What drives the performance of this company's shares? A deep dive into the factors influencing investment decisions in this publicly traded entity.

These shares represent ownership in a specific company listed on a stock exchange. Investors buy and sell these shares based on their perception of the company's future performance. This performance is influenced by factors like revenue growth, profitability, market share, and industry trends.

The company's success, measured by factors such as profitability and consistent growth, influences investor confidence and, subsequently, the price of the company's stock. Market trends, including overall economic conditions and sector-specific developments, also play a significant role. A company's response to industry challenges, product innovations, and management's strategy are key factors that impact investor sentiment and share price. Historical performance, including past financial results and stock price movements, also serves as a crucial indicator for potential investors. The success of competitors, government policies, and technological advancements in the industry further shape the dynamics of the market for these shares.

To gain a deeper understanding of this company's stock, an examination of the company's financial reports, market trends, and future projections is essential. Further investigation into the company's history and leadership is also vital to make informed investment decisions. By comprehensively analyzing the company's financial health and market positioning, investors can evaluate the potential risks and rewards associated with these shares.

Celsion Stocks

Understanding Celsion stock necessitates a comprehensive examination of various interconnected factors. Evaluating these key aspects provides a more nuanced perspective on the investment landscape surrounding this stock.

- Financial Performance

- Market Trends

- Industry Context

- Product Development

- Regulatory Factors

- Competitive Analysis

- Investor Sentiment

Celsion's financial performance is intrinsically linked to market trends. Positive industry shifts, for instance, in oncology treatments, can positively impact stock valuation. A deeper look at product development reveals crucial details: successful clinical trials for novel cancer therapies are pivotal. Investor sentiment, often shaped by regulatory decisions (e.g., FDA approvals) and competitive pressures, can significantly sway stock prices. By thoroughly analyzing these facets, a more complete picture of Celsion's future potential can emerge, though risk assessment remains crucial. For example, if Celsions pivotal product receives FDA rejection, the impact on the stock is likely to be negative, demonstrating the interrelation between the factors listed.

