What do quarterly earnings reports reveal about a company's financial health, and why are they significant for investors?

Quarterly earnings reports, often containing vital financial information about a company, represent a snapshot of a company's financial performance during a three-month period. These reports typically detail revenue generated, expenses incurred, and the resulting net income or loss. For example, a company might announce a significant increase in revenue and profits, indicating robust business operations. Conversely, a decline in these figures could signal challenges in the market or internal operational inefficiencies.

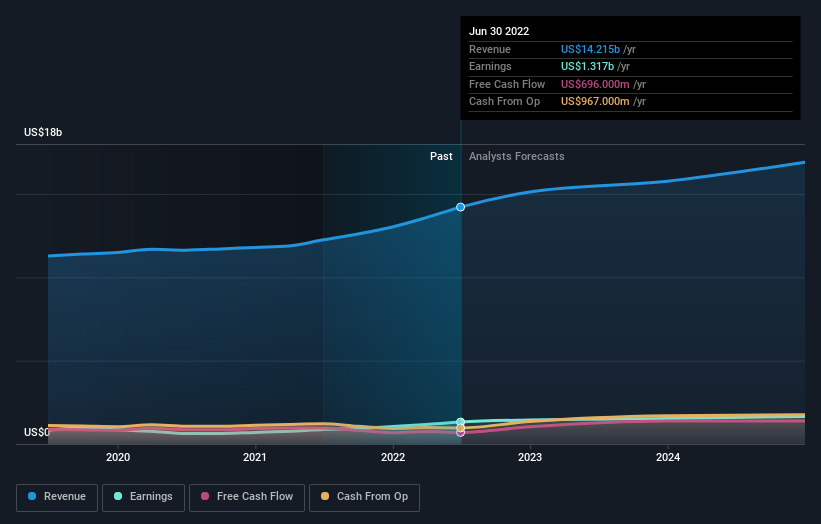

These reports are crucial for investors and stakeholders to assess the financial health of a company and forecast its future performance. Understanding the trends presented within the reports can help predict future stock prices or make informed decisions regarding investments. Analyzing historical patterns of earnings can provide insight into a company's ability to consistently generate profits. The reports contribute significantly to market intelligence and are often a major factor influencing stock market valuations.

Analysis of these reports often forms the foundation of detailed financial assessments and insights into market dynamics. This understanding fuels informed investment strategies and informs crucial business decisions within organizations.

gWW Earnings

Understanding quarterly earnings, or gWW earnings as they may sometimes be presented, is crucial for evaluating a company's financial performance. These figures provide vital insights into operational success and future prospects.

- Financial Performance

- Revenue Growth

- Profitability

- Market Trends

- Investment Decisions

- Stock Valuation

- Operational Efficiency

- Analyst Predictions

Quarterly earnings reports are a multifaceted representation of a company's performance. Revenue growth, profitability, and market trends are pivotal indicators. Strong revenue growth might suggest a favorable market position, while consistent profitability points to operational efficiency. Investment decisions and stock valuations often hinge on these figures. Analysts' predictions offer further insight into future performance. Strong earnings figures, combined with market favorability, typically translate to increased stock value. Conversely, declining profitability or negative market sentiment may prompt investors to reassess their positions.

1. Financial Performance

Quarterly earnings (gWW earnings) directly reflect a company's financial performance over a defined period. Analyzing these earnings is essential for understanding a company's health and potential. Robust financial performance is often indicated by favorable gWW earnings. Conversely, declining gWW earnings might signal underlying issues requiring investigation.

- Revenue Growth

Revenue growth, a key component of financial performance, is frequently reflected in gWW earnings. Significant increases in revenue over the reported quarter usually signify a growing market share or successful product launches. Conversely, stagnant or declining revenue can indicate market saturation, weaker consumer demand, or ineffective marketing strategies. In evaluating gWW earnings, examining the revenue trend helps gauge a company's market traction and future potential.

- Profitability

Profitability, the difference between revenue and expenses, is a critical metric within financial performance. Positive and increasing profitability in gWW earnings suggests efficient operations, effective cost management, and strategic pricing. A decline in profitability might indicate pricing pressures, increased operating costs, or a need for cost-cutting measures to maintain competitiveness. This analysis is essential when evaluating the overall health of a company.

