What is the significance of social commentary on stock market activity? Understanding the online stock discussion platform and its role in investment decisions.

The online platform for discussing and analyzing stock market activity plays a significant role in the investment landscape. This platform facilitates the rapid dissemination of information and opinions about stocks, companies, and market trends. Participants often post real-time observations, interpretations, and predictions. An example might involve a user noting a particular company's recent earnings report and their resulting market reaction, sharing this with the community, and generating a discussion around possible future price movements. The platform's dynamic nature enables rapid information sharing and creates a platform for collective analysis.

This platform's influence on the market is undeniable. The aggregation of diverse perspectives can significantly impact market sentiment. Real-time feedback and discussion facilitate dynamic adjustments to investment strategies. The rapid flow of information can also contribute to volatility. Market participants, whether individual investors or professional traders, rely on this online community for insights and analysis, potentially altering their decisions based on the trends identified within the discussions.

To further understand the impact of this platform, it's essential to explore its role in driving market trends. This includes analyzing how community sentiment and real-time discussions influence trading decisions, and how these discussions are perceived by and affect investors of different backgrounds and levels of experience. The effects of this platform on financial markets are multifaceted, and a detailed understanding of this social commentary is critical for insightful analysis.

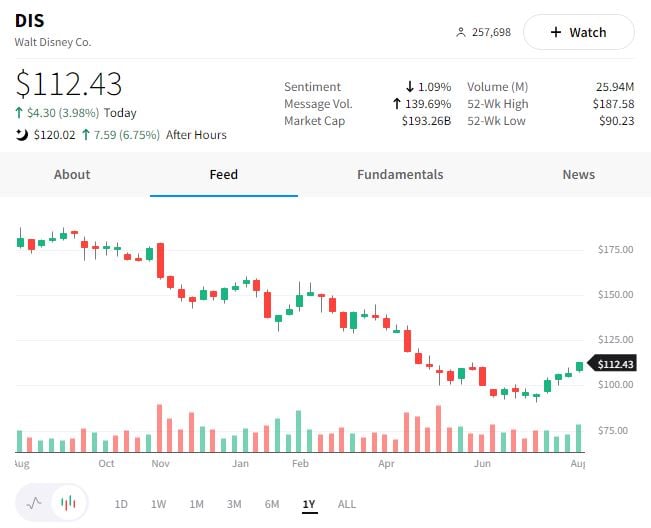

dis stocktwits

Understanding online stock discussion platforms is crucial for evaluating market sentiment and investment strategies. Key aspects of these platforms, such as the speed of information dissemination and the influence on investor decisions, warrant careful examination.

- Real-time information

- Community analysis

- Sentiment impact

- Trading decisions

- Market volatility

- Investment strategies

- Information accuracy

The speed of information dissemination on platforms like StockTwits directly influences trading decisions and market volatility. Community analysis, while providing a diverse range of perspectives, can also amplify both positive and negative sentiment, potentially impacting market trends. The influence on investor decisions is significant, as traders often rely on the collective insights from these forums. However, the accuracy of information shared is crucial. Unreliable or misleading information, whether intentional or unintentional, can lead to misinformed trading decisions. This necessitates critical evaluation and understanding of the context and source of the information. These platforms offer an opportunity for market participants to access a broad array of analyses, but this collective wisdom must be filtered through discerning judgment.

1. Real-time information

Real-time information is a defining characteristic of online stock discussion platforms. The rapid dissemination of news, analyses, and market reactions forms the core of these communities. This immediacy allows for near-instantaneous responses to events like earnings announcements, regulatory changes, or significant news impacting specific companies. For example, a sudden downturn in a company's stock price following a disappointing earnings report may be quickly noted and analyzed on a platform, influencing further trading activity as individuals react in real-time. This immediacy is a significant component in driving market volatility and shaping investor decisions.

The rapid exchange of real-time information has both positive and negative consequences. While it can facilitate informed decision-making based on up-to-the-minute updates, it can also lead to heightened volatility. Overreactions to news or speculation can cause price fluctuations unrelated to fundamental factors. Understanding how real-time information influences market behavior is vital for both individual and institutional investors. A deep understanding of the platform allows individuals to navigate this complex environment, discern valuable insights from noise, and potentially mitigate risk based on timely data.