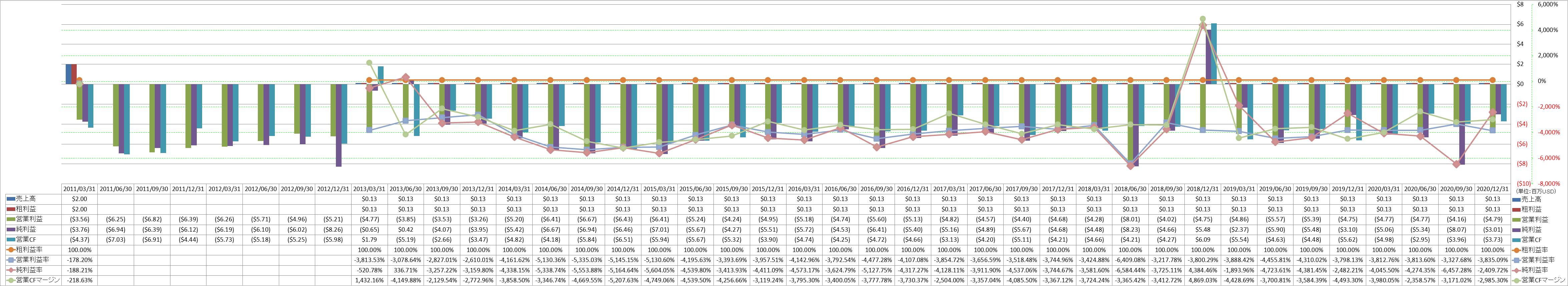

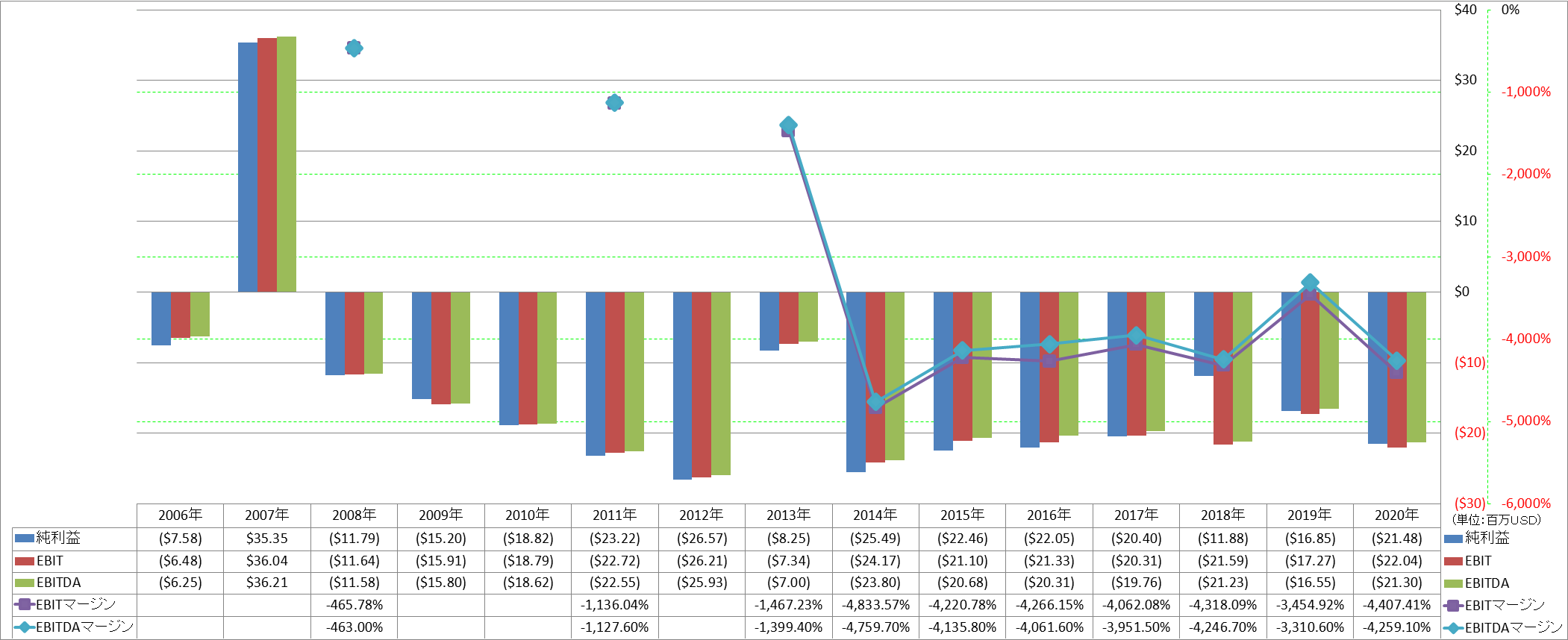

1. Financial Performance

Financial performance directly impacts Celsion stock valuation. Profitability, revenue growth, and cash flow are critical factors. Strong quarterly earnings reports, reflecting increased sales or reduced expenses, typically lead to higher stock prices. Conversely, disappointing financial results often result in decreased investor confidence and lower stock values. A company consistently generating profits signals a healthy business model and attracts investors.

Consider historical examples. A pharmaceutical company showcasing substantial revenue growth from a successful new drug launch would likely see its stock price rise, reflecting investor confidence in the company's future. Conversely, if a company reports declining revenues or significant losses, investors may sell their shares, leading to a decrease in stock price. The relationship between financial health and stock price is demonstrably strong and provides critical insights for investors.

Understanding a company's financial performance is fundamental to evaluating Celsion stock. Positive financial results, consistently demonstrated over time, suggest a strong investment opportunity. Conversely, prolonged financial struggles can indicate considerable risk. Investors must diligently analyze financial reports, including income statements, balance sheets, and cash flow statements, to make well-informed decisions regarding Celsion stock. Crucially, this analysis must consider the broader context of market trends and industry performance.

2. Market Trends

Market trends exert a substantial influence on the valuation and performance of Celsion stock. These trends encompass broader economic conditions, such as interest rates and inflation, as well as sector-specific developments within the biotechnology and healthcare industries. A positive trend in the overall market often correlates with increased investor confidence, leading to higher stock prices. Conversely, a downturn in the market can trigger a decline in stock value. Specific shifts in the biotech sector, such as regulatory changes impacting drug approvals or increased competition, directly affect investor sentiment towards companies like Celsion. For example, a significant regulatory hurdle impacting a particular therapy area could negatively influence investor perception of companies whose products operate in that area.

Consider a scenario where broader economic conditions improve. Increased investor confidence often translates into heightened demand for stocks across various sectors, including biotechnology. This elevated demand, combined with a perceived positive outlook for the biotechnology sector, typically results in a rise in Celsion stock prices. Conversely, a downturn in the global economy may dampen investor enthusiasm for riskier investments such as biotechnology stocks, thus potentially leading to a decline in Celsion stock prices. Specific developments within the healthcare industry, like rising costs for healthcare services or changing patient preferences, also influence investor interest in companies like Celsion, impacting stock performance accordingly.

Understanding the interplay between market trends and Celsion stock performance is crucial for investors. An investor attuned to prevailing market trends, sector-specific developments, and the companys response to them can potentially make more informed decisions. By tracking these trends, investors can better anticipate potential stock price fluctuations and potentially mitigate risk. For instance, an investor aware of increasing regulatory scrutiny in the field of cancer treatments may adjust their expectations for a company like Celsion, especially if their product pipeline is heavily focused on this area. A comprehensive understanding of the market environment helps in evaluating the potential for both short-term gains and long-term value creation from investments in Celsion stock.