- Expense Management

Controlling expenses is vital for achieving profitability. The gWW earnings report highlights the cost structure of the business. Efficient management of administrative, operational, and sales expenses in relation to revenue directly impacts profitability and therefore gWW earnings. Analyzing these expenses against industry benchmarks provides a clear understanding of a company's operational efficiency.

- Cash Flow Management

Healthy cash flow is crucial for sustaining operations and future investments. Positive and growing cash flow, evident in gWW reports, suggests a company's ability to generate revenue and manage its expenses effectively. Negative or declining cash flow can indicate potential financial instability and liquidity issues, which negatively impacts the overall financial outlook and therefore the perception of gWW earnings.

Understanding these facets of financial performance within the context of gWW earnings provides a comprehensive view of a company's financial health. Detailed examination of these aspects allows stakeholders to assess potential risk and reward, leading to more informed investment or business decisions.

2. Revenue Growth

Revenue growth is a fundamental component of gWW earnings. A company's ability to increase revenue directly influences its profitability and overall financial health, reflected in gWW earnings. Strong revenue growth typically translates to higher gWW earnings, indicating a company's ability to expand its market share and increase its income. Conversely, stagnant or declining revenue growth can lead to lower gWW earnings, potentially signaling challenges in the marketplace or internal operational inefficiencies.

The importance of revenue growth as a component of gWW earnings is underscored by several real-world examples. A company consistently experiencing revenue growth, driven by successful product launches or effective marketing campaigns, will likely demonstrate higher gWW earnings. Conversely, if a company's revenue growth stagnates or declines amidst a competitive market, this negative trend is likely to manifest in lower gWW earnings. The correlation between revenue growth and gWW earnings is a critical element of financial analysis, often influencing investment decisions and market valuations. For instance, a significant increase in quarterly revenue growth, surpassing analysts' estimates, frequently signals robust business performance and leads to a positive stock market response.

Understanding the connection between revenue growth and gWW earnings has practical significance for investors, analysts, and business leaders. Investors can assess a company's growth potential by examining trends in revenue growth and correlating them with reported gWW earnings. Analysts use this relationship to forecast future performance and provide valuations. Companies can utilize this understanding to develop strategies to enhance revenue generation and improve overall financial performance. For example, a business experiencing low revenue growth might identify and address market weaknesses or optimize its sales and marketing processes to stimulate expansion and improve its gWW earnings. A thorough understanding of this relationship is vital to make well-informed decisions in a complex business environment.

3. Profitability

Profitability is a cornerstone of evaluating a company's financial health, inextricably linked to gWW earnings. Strong profitability usually indicates effective management and efficient operations, directly impacting the positive trajectory of reported quarterly earnings. Conversely, declining profitability often reflects challenges and can forecast potential negative trends in gWW earnings.

- Gross Profit Margin

Gross profit margin, calculated as gross profit divided by revenue, indicates the proportion of revenue remaining after accounting for direct costs of production. A consistent and increasing gross profit margin suggests a company's pricing strategies are effective and production efficiencies are maintained. High margins contribute significantly to gWW earnings by increasing the profit base available for further expenses. Examples include companies in industries with strong pricing power, such as technology or pharmaceuticals. Conversely, companies with low margins, like those in highly competitive consumer markets, may face limitations in their gWW earnings potential.

- Operating Profit Margin

Operating profit margin measures profitability after considering all operating expenses. It reveals a company's efficiency in managing its operations. A robust operating profit margin translates to more profit available for investors and shareholders, strengthening gWW earnings. Companies with highly efficient supply chains and low administrative overhead often showcase higher operating profit margins, directly contributing to better gWW earnings. This is particularly relevant in manufacturing or retail settings where operational efficiency is critical.

- Net Profit Margin

Net profit margin, reflecting the portion of revenue remaining after all expenses are deducted, provides the ultimate measure of profitability. A positive and growing net profit margin is a strong indicator of a company's overall financial health and reflects favorably on gWW earnings. High-profit businesses like software companies often exhibit strong net profit margins. However, companies operating in highly competitive environments or with substantial debt servicing costs might find their net profit margin constrained, potentially affecting gWW earnings.