In conclusion, the importance of real-time information on online stock discussion platforms cannot be overstated. It fuels the dynamic nature of these communities, directly impacting investor decisions and market movements. Understanding the mechanisms through which real-time information shapes market sentiment is vital for effective investment strategies and risk management. However, investors must also recognize the potential for misinterpretation and overreaction to fleeting market signals. Critical evaluation of sources and context remains paramount in this dynamic environment.

2. Community Analysis

Online stock discussion platforms, such as StockTwits, foster a community where diverse perspectives on market trends, company performance, and investment strategies converge. This "community analysis" plays a significant role in shaping sentiment and potentially influencing market behavior. Understanding its multifaceted nature is crucial for evaluating the platform's impact on investment decisions and market dynamics.

- Aggregation of Diverse Perspectives:

The platform brings together a wide range of users, each with varying levels of experience, knowledge, and investment goals. This aggregation creates a collective analysis that reflects a broader spectrum of opinions and interpretations, encompassing not only informed analysis but also speculation and sentiment. Examples include discussions on new product launches, earnings reports, and industry news, where diverse opinions contribute to a dynamic interpretation of the market's reaction. The implications of this aggregation are complex, potentially leading to significant market movements based on the overall sentiment within the community.

- Rapid Feedback and Iteration:

The platform facilitates rapid feedback loops where participants react to news and events instantly. This real-time analysis and discussion allow for immediate adjustments and adaptations to investment strategies based on evolving market sentiment. For example, a market correction might trigger immediate discussions about hedging strategies or potential buy opportunities, and the collective response shapes subsequent trading actions. The speed and volume of this iterative process are key characteristics of the platform.

- Influence on Market Sentiment:

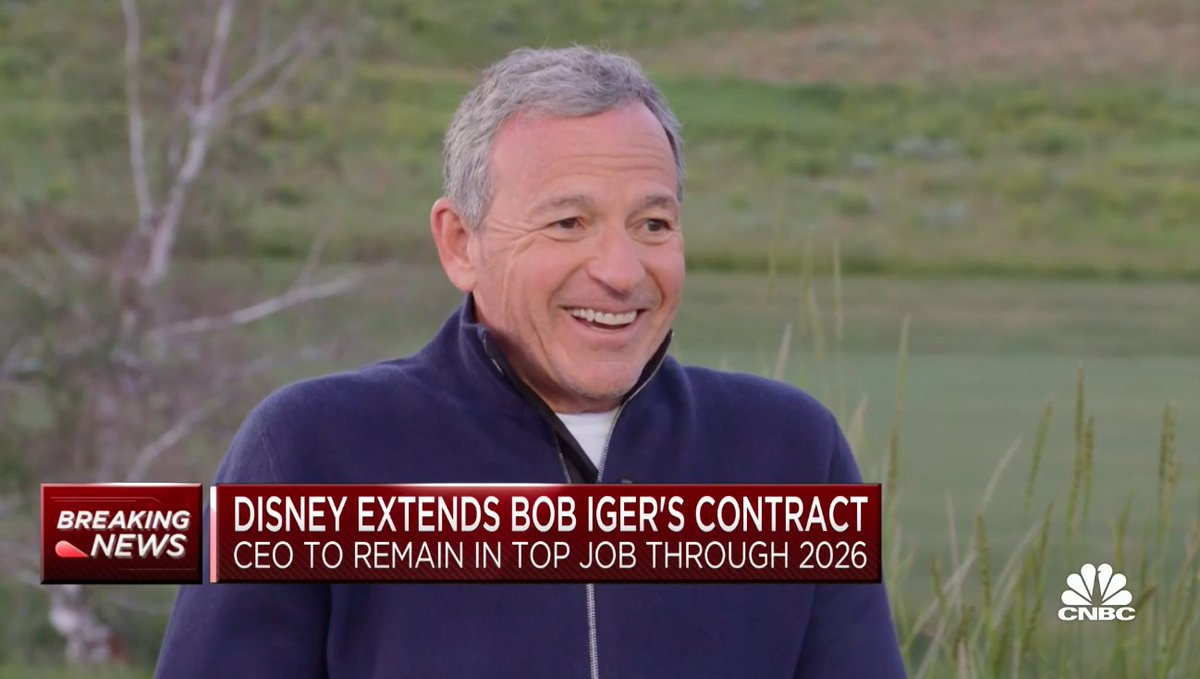

The aggregated analysis on the platform can significantly influence market sentiment. A consensus of positive or negative opinion regarding a company or sector can induce substantial price swings, even if not directly correlated to fundamental data. For example, increased discussion and concern surrounding a company's leadership could lead to a negative sentiment and subsequent decline in its stock price regardless of financial performance. Understanding this connection between online commentary and market psychology is vital.

- Potential for Misinformation and Speculation:

The nature of the platform encourages rapid information sharing, which can facilitate the spread of rumors, speculation, and potentially inaccurate or misleading information. This necessitates careful scrutiny by investors. Identifying reliable sources and evaluating the credibility of analyses is paramount to navigating this environment, as speculative information can significantly impact decisions.

In conclusion, community analysis on platforms like StockTwits is a complex interplay of diverse perspectives, rapid feedback, and market sentiment. While this collective intelligence can be a valuable resource for informed investment decisions, investors must be mindful of the platform's potential for misinterpretation, speculation, and the spread of misinformation. Understanding these various facets of community analysis is crucial for navigating the dynamic environment of online stock discussion platforms.

3. Sentiment Impact

Online stock discussion platforms, exemplified by StockTwits, exert a significant influence on market sentiment. The rapid dissemination of information and diverse opinions expressed on these platforms can significantly impact how investors perceive market trends and individual securities. This influence on sentiment is a key factor in the dynamic nature of stock prices and trading activities.

- Amplified Sentiment:

The collective sentiment expressed on these platforms can amplify existing market trends. Positive or negative discussions surrounding a particular stock can reinforce market opinions. If a significant portion of the community expresses optimism about a company's future prospects, for instance, the stock price might rise even in the absence of substantial fundamental changes. Conversely, widespread pessimism can lead to a downward trend. The interconnectedness of the platform allows for the quick transmission and magnification of sentiment, influencing the overall market atmosphere.

- Formation of Collective Perception:

Discussions and analyses on these platforms contribute to the formation of a collective perception of market trends and individual securities. This perceived consensus, regardless of its factual basis, often influences investment decisions. Analysts might base their forecasts on patterns of sentiment in the online forums, and this information becomes a component in their evaluations. Individual investors frequently reference these online discussions when forming their own opinions and strategies, demonstrating the significant role of perceived consensus on the platform.

- Influence on Market Volatility:

Rapid shifts in sentiment expressed on these platforms can significantly contribute to market volatility. Unpredictable fluctuations in online commentary can create sudden price swings, whether in response to news events, speculation, or unforeseen social media trends. These fluctuations may not be directly correlated with fundamental changes in the companies being discussed, but the impact on market sentiment can be substantial. The platform's dynamic structure enables this amplified volatility.

- Impact on Investment Decisions:

The sentiment expressed on platforms like StockTwits directly influences investment decisions. Investors often rely on collective opinions and analyses to make informed choices. The collective wisdom of the online community plays a significant role in shaping trading decisions and risk assessments for both individual and institutional investors. Furthermore, this impact is evident in real-time trading activity, which is often influenced by the prevalent sentiment reflected on the platform.

In summary, the sentiment impact of online stock discussion platforms is profound. The rapid dissemination of information, the formation of collective perceptions, and the amplification of trends contribute significantly to market volatility and influence investor behavior. Investors need to critically assess the information presented on these platforms, recognizing the potential for amplification of sentiment and the resulting impact on investment decisions.

4. Trading Decisions

The connection between trading decisions and online stock discussion platforms like StockTwits is profound. The rapid exchange of information, opinions, and analyses within these communities significantly influences market behavior. This influence manifests in various facets of trading activity, impacting strategies, risk assessments, and overall market dynamics.

