What does a positive outlook on the market signify? A strong, confident perspective on market trends.

A positive or optimistic outlook regarding the future performance of a financial market or specific asset is often expressed using terms like "positive" or "bullish." This outlook frequently implies that prices are expected to increase. The implied expectation of rising prices is a critical element in market analysis. An example might be a statement like: "Analyst forecasts suggest a bullish outlook for the technology sector, with expected price gains for the following quarter." In this case, "bullish" acts as an adjective describing the outlook. Another example could be an increase in buy orders within a stock market.

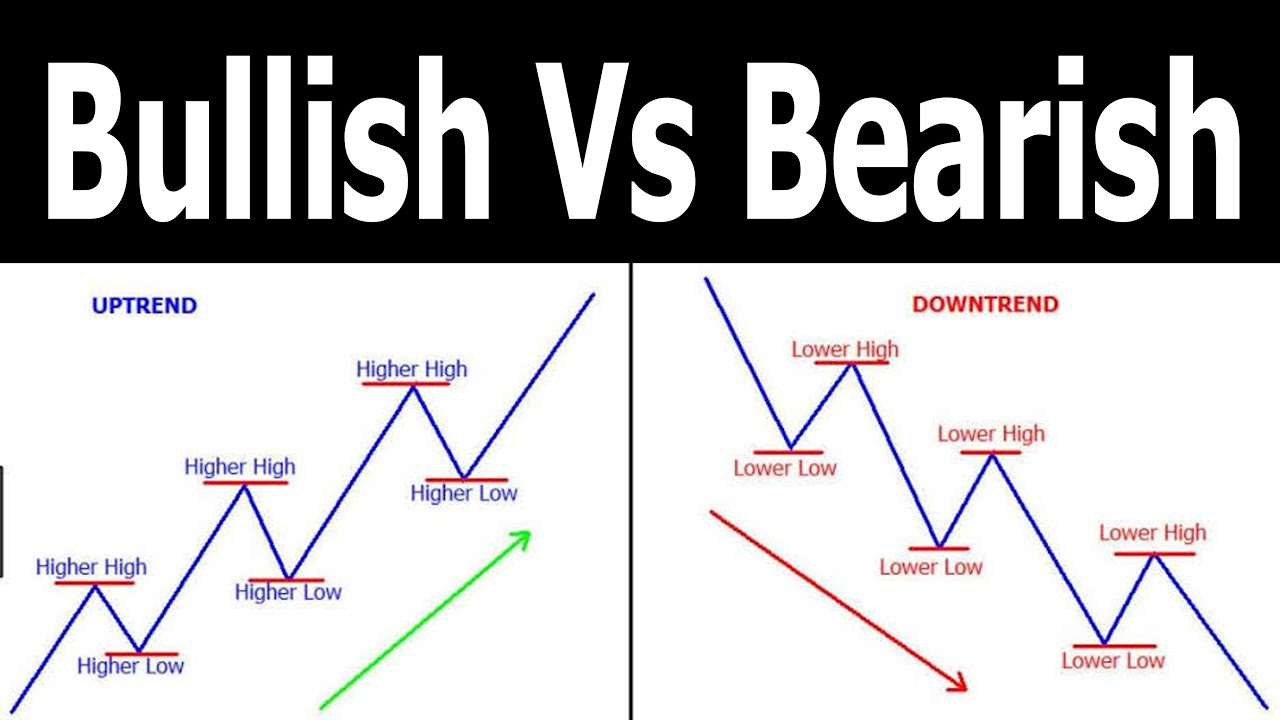

A bullish market outlook typically suggests favorable conditions for investment. Improved economic indicators, increased consumer confidence, and supportive government policies often accompany this positive sentiment. Understanding and interpreting this optimistic perspective can be a critical aspect of successful investment strategies. This positive outlook often leads to increased market activity and potentially higher returns for investors. Historical data shows that periods of bullish sentiment often precede significant market gains, highlighting its importance in market analysis. Conversely, a bearish outlook, a negative outlook, indicates a predicted decline in value.