- Pricing Power and Cost Control

Companies with substantial pricing power can command premium prices for their goods or services. This pricing power translates directly to higher revenue and, consequently, stronger gWW earnings. Simultaneously, meticulous cost control, whether through streamlined operations or strategic sourcing, enables a company to manage expenses effectively and improve its profit margins, thereby enhancing gWW earnings.

In summary, profitability metrics, from gross profit to net profit margin, are integral components of evaluating a company's performance as reflected in gWW earnings. A robust and consistent profitability trend usually signals strong financial health and indicates the potential for sustained growth in subsequent quarters' gWW earnings reports. Conversely, a decline in these key profitability metrics warrants closer scrutiny, as it could indicate underlying issues that may negatively impact future gWW earnings.

4. Market Trends

Market trends exert a significant influence on a company's quarterly earnings (gWW earnings). Understanding these trends is crucial for analyzing the potential impact on financial performance. Fluctuations in consumer demand, economic conditions, and industry-wide shifts directly correlate with reported earnings figures. Positive market trends typically correlate with higher gWW earnings, while adverse trends frequently result in lower earnings.

- Consumer Spending and Demand

Changes in consumer spending habits directly affect sales figures. Economic downturns, for example, often lead to reduced consumer spending, impacting demand for various products and services. Consequently, sales decline, resulting in lower gWW earnings. Conversely, periods of economic prosperity typically see increased consumer spending, stimulating demand and higher gWW earnings. Specific examples include industries directly reliant on consumer discretionary spending, such as retail and tourism. Understanding anticipated consumer spending patterns is critical in projecting future gWW earnings.

- Economic Conditions

Economic indicators, such as GDP growth, interest rates, and inflation, significantly affect overall market conditions. Periods of high inflation or economic recession typically correlate with lower consumer confidence and decreased investment, hindering overall growth. These factors ultimately lead to lower gWW earnings. Conversely, favorable economic climates, with lower interest rates and sustained GDP growth, generally boost consumer confidence and investment, resulting in higher gWW earnings for companies positioned to benefit from such trends. The relationship between economic indicators and gWW earnings is complex but warrants careful consideration.

- Industry-Specific Trends

Specific shifts within particular industries often impact individual company performance. Emerging technologies, technological advancements, or changing consumer preferences can create opportunities or challenges for various sectors. Companies aligned with rapidly growing markets or technological advancements generally report higher gWW earnings. Conversely, companies struggling to adapt to industry-wide shifts may experience declining gWW earnings. For instance, the rise of online retail significantly impacted traditional brick-and-mortar stores. Recognizing these industry-specific trends is vital in assessing a company's positioning within its market and its consequent potential gWW earnings.

- Geopolitical Events

Geopolitical events, such as trade wars or global conflicts, can cause significant disruptions to supply chains, impacting production, resource costs, and market access. Unforeseen geopolitical events often result in lower gWW earnings due to supply chain disruptions or heightened uncertainty. Conversely, favorable geopolitical events can create new opportunities for certain industries, leading to improved gWW earnings. The unpredictable nature of these events necessitates careful assessment and preparedness. Industries reliant on international trade are often most sensitive to such risks and variations in earnings.

In conclusion, understanding market trends is fundamental to interpreting and forecasting gWW earnings. Companies need to carefully monitor consumer spending, economic indicators, industry-wide shifts, and geopolitical events to anticipate their impact on financial performance. By incorporating this knowledge, stakeholders can make more informed decisions and assess the potential for favorable or unfavorable gWW earnings outcomes.

5. Investment Decisions

Investment decisions are profoundly influenced by gWW earnings. Quarterly earnings reports are a primary source of information for investors, guiding decisions about stock purchases, sales, or holding positions. Positive gWW earnings frequently correlate with increased investor confidence and potentially higher stock valuations, motivating further investment. Conversely, negative or declining earnings often lead to investor apprehension, potentially prompting divestment or a cautious approach to future investments.