- Influence of Community Sentiment:

Trading decisions are often influenced by the collective sentiment expressed within the platform. A prevailing sense of optimism or pessimism surrounding a particular stock or sector can significantly affect trading activity. For example, sustained positive discussions about a company's innovative product launch may spur buyers, potentially leading to a price increase, even if fundamentals haven't yet changed. Conversely, negative commentary about a company's financial performance can trigger selling pressure, causing a decline in the stock's value.

- Real-Time Responses to Market Events:

The real-time nature of these platforms enables rapid responses to market events. Investors can immediately react to breaking news, earnings reports, or regulatory announcements, often adjusting their trading strategies based on community analysis. For instance, a significant price drop following a disappointing earnings report will usually generate swift responses and potentially generate further trading activity as individual investors adjust their positions.

- Implementation of Collective Analysis:

Investors may use the collective analysis provided by the platform as a factor in their trading decisions. The aggregation of diverse perspectives, while potentially containing speculation or misinformation, can offer valuable insights into market sentiment. Investors often assess prevailing opinions within the community, attempting to gauge the overall market sentiment before acting on a trading opportunity, potentially informing their own decisions.

- Impact of Speculation and Rumors:

The very nature of these platforms, facilitating the rapid spread of information, carries the risk of misinformation, rumors, and speculation. Trading decisions based on these unreliable sources can lead to erroneous outcomes. The platform's structure fosters the potential for speculation, influencing trading volumes even when lacking fundamental support. Carefully evaluating the source and credibility of information is crucial for responsible trading.

In conclusion, trading decisions are intricately linked to online stock discussion platforms. The platform influences sentiment, facilitates real-time responses, promotes the use of collective analysis, and potentially impacts trading outcomes. Understanding the nuances of this relationshipincluding the potential for misinformation and speculationis essential for successful and informed trading within the context of these dynamic platforms.

5. Market Volatility

Market volatility, characterized by significant and rapid fluctuations in asset prices, is intrinsically linked to online stock discussion platforms. The speed and scope of information dissemination, the influence of community sentiment, and the potential for misinformation all contribute to the dynamics of price changes. Understanding this relationship is crucial for navigating the complexities of financial markets.

- Real-Time Information and Price Swings:

The rapid dissemination of information on online platforms, particularly those focused on stock discussions, can trigger immediate price reactions. News updates, earnings reports, or even speculative comments can lead to significant price swings. Real-time trading decisions influenced by the information on these platforms can amplify volatility as investor sentiment rapidly changes and drives short-term market fluctuations. For example, a controversial tweet about a company's future prospects, discussed widely on the platform, might trigger substantial price movement even before the company officially releases a statement.

- Community Sentiment and Amplified Volatility:

The aggregated sentiment expressed on these platforms can amplify existing market trends. A general consensus of pessimism or optimism can lead to larger price movements compared to situations with less pronounced or less shared sentiment. If a large segment of the community expresses negative opinions about a sector, it might cause greater selling pressure and further decline in that sector's stock prices. The community's collective emotional response is often an important driving force of short-term volatility.

- Speculation and Misinformation:

The rapid spread of information can facilitate the dissemination of speculation and misinformation. Unverified or misleading analyses shared on these platforms can create unwarranted market volatility. The speed with which speculation spreads, amplified by the platform's structure, can impact prices regardless of their intrinsic value or fundamental underpinnings. This is a significant risk factor, as misleading information can lead to large-scale and unsustainable fluctuations in the market.

- Feedback Loops and Market Instability:

The interaction between price changes and online discussions creates a feedback loop. Negative price action often triggers further discussion and potentially more negative commentary. Conversely, positive price movements might lead to more optimistic discussions and encourage further investment. This cycle of reaction and response can create periods of heightened market instability and, in some cases, self-fulfilling prophecies.

In conclusion, the interplay between market volatility and online stock discussion platforms is complex. Understanding the factors driving real-time information dissemination, community sentiment, speculation, and feedback loops is crucial for navigating the inherent risks associated with this dynamic market environment.