Moving forward, this article will explore the analysis tools and techniques used to discern bullish market trends.

Bullish Outlook

A positive market outlook, often referred to as a "bullish" perspective, is a crucial element in financial analysis. Understanding the key aspects of this outlook is essential for informed decision-making.

- Market confidence

- Price increase

- Investment optimism

- Economic indicators

- Analyst forecasts

- Increased activity

- Positive sentiment

- Potential gains

These aspects are interconnected. High market confidence often correlates with predicted price increases, fueling optimism among investors. Favorable economic indicators, such as strong GDP growth, frequently coincide with positive analyst forecasts and increased trading activity, suggesting potential gains. Ultimately, a bullish market outlook represents a confluence of favorable economic conditions, investor psychology, and expert predictions. For instance, a sustained period of bullish sentiment might lead to substantial stock market gains, whereas an abrupt reversal could trigger significant price declines.

1. Market Confidence

Market confidence is a critical component in assessing a bullish market outlook. High confidence levels often signal widespread optimism regarding future market performance, driving investment decisions and potentially leading to price increases. This connection is crucial because it translates general sentiment into tangible market activity.

- Economic Indicators and Sentiment

Positive economic indicators, such as strong employment figures or rising consumer spending, often bolster market confidence. This positive sentiment can lead investors to anticipate continued gains, driving further investment and creating a self-reinforcing cycle. Conversely, negative economic data can erode confidence and lead to a bearish outlook. Examples include periods of low unemployment or rising inflation, influencing expectations about the direction of the market.

- Analyst Consensus and Forecasts

A strong consensus among market analysts and financial experts that forecasts point toward positive market trends often fuels confidence. When major institutions and analysts agree on a favorable outlook, it can reassure investors and create a supportive environment for price increases. This consensus contributes significantly to the overall sentiment driving a bullish market.

- Previous Market Performance and Trends

Successful market performance in the past, often evident in historical trends of consistent gains or strong recovery after setbacks, builds confidence. Investors tend to trust data from the past to forecast future trends. Recognizing recurring patterns, such as price growth correlated with increased investor interest or past booms, can influence and bolster investor confidence and the overall market sentiment.

- Government Policies and Regulation

Government policies that support economic growth or stability, such as supportive fiscal policies or sound monetary regulation, create a more favorable environment for market confidence. Investors respond favorably to these policies and may anticipate market gains. Conversely, policies viewed as uncertain or detrimental can significantly diminish investor confidence.

In summary, market confidence acts as a catalyst for a bullish outlook. Positive economic trends, analyst agreement, historical data, and supportive policies all contribute to a more optimistic view of the market's future. A robust understanding of these interconnected factors is invaluable for evaluating the validity and sustainability of a bullish market. These elements collectively influence investor behavior and, ultimately, the trajectory of market performance.

2. Price Increase

A price increase is a key indicator and a significant driver of a bullish market outlook. The correlation between rising prices and a bullish sentiment is deeply rooted in market psychology and economic principles. This relationship underscores the importance of understanding how price movements reflect broader market trends.

- Increased Investor Confidence

A sustained increase in asset prices, whether stocks, commodities, or other investments, tends to signal growing investor confidence. This confidence is often fueled by factors such as strong earnings reports, positive economic indicators, or supportive government policies. The perception of increasing value fosters a belief that further price appreciation is likely. This creates a self-reinforcing cycle, where rising prices attract more investment, leading to further price increases.

- Demand-Supply Dynamics

Rising prices often result from an imbalance between supply and demand. If demand for an asset exceeds supply, its price will naturally increase. This is a fundamental economic principle. This can be driven by factors such as high demand from institutional investors, new product introductions, or limited availability. In a bullish market, the observed price increases suggest that the current market conditions favor continued appreciation.

- Expectation of Future Growth

Investors typically anticipate future growth when prices are on an upward trajectory. The price increase itself is seen as a confirmation of this anticipated growth, which in turn encourages further investment. This creates a positive feedback loop where expectations and reality reinforce each other. Investors are willing to pay higher prices if they believe the underlying asset or market will continue to appreciate.