The importance of gWW earnings in investment decisions stems from their ability to offer a snapshot of a company's operational performance. Consistent and increasing gWW earnings often suggest a company is successfully navigating the market, growing revenue, and managing costs effectively. These factors are critical indicators for potential return on investment. Consider, for example, a company consistently exceeding earnings projections; this often attracts further investment and drives up the stock price, creating a virtuous cycle. However, a sudden downturn in gWW earnings can trigger concerns about a company's future prospects, prompting investors to sell shares, potentially leading to a downward trend in the stock price. Historical data, including a company's consistent pattern of gWW earnings, is frequently used to assess its investment viability and risk. Investment strategies and portfolios are often constructed considering potential fluctuations in gWW earnings to minimize risk. Analysts frequently incorporate gWW earnings data into their valuation models to project future performance and inform investment recommendations.

Recognizing the inextricable link between investment decisions and gWW earnings is crucial for investors. Accurate interpretation of gWW earnings reports, coupled with thorough market analysis and consideration of broader economic trends, significantly enhances the likelihood of sound investment choices. A deep understanding of the relationship permits informed decisions regarding risk tolerance, investment diversification, and long-term financial goals. Failure to consider gWW earnings in investment strategies can lead to suboptimal returns or, in extreme cases, financial losses. Consequently, careful monitoring and analysis of gWW earnings form a critical element of successful investment strategies.

6. Stock Valuation

Stock valuation is a crucial process for determining the intrinsic worth of a company's stock. gWW earnings play a significant role in this process, influencing how investors perceive a company's future potential and, consequently, its stock price. Strong gWW earnings typically signal robust financial health and market success, which often leads to higher stock valuations. Conversely, weak or declining gWW earnings can lead to diminished investor confidence and potentially lower valuations.

- Earnings Per Share (EPS) and Valuation

EPS, a key component of gWW earnings, directly impacts stock valuation. A company consistently producing higher EPS suggests greater profitability, a positive signal for investors. This positive trend frequently translates to higher valuations. Conversely, declining EPS often leads to decreased investor confidence and a potential decline in stock value. Companies known for consistent high EPS often command higher valuations. For example, a pharmaceutical company announcing strong gWW earnings with corresponding high EPS may see an increase in stock price as investors anticipate continued success.

- Growth Potential and Future Projections

Analysts often analyze gWW earnings to project a company's future growth potential. Consistent positive gWW earnings trends, combined with positive market outlook and strategic initiatives, can suggest high growth potential, leading investors to assign a higher valuation to the company's stock. Strong future projections, based on historical gWW earnings data, often influence a company's market capitalization. For instance, a tech company with increasing gWW earnings accompanied by innovative product launches might receive higher valuations than competitors with stagnant or declining earnings.

- Market Comparison and Valuation Benchmarks

Investors frequently compare a company's gWW earnings with those of its competitors and industry benchmarks. If a company's gWW earnings consistently outperform its peers, it often commands a higher valuation. Conversely, consistently lower gWW earnings relative to competitors can lead to a lower stock valuation. Companies exhibiting strong performance relative to their peers in the sector will often have a higher market valuation. For example, a retail company achieving higher gWW earnings and sales compared to its competitors in a similar economic climate usually receives a premium valuation in the market.

- Risk Assessment and Valuation Discounting

gWW earnings are also vital for assessing risk and calculating a company's valuation discount. Companies with inconsistent or declining earnings might face higher risk premiums, leading to a lower valuation. Conversely, companies consistently delivering strong earnings often exhibit lower risk premiums and higher valuations. Factors like potential market shifts or specific company vulnerabilities often determine how analysts incorporate these risk factors into the valuation process, affecting investor sentiment and subsequently stock prices. For example, a company facing significant legal risks might experience lower valuations due to the risk-adjusted valuation.

In conclusion, gWW earnings are an integral component of stock valuation. These earnings data, coupled with market comparisons, future projections, and risk assessments, are critical factors shaping investor perceptions and, consequently, the valuation of a company's stock. This, in turn, impacts decisions in the stock market and reflects the markets view of a companys prospects.

7. Operational Efficiency

Operational efficiency directly impacts a company's quarterly earnings (gWW earnings). Effective resource utilization, streamlined processes, and minimized waste are crucial to generating profit and ultimately influencing the positive trajectory of gWW earnings. Analyzing operational efficiency within the context of gWW earnings is vital for understanding a company's overall financial health and future prospects.