3. Industry Context

The biotechnology and oncology sectors are critical contexts for understanding Celsion stock. The company's success and stock performance are heavily influenced by advancements, trends, and regulatory landscapes within these fields. A thorough analysis of the industry's dynamics is essential for evaluating the potential of Celsion stock.

- Regulatory Landscape

Regulatory approvals and hurdles directly impact Celsion's product pipeline and market position. Changes in regulatory requirements or delays in approval processes for cancer treatments can significantly affect Celsion's stock valuation. For example, setbacks in clinical trials, or stricter guidelines for drug development, can lead to decreased investor confidence and lower stock prices. The complexity and stringency of regulatory oversight within the oncology industry are crucial factors to consider when assessing Celsion's future prospects.

- Technological Advancements

Rapid advancements in cancer research and treatment technologies are a defining characteristic of the oncology industry. Innovations in areas such as immunotherapy, targeted therapies, and precision medicine can dramatically reshape the market. These advancements might either create opportunities or pose challenges to established players like Celsion. For instance, breakthroughs in drug delivery or in identifying new cancer biomarkers could lead to new treatment protocols and alter the competitive landscape. Understanding these developments is crucial for assessing the long-term viability of Celsion stock.

- Competitive Environment

The competitive intensity within the oncology sector is high, with numerous companies vying for market share. Existing and emerging competitors in cancer treatments have a bearing on Celsion's market position and pricing power. Strategic partnerships, mergers, and acquisitions within the industry can alter the competitive landscape. Changes in pricing policies, novel treatment methods, or the entrance of a strong competitor can impact Celsion's stock value.

- Market Size and Growth Potential

The market size and projected growth rate of the oncology sector play a significant role in Celsion's future potential. Large and growing markets often present greater opportunities for companies like Celsion. Factors like population demographics, prevalence of cancer types, and treatment preferences can dictate market size and its projected expansion. Understanding the growth potential in cancer treatment within the industry as a whole contributes significantly to assessing Celsion stock's long-term outlook.

Considering the intricate interplay of these industry contextsregulatory pressures, technological advancements, competitive dynamics, and market growth potentialis crucial for effectively assessing Celsion stock. Investors must conduct thorough analysis to understand how these factors influence Celsion's ability to adapt, innovate, and thrive in the evolving oncology landscape. This understanding is essential for informed investment decisions.

4. Product Development

Product development is a critical determinant of Celsion stock performance. Successful product development efforts translate to new revenue streams, market expansion, and heightened investor confidence, all of which influence stock valuation. Conversely, delays, setbacks, or failures in product development can lead to investor concern and negatively impact stock prices. Understanding the specific facets of product development within the context of Celsion stock is crucial for assessing its potential.

- Clinical Trial Outcomes

Clinical trial results are paramount to product development. Positive outcomes, demonstrating efficacy and safety of a product, bolster investor confidence. Significant progress in pivotal trials, for example, leading to successful regulatory approvals, can significantly impact stock price positively. Conversely, negative trial results or failed milestones can cause investor concern, leading to stock price declines. These outcomes often determine the commercial viability of a product, significantly affecting a company's financial future and, therefore, its stock valuation.

- Regulatory Approvals and Submissions

Obtaining regulatory approvals for a product is a critical juncture in product development. Successful regulatory submissions and timely approvals are highly correlated with increased market access and sales potential, favorably impacting stock prices. Conversely, regulatory delays or rejection of a product submission can negatively impact investor sentiment and lead to stock price declines. The stringent requirements and time frames involved in obtaining necessary regulatory clearances are fundamental elements to consider in assessing the company's development strategy.

- Manufacturing and Supply Chain Capacity

Efficient manufacturing processes and a reliable supply chain are critical for sustained product development. The capacity to meet market demand ensures consistent revenue generation. Problems in manufacturing processes, or bottlenecks in the supply chain, can lead to delays in product delivery, reduced revenue, and consequent negative impacts on investor confidence and stock prices. Ensuring reliable manufacturing is crucial for maintaining consistent product availability and achieving targeted market penetration.

- Intellectual Property Protection

Strong intellectual property (IP) protection safeguards a product's development investments. Patents and other intellectual property rights ensure the company's exclusive right to exploit a product, encouraging innovation. The strength and longevity of IP protection are key indicators of long-term potential, influencing stock valuations positively. Conversely, threats to or expiration of patents can diminish a product's market exclusivity and affect stock valuation adversely.

In conclusion, effective product development significantly shapes Celsion