- Market Sentiment and Indicators

Rising prices are frequently accompanied by positive market sentiment. Analysts and commentators tend to express bullish views when prices are consistently moving upwards. Various market indicators, like rising volume in transactions, accompany this trend. These indicators corroborate the expectation of price increases, creating a strong correlation between the observed price movement and the bullish outlook.

In conclusion, a consistent price increase is a critical component of a bullish market. The observed price increases reflect heightened investor confidence, underlying demand and supply dynamics, and expectations of future growth. These factors combined create a positive feedback loop, reinforcing the bullish sentiment and driving continued price appreciation.

3. Investment Optimism

Investment optimism, a crucial element in market analysis, is deeply intertwined with a bullish outlook. This positive sentiment concerning the future performance of assets fuels investment decisions and often anticipates sustained market growth. Understanding the drivers and manifestations of investment optimism is vital for comprehending a bullish market environment.

- Economic Indicators and Expectations

Positive economic data, like robust employment figures or growing consumer confidence, often fosters investment optimism. This optimism translates into increased investment activity as investors perceive favorable conditions for future returns. For instance, a sustained period of low unemployment and high consumer spending might lead to an expectation of continued business growth and subsequently, a bullish outlook.

- Analyst Consensus and Forecasts

A broad consensus among analysts and financial experts regarding positive future trends reinforces investment optimism. If numerous experts predict continued growth across sectors, investors may be more inclined to believe in a bullish market. Strong, positive forecasts from trusted institutions significantly influence investor choices.

- Historical Performance and Trends

Past successes and established market trends contribute to investment optimism. The experience of past growth periods and the recognition of recurring patterns, including a correlation between certain economic indicators and price increases, can instill a sense of anticipation in investors. Historical data and consistent positive returns often create an environment where investors anticipate continued growth.

- Government Policies and Regulation

Supportive government policies aimed at promoting economic growth or market stability can significantly influence investment optimism. Clear, stable regulations and policies create a sense of security, encouraging investment. Conversely, uncertainty or policies perceived as detrimental can undermine confidence.

In essence, investment optimism acts as a crucial driver in a bullish market. The interconnected nature of these elements, including economic signals, expert opinion, historical context, and regulatory environment, all influence the overall confidence and expectations shaping investment decisions. A strong positive market outlook, or "bullish" perspective, relies heavily on these factors. The positive feedback loop between optimistic sentiment and investment activity is a hallmark of a flourishing market environment.

4. Economic Indicators

Economic indicators play a pivotal role in shaping market sentiment and influencing the likelihood of a "bullish" outlook. Their significance stems from the correlation between economic health and investor confidence. Positive indicators often suggest a robust economy, leading investors to anticipate increased profits and value appreciation, creating a bullish environment. Conversely, negative indicators can instill caution and lead to a bearish market sentiment.

- Gross Domestic Product (GDP) Growth

GDP growth is a key indicator reflecting the overall economic output of a nation. A rising GDP suggests a healthy economy expanding its production and services. This growth, when consistent, often translates into higher corporate profits and increased investor confidence, making a bullish market more probable. Examples of this include periods of sustained economic expansion and reduced unemployment rates, which often accompany significant GDP growth and fuel bullish outlooks.

- Consumer Spending and Confidence

Consumer spending drives a significant portion of economic activity. Strong consumer spending and confidence often accompany a healthy economy, boosting consumer demand and leading to higher production and growth in various sectors. This translates directly to a bullish market expectation, as increased demand is usually seen as a positive sign and often results in rising stock prices and other asset valuations. Decreasing consumer confidence, on the other hand, frequently correlates with a bearish market view.

- Employment Levels and Unemployment Rates

Stable or declining unemployment rates, coupled with consistent job creation, usually signal a strong labor market. A strong labor market often signifies a healthy and productive economy, leading to higher consumer spending and overall economic expansion. Such positive employment indicators often align with a bullish outlook for investment, as a strong labor market fuels growth and enhances the prospects for profitable returns. High unemployment rates, in contrast, generally correspond with negative market expectations.