- Inventory Management

Efficient inventory management, minimizing holding costs and avoiding stockouts, is critical for maximizing profitability. Reduced inventory holding translates to lower storage costs and less capital tied up in non-productive assets, improving cash flow and contributing favorably to gWW earnings. A company maintaining optimal stock levels, avoiding overstocking, and streamlining order fulfillment demonstrates operational excellence, maximizing revenue and minimizing waste.

- Supply Chain Optimization

A robust and streamlined supply chain reduces lead times, minimizes costs associated with procuring materials, and improves the overall delivery process. Optimized supply chains, ensuring uninterrupted material flow, result in a more predictable production schedule, enabling the company to meet demand efficiently and consistently. This predictability positively impacts gWW earnings by reducing uncertainties and inefficiencies.

- Labor Productivity

Maximizing labor productivity, improving employee efficiency, and minimizing downtime enhances output. Increased productivity directly translates to more goods or services produced per unit of time, boosting output and potentially enhancing gWW earnings. A company with a highly skilled and productive workforce, equipped with the necessary tools and training, demonstrates strong operational efficiency, enabling consistent delivery of products or services, contributing positively to financial performance.

- Process Automation and Technology Adoption

Automation and technological advancements optimize processes, minimize errors, and enhance overall efficiency. Implementation of sophisticated technologies that streamline workflows, reduces manual labor, and accelerates production processes improves operational efficiency, contributing to positive gWW earnings. An organization effectively utilizing technology for automation often sees a marked improvement in resource allocation, facilitating optimal use of labor and capital and generating higher profits and gWW earnings.

In conclusion, operational efficiency is intrinsically linked to gWW earnings. A company exhibiting strong operational efficiency demonstrates its ability to manage resources effectively, minimize costs, and maximize output. This translates into higher profitability, which directly impacts reported gWW earnings positively. Organizations prioritizing operational efficiency, through meticulous planning, streamlined processes, and optimal resource utilization, are more likely to experience improved financial performance as reflected in their gWW earnings.

8. Analyst Predictions

Analyst predictions, often incorporated into financial analysis, significantly influence the interpretation and impact of gWW earnings. These predictions serve as a critical component, influencing market perception and investor behavior. Analysts' projections, based on historical trends, market analysis, and company-specific factors, provide a framework for understanding gWW earnings within their broader context. A consensus among analysts for positive future gWW earnings often leads to heightened investor confidence and potential stock price appreciation. Conversely, a pessimistic outlook, fueled by predicted lower earnings, can decrease investor interest and potentially trigger a decline in stock value. The influence of analyst predictions is evident in how market expectations, shaped by these forecasts, directly affect the actual realized gWW earnings and subsequent market reaction.

Real-world examples highlight the interplay between analyst predictions and gWW earnings. A technology company consistently exceeding analyst predictions for gWW earnings may experience a surge in investor interest, driving up its stock price. Conversely, a company failing to meet or exceed predicted gWW earnings might face a decrease in stock price. The credibility and accuracy of analyst predictions are critical factors. Reliable analysts often base their predictions on a comprehensive understanding of market dynamics and detailed financial analysis. Conversely, if analyst predictions are inconsistent or inaccurate, their influence on investor sentiment and stock valuation becomes less impactful or even detrimental. The interplay between predicted and actual gWW earnings highlights the dynamic relationship between analyst assessments and market responses. Companies seeking to manage investor expectations effectively must closely monitor analyst predictions to understand their impact.

In summary, analyst predictions play a vital role in shaping the market's perception of gWW earnings. These predictions, combined with historical data and market analysis, provide a crucial framework for interpreting financial results and anticipating future performance. Understanding the connection between analyst predictions and gWW earnings is critical for investors seeking to make well-informed decisions. However, relying solely on analyst predictions without comprehensive research and analysis can be risky. A balanced approach, combining insights from analyst predictions with independent research, leads to more effective and informed investment strategies. The overall influence of these predictions on actual gWW earnings highlights the complex interplay between market expectations and corporate performance.

Frequently Asked Questions about gWW Earnings

This section addresses common inquiries regarding quarterly earnings (gWW earnings), providing clarity and context for understanding these reports.

