crucial for navigating potential losses alongside potential gains. Probability analysis emerged as a vital tool, providing a framework for quantifying uncertainty and informing decisions. Understanding the influence of emotional investment, often a significant factor in high-stakes decisions, is also critical. Strategic planning, encompassing proactive risk management, resource allocation, and contingency measures, proved indispensable for optimizing resource utilization. Outcome analysis, focusing on the lessons learned from past endeavors, plays a key role in refining future approaches and ensuring informed decisions. Finally, the financial commitment itself, encompassing factors like liquidity and risk tolerance, significantly impacts the entire process. Collectively, these facets underscore the importance of a holistic approach when evaluating substantial investments or wagers.

The complexities of "stake bets" require a sophisticated understanding of probabilities, risks, and rewards. A structured approach, integrating various analytical tools and considering the interplay of emotional and rational factors, is crucial for navigating the inherent uncertainties. Successful engagement with "stake bets" demands a commitment to meticulous planning, informed decision-making, and continuous evaluation. A deeper comprehension of these principles is not merely academically interesting but profoundly important in maximizing the chances of positive outcomes in a range of professional and personal endeavors.

Detail Author:

- Name : Aracely Schulist Jr.

- Username : reinhold.reinger

- Email : tromp.guido@hotmail.com

- Birthdate : 1972-10-20

- Address : 373 Nienow Inlet Apt. 990 Fannymouth, AR 58704

- Phone : 703-298-1086

- Company : McLaughlin-Zieme

- Job : Paperhanger

- Bio : Dolore nostrum sunt mollitia. Eligendi ipsam saepe odio accusantium. Suscipit ipsum qui assumenda officiis atque voluptates odit.

Socials

instagram:

- url : https://instagram.com/vincenzo_cole

- username : vincenzo_cole

- bio : Numquam tenetur dicta quo dolorem minima. Aut et sint modi soluta. Nemo recusandae consectetur aut.

- followers : 6995

- following : 2657

linkedin:

- url : https://linkedin.com/in/colev

- username : colev

- bio : Praesentium et magni impedit magnam omnis quidem.

- followers : 2451

- following : 2632

facebook:

- url : https://facebook.com/vincenzo_cole

- username : vincenzo_cole

- bio : Officia doloribus dicta hic facere fugit voluptas et explicabo.

- followers : 5239

- following : 1267