- Inflation Rate

Inflation, measured by the rate at which prices rise, must be carefully monitored. While moderate inflation may reflect a growing economy, high and unpredictable inflation can often indicate underlying economic instability. Investors generally associate a stable, moderate inflation rate with a bullish market outlook. Unpredictable or excessively high inflation often leads to uncertainty and diminished investor confidence, making a bearish market more likely.

In summary, economic indicators provide valuable insights into the overall health and direction of an economy. A confluence of positive economic indicators often correlates with a bullish market outlook, increasing investor confidence and leading to potentially higher returns. Conversely, negative economic indicators can undermine this confidence and create a bearish environment. Tracking these indicators is crucial for evaluating the market's future direction and making informed investment decisions.

5. Analyst Forecasts

Analyst forecasts, often integral to financial markets, can significantly influence market sentiment and contribute to a bullish outlook. The strength and consistency of these forecasts play a substantial role in shaping investor confidence and potentially driving market trends. A consensus of positive forecasts among prominent analysts often correlates with a surge in investor optimism, thereby escalating the probability of a bullish market. This relationship underscores the importance of understanding how analyst assessments are integrated into the overall market dynamics.

The impact of analyst forecasts is demonstrably evident in numerous real-world examples. For instance, a widely anticipated positive earnings report from a major corporation, corroborated by bullish forecasts from several investment banks, frequently leads to increased demand for the company's stock, pushing prices upward. Conversely, unfavorable projections, often coupled with negative analyst reports, can trigger selling pressure, potentially leading to downward market trends. These examples highlight the direct correlation between analyst opinions and market behavior. Furthermore, the dissemination of such forecasts, through various media outlets and financial platforms, amplifies their influence, shaping public perception and investment decisions. Sophisticated investment strategies frequently incorporate analyst forecasts into their models to predict price movements and assess risk.

Understanding the connection between analyst forecasts and a bullish market is critical for navigating financial markets. While analyst predictions are not guarantees, the widespread agreement on positive future prospects significantly influences investor psychology and market behavior. A crucial aspect involves recognizing the potential biases and limitations inherent in analyst forecasts. Divergent opinions, market volatility, and unexpected events can all undermine the predictive power of these assessments. Consequently, while analyst forecasts provide valuable insights, they should not be the sole determinant in investment decisions. A nuanced understanding of the market, incorporating diverse perspectives, is critical for sound investment strategies. Careful analysis of the underlying factors driving the forecasts is equally crucial, ensuring informed judgments beyond simply accepting the consensus.

6. Increased Activity

Increased market activity is a key indicator often associated with a bullish market outlook. A surge in trading volume, trading frequency, and overall engagement signifies heightened investor interest and optimism regarding future price appreciation. This connection arises from the cyclical nature of financial markets: increased activity often precedes and fuels a bullish trend.

The relationship between increased activity and a bullish market is multifaceted. Higher trading volume frequently accompanies positive economic indicators, strengthening the overall perception of a favorable market environment. This increased activity also reflects a growing confidence among investors who anticipate further price gains. Investors seeking higher returns often gravitate toward markets experiencing robust activity, leading to a self-reinforcing cycle. Real-world examples include the surge in trading activity preceding a significant stock market rally or a surge in cryptocurrency trading volume coinciding with an upward trend in a specific cryptocurrency's value. Understanding this connection is vital for investors to identify potential opportunities and mitigate risks.

The practical significance of recognizing increased activity as a component of a bullish outlook is substantial. Investors can utilize this insight to inform their investment strategies, potentially recognizing early signs of market shifts. By monitoring trading volume and frequency alongside other key indicators, investors can gauge the strength and sustainability of a bullish trend. However, increased activity alone does not guarantee sustained growth. Other factors, like fundamental economic data and market sentiment, must also be considered to ensure a comprehensive evaluation of the market's direction. Investors must maintain a cautious approach, acknowledging that increased activity can be a precursor to both positive and negative market shifts, demanding a well-rounded market analysis for successful decision-making.