Question 1: What are gWW earnings, and why are they important?

gWW earnings represent a company's financial performance during a three-month period. They detail revenue generated, expenses incurred, and the resulting net income or loss. These reports are crucial for investors and stakeholders, offering insights into a company's operational health, market position, and future prospects. Understanding trends in gWW earnings allows for informed investment decisions and strategic assessments.

Question 2: How do gWW earnings affect stock prices?

Strong gWW earnings, exceeding expectations, often lead to increased investor confidence, driving up stock prices. Conversely, disappointing or declining earnings frequently result in decreased investor confidence and potential stock price drops. The market's reaction to gWW earnings reflects investor perceptions of the company's current performance and future potential.

Question 3: What factors influence gWW earnings?

Several factors contribute to gWW earnings. Market trends, such as consumer demand and economic conditions, significantly impact sales and revenue. Internal factors like operational efficiency, cost management, and strategic decision-making also play crucial roles. Industry-specific trends and external events can also affect a company's financial performance and earnings.

Question 4: How are gWW earnings reported and interpreted?

Companies typically announce gWW earnings in press releases and financial statements. These reports usually include comparative figures from the same period in previous years, facilitating trend analysis. Investors and analysts then interpret these figures in the context of market trends and industry benchmarks to gauge a company's performance and forecast future earnings.

Question 5: What are the limitations of relying solely on gWW earnings for investment decisions?

gWW earnings, while valuable, are a single data point in a company's financial history. Investors must consider broader market trends, industry dynamics, and other relevant factors to gain a holistic perspective. Analyzing gWW earnings alongside a comprehensive evaluation of a company's financial health, competitive landscape, and management team yields a more informed investment strategy. Past performance is not indicative of future results, and other analyses should accompany gWW earnings evaluation.

In conclusion, gWW earnings provide critical information regarding a company's financial performance and are instrumental in investment decisions. However, investors should not rely solely on this data but instead consider a broader range of factors to gain a complete and informed perspective.

Moving forward, let's delve into the detailed analysis of specific gWW earnings reports and their implications for different industries.

Conclusion

This analysis has explored the multifaceted nature of quarterly earnings (gWW earnings). The study highlighted the critical role of gWW earnings in evaluating a company's financial health and future prospects. Key components examined include revenue growth, profitability, operational efficiency, market trends, and how these factors influence stock valuations and investment decisions. The analysis underscored the importance of considering these elements in conjunction with analyst predictions and industry benchmarks for a comprehensive understanding. Further, the discussion emphasized the limitations of relying solely on gWW earnings data, underscoring the need for a broader assessment encompassing market context and risk factors. The interplay between gWW earnings and investor sentiment, stock valuation, and market trends was highlighted throughout the exploration.

In conclusion, gWW earnings are a significant indicator of financial performance, but their interpretation requires a nuanced understanding of the broader market environment. Investors and analysts should adopt a comprehensive approach, analyzing gWW earnings in conjunction with market trends, economic indicators, and other relevant factors to make well-informed decisions. The dynamics inherent in interpreting quarterly earnings figures emphasize the importance of a nuanced perspective, factoring in multiple perspectives to predict potential future performance. Further analysis of specific sectors and industries, considering unique trends and challenges, will enhance the efficacy of this approach.

Detail Author:

- Name : Hettie Haley

- Username : lemke.cindy

- Email : electa.lynch@kiehn.com

- Birthdate : 1992-11-12

- Address : 77683 Goldner Expressway Suite 207 West Maidaville, WV 37969

- Phone : (207) 345-3379

- Company : King-Reichert

- Job : Software Engineer

- Bio : Expedita nam est voluptates consequuntur. Est nulla quo non odio atque laborum. Voluptas odio dolorum molestias praesentium vel voluptas ducimus.

Socials

tiktok:

- url : https://tiktok.com/@manuelaullrich

- username : manuelaullrich

- bio : Et nostrum corrupti et et quo.

- followers : 804

- following : 2712

twitter:

- url : https://twitter.com/manuela_ullrich

- username : manuela_ullrich

- bio : Eveniet minima et aspernatur et odit quae. Praesentium in dolorem porro quidem. Provident nisi id nihil laboriosam quibusdam rerum et.

- followers : 362

- following : 304