6. Investment Strategies

Investment strategies are integral components of online stock discussion platforms. These strategies, encompassing various approaches to asset allocation, risk management, and market timing, are frequently discussed and analyzed within these communities. Understanding how these strategies interact with the platform's dynamic environment is crucial for investors. For instance, a significant portion of conversations revolves around identifying stocks exhibiting specific growth patterns or those potentially undervalued by the market based on analyses shared on the platform. The active discussion surrounding these strategies shapes market behavior and, consequently, influences investment outcomes.

The platform acts as a repository of diverse investment approaches, from fundamental analysis emphasizing intrinsic value to technical analysis focusing on price patterns and indicators. Investors often leverage the collective insights shared within the community to refine their strategies. For example, if a community consensus emerges suggesting a potential upward trend for a specific sector, investors might incorporate this collective opinion into their existing strategies, potentially adjusting their portfolio allocations accordingly. Furthermore, the community itself becomes a platform for testing and validating strategies. Investors can share their experiences, successes, and failures in applying different strategies, influencing the discussions and analyses within the platform. This creates a dynamic environment where established strategies can evolve, or entirely new strategies can be formulated based on shared experiences.

The ability to discern credible strategies from speculation is paramount for successful investment decision-making. The constant exchange of information and ideas, while potentially beneficial, also necessitates careful analysis. Investors should evaluate the reasoning behind different strategies, scrutinize supporting data, and avoid blindly following trends without a thorough understanding of their own investment objectives and risk tolerance. Consequently, understanding the intricate interplay between investment strategies and online discussion platforms is vital for effectively managing investment portfolios in a dynamic market environment. Investors can leverage the collective knowledge of the platform while critically evaluating the information to ensure alignment with individual objectives. Ultimately, a thoughtful approach to incorporating information from these platforms into investment strategies is critical for success.

7. Information Accuracy

The accuracy of information disseminated on online stock discussion platforms is critical. Unreliable or inaccurate information can significantly impact investment decisions, potentially leading to substantial financial losses or missed opportunities. The nature of these platforms, characterized by rapid information sharing and diverse perspectives, necessitates a rigorous approach to evaluating the credibility of claims and analyses.

- Verification of Sources:

Assessing the credibility of sources is paramount. Information from reputable financial analysts, established news outlets, or publicly available company data should be prioritized over anonymous or unsubstantiated claims. Distinguishing between expert opinions and uninformed speculation is crucial for investors navigating these platforms. Lack of verifiable sources can lead to reliance on rumor or misinformation, potentially resulting in poor investment decisions.

- Contextual Evaluation:

Isolated pieces of information can be misleading. Understanding the broader context, including market trends, company performance, and relevant news, is essential. Contextual analysis can distinguish genuine market signals from noise or speculation. A piece of information appearing contradictory in isolation may align with established market trends when viewed in the proper context.

- Scrutiny of Speculation and Rumors:

Platforms often host speculation and rumors. Evaluating the likelihood of these claims is crucial. Unverified or unsubstantiated assertions lack the same weight as reliable data. Differentiating between factual data and speculation is vital in avoiding impulsive actions based on unreliable information, which can exacerbate risk.

- Assessment of Emotional Tone:

Emotional language and tone can influence interpretation. Identifying overtly optimistic or pessimistic commentary, or unsubstantiated statements presented as objective facts, helps gauge the reliability of presented information. Statements based solely on emotional reactions should be viewed with caution as they may not reflect sound analysis.

The accuracy of information shared on these platforms is not just a matter of individual investment decisions; it affects the broader market dynamics. Reliable information underpinning investment strategies contributes to a more stable and predictable market environment. Conversely, the prevalence of misinformation and speculation can lead to unwarranted volatility and detrimental outcomes for participants across the market spectrum. Therefore, fostering a culture of critical evaluation and responsible information sharing is crucial for the platform's long-term success and its contribution to a well-functioning market.

Frequently Asked Questions about Online Stock Discussion Platforms

This section addresses common inquiries regarding online platforms dedicated to discussing stock market activity. Clear answers are provided to dispel common misconceptions and offer a comprehensive understanding of these online communities.

Question 1: What is the primary purpose of these online discussion forums?

These platforms facilitate the rapid exchange of information, opinions, and analyses related to stocks, companies, and market trends. Discussions encompass a wide range of topics, from earnings reports and company news to broader market predictions and individual investment strategies. The primary function is to provide a forum for the community to share insights and engage in dynamic, real-time discourse.

Question 2: How do these online discussions influence market activity?

The collective sentiment expressed on these platforms can significantly impact market sentiment and, consequently, trading decisions. Widespread optimism or pessimism regarding a specific stock or sector can lead to corresponding price fluctuations, even if not directly correlated with fundamental changes. The speed at which these discussions evolve contributes to market volatility.

Question 3: What are the potential risks associated with relying solely on online information?

The speed of information dissemination on these platforms can facilitate the spread of misinformation, rumors, or speculative analysis. Relying solely on unverified information can lead to poor investment choices and financial losses. Critical evaluation of sources and proper context are crucial for responsible participation.

Question 4: How can users evaluate the reliability of the information shared?

Users should prioritize information from reputable financial analysts, established news outlets, or publicly available company data. Evaluating the source's credibility, examining supporting evidence, and considering the broader context are essential. Scrutinizing the tone of discussion (optimistic/pessimistic) and the presence of speculation is also important.

Question 5: What role do investment strategies play in these online discussions?

Different investment strategies, from fundamental analysis to technical analysis, are frequently debated and discussed. These online forums can be valuable resources for learning and exploring various approaches. However, adopting strategies based solely on unverified information shared on these platforms poses risks. Investors must integrate online discussions with their own due diligence.

Understanding these considerations is crucial for navigating online stock discussion platforms responsibly. Effective participation requires discernment, critical evaluation, and a nuanced understanding of the platform's strengths and limitations.

Moving forward, a deeper examination of the financial market's overall structure and the mechanics underlying stock price movements will be explored in the subsequent section.

Conclusion

Online stock discussion platforms, exemplified by StockTwits, exert a considerable influence on market dynamics. The rapid dissemination of information, diverse analyses, and aggregation of investor sentiment directly affect trading decisions and market volatility. This study highlights the significant role of community analysis in shaping market perceptions and the potential for amplified sentiment, potentially leading to price fluctuations independent of fundamental factors. The inherent interplay between real-time information, community sentiment, and speculation underscores the need for critical evaluation of sources and the importance of contextual understanding when navigating these platforms. Furthermore, the influence on investment strategies, the potential for misinformation, and the resulting impact on market stability all underscore the complexity of this interaction. The platform's inherent characteristics create a dynamic environment demanding rigorous evaluation and prudent decision-making.

Moving forward, a nuanced understanding of the mechanisms linking online discussions and market behavior is essential for both individual and institutional investors. Effective investment strategies must integrate insights gleaned from these platforms with thorough fundamental analysis and a clear comprehension of individual risk tolerance. Ultimately, navigating the intricate relationship between online stock discussions and financial markets requires a balance of utilizing readily available information and exercising independent judgment. Further research into the long-term implications of this relationship, including the identification of potential vulnerabilities and the development of mitigating strategies, is warranted.

Detail Author:

- Name : Stephen Schumm

- Username : florian73

- Email : wilburn07@wyman.info

- Birthdate : 1984-06-24

- Address : 975 Jameson Circle South Onaville, IL 50446-5363

- Phone : 424.330.4498

- Company : Cartwright Group

- Job : Agricultural Inspector

- Bio : Ad tempore sunt magnam blanditiis qui fugiat. Voluptatem dolorem ut voluptatibus consequatur. Error laboriosam nesciunt optio velit animi qui.

Socials

twitter:

- url : https://twitter.com/stacey.larkin

- username : stacey.larkin

- bio : Iure nihil aspernatur et autem dolorum aut et. Quis qui saepe quae voluptatum qui eos. Consectetur quia soluta error cum tempore sapiente autem.

- followers : 5894

- following : 122

facebook:

- url : https://facebook.com/larkins

- username : larkins

- bio : Aut ipsa quidem libero doloribus. Sit qui enim dolor debitis quas sequi.

- followers : 4783

- following : 1995