7. Positive Sentiment

Positive sentiment, a crucial element in financial markets, is inextricably linked to a "bullish" outlook. A pervasive sense of optimism regarding market performance, often fueled by positive economic indicators, expert opinions, and past performance, frequently precedes and contributes to a sustained upward trend. This optimistic climate influences investment decisions, potentially driving price increases and shaping overall market behavior.

- Economic Indicators and Optimism

Positive economic data, such as rising employment rates, strong GDP growth, and increasing consumer confidence, typically generate a positive sentiment in financial markets. When these metrics suggest a healthy economy, investors often feel more confident about future returns, leading to heightened investment activity and potentially pushing prices upward. This interconnectedness highlights the crucial role economic indicators play in shaping positive market sentiment.

- Analyst Consensus and Projected Growth

A widespread agreement among financial analysts regarding favorable market prospects plays a significant role in fostering positive sentiment. When prominent analysts consistently project positive growth, it can instill confidence in investors and further encourage investment. This consensus, often communicated through reports and forecasts, contributes significantly to a bullish market environment.

- Historical Trends and Past Successes

Successful past performance and positive market trends can also generate optimistic sentiment. Past growth cycles and recognizable patterns contribute to the expectation of continued growth. Investors observing a consistent history of price appreciation tend to have a more positive outlook, increasing the likelihood of future investment. Therefore, historical performance can become a self-fulfilling prophecy.

- Government Policies and Market Stability

Government policies supporting economic stability and growth can foster a positive sentiment in financial markets. Clear, consistent policies create a predictable and supportive environment, encouraging investors and potentially leading to a bullish market. Conversely, uncertainty or instability in policies can decrease confidence and lead to negative market sentiment.

In conclusion, positive sentiment is a complex interplay of various factors, including economic indicators, analyst projections, historical data, and policy stability. A robust and widespread positive sentiment is often a crucial antecedent to a bullish market, influencing investment decisions, potentially driving price increases, and shaping the overall trajectory of market performance. Understanding these connections is vital for investors seeking to navigate and capitalize on favorable market conditions.

8. Potential Gains

Potential gains are intrinsically linked to a bullish outlook. A bullish market perspective, by definition, anticipates rising asset values. This anticipation hinges on the perceived prospect of future increases in prices, creating a positive feedback loop where potential gains drive investment and further price appreciation. The expectation of profit motivates investment decisions and drives market activity. For example, a company's strong earnings outlook, supported by positive market trends and analyst projections, can lead to increased investor confidence and a surge in stock prices, precisely due to the anticipation of substantial future returns.

The importance of potential gains as a component of a bullish outlook cannot be overstated. This expectation of future profitability is a crucial catalyst. Successful businesses often experience periods of increased profitability, and these periods often coincide with a bullish market environment. Similarly, emerging markets with anticipated growth potential and favorable government policies tend to attract significant investment capital. The allure of these potential gains fuels investor interest and propels the market upward. However, the crucial element is not just potential gains, but realistic potential gains, supported by verifiable data and not simply speculative predictions. For instance, a company announcing groundbreaking technological innovations, alongside strong financial projections, creates an environment where potential gains are well-founded. Conversely, potential gains based solely on speculation or unsupported predictions could lead to market volatility and, ultimately, disappointment.

In conclusion, the connection between potential gains and a bullish market outlook is fundamental. Anticipation of future profits is a primary driver of investment and market activity. However, for this outlook to translate into sustainable growth, the potential gains must be grounded in verifiable factors and sound analysis. Investors must distinguish between genuine potential and speculative forecasts, ensuring that their decisions are informed by reliable data rather than unsubstantiated optimism. A clear understanding of this connection allows investors to make more discerning decisions in a complex and dynamic market environment.

Frequently Asked Questions about a Bullish Market

This section addresses common questions and concerns regarding a bullish market. Understanding these issues can help clarify the characteristics and implications of this market outlook.

Question 1: What exactly constitutes a "bullish" market?

A bullish market is characterized by a general expectation of rising asset prices, primarily stocks, bonds, or other investment instruments. This expectation is often based on factors like positive economic indicators, favorable investor sentiment, and optimistic analyst forecasts. A sustained period of rising prices, accompanied by increased trading volume and investor confidence, are hallmarks of this market condition.

Question 2: What are the key drivers of a bullish market?

Several factors contribute to a bullish market. Positive economic indicators such as robust GDP growth, low unemployment rates, and rising consumer spending often fuel confidence. Strong corporate earnings reports, favorable analyst projections, and supportive government policies can further reinforce this positive outlook. A positive sentiment among investors can also be a critical catalyst for continued price increases.

Question 3: How can investors identify a potential bullish trend?

Several indicators can signal a potential bullish market shift. Monitoring economic data releases, paying close attention to analyst reports, tracking market activity through trading volume, and assessing investor sentiment are crucial. Observing established patterns, though not guarantees, can highlight potential bullish developments. However, a holistic approach considering numerous indicators is essential.

Question 4: Are there risks associated with a bullish market?

While a bullish market generally presents opportunities for increased returns, risks still exist. Rapid price increases can lead to speculative bubbles, and unforeseen eventssuch as economic downturns or geopolitical instabilitycan disrupt the trend. Furthermore, investors should be aware that past performance is not indicative of future results.

Question 5: What strategies are suitable during a bullish market?

Various investment strategies can be effective during a bullish market. These include value investing, growth investing, and dividend-focused strategies. Strategies should be carefully tailored to risk tolerance, investment goals, and market dynamics. Diversification and a well-defined investment plan are crucial components of a strategy during any market condition.

Understanding the factors contributing to a bullish market, the potential risks, and effective investment strategies can aid investors in navigating market conditions successfully.

This concludes the FAQ section. The following section will explore specific investment strategies.

Conclusion

This article explored the multifaceted nature of a bullish market outlook. Key factors influencing this optimistic perspective were examined, including robust economic indicators, favorable analyst forecasts, and sustained investor confidence. The interconnectedness of these elements, culminating in a positive market sentiment, was highlighted. The cyclical nature of market trends, with price increases driving further investment and optimism, was also emphasized. Furthermore, the importance of distinguishing between genuine potential for gains and speculative projections was stressed. The analysis underscored that a bullish outlook, while promising, is not without risk, highlighting the need for careful consideration of various market indicators and a thorough understanding of investment strategies.

Ultimately, understanding a bullish market environment requires a comprehensive assessment of underlying economic factors, analyst projections, and investor sentiment. While a bullish outlook often presents opportunities for potential gains, it's crucial to acknowledge potential risks and maintain a balanced perspective. By recognizing the interconnected factors and nuanced complexities of this market dynamic, informed decisions and strategic investment approaches can be formulated, promoting a more successful and resilient investment strategy during periods of anticipated market growth.

Detail Author:

- Name : Dr. Seth Kessler DVM

- Username : frederic99

- Email : bryon62@yahoo.com

- Birthdate : 1993-03-01

- Address : 6397 Jana Falls Suite 459 South Camron, VA 31854-6946

- Phone : +13864390264

- Company : Von-Orn

- Job : Auditor

- Bio : Sapiente et consequatur perspiciatis ut. Dolorem nihil rerum necessitatibus quo. Excepturi aliquam quo tempora ex hic voluptate et. Mollitia alias sed recusandae sint quam magni est.

Socials

twitter:

- url : https://twitter.com/devan_id

- username : devan_id

- bio : Esse sed facere in esse. Corporis reprehenderit vitae sunt dolore sapiente. Eos fugiat accusantium doloremque iure atque dolorum accusamus. Ex rerum quo ut.

- followers : 3136

- following : 1626

instagram:

- url : https://instagram.com/devan_o'kon

- username : devan_o'kon

- bio : Omnis consequatur ex ea dolor reiciendis et. Neque qui laborum earum. Eos culpa voluptatum tempora.

- followers : 3448

- following : 12

tiktok:

- url : https://tiktok.com/@do'kon

- username : do'kon

- bio : Rerum neque aut quidem in et repellat ut. Exercitationem impedit nemo esse ut.

- followers : 5292

- following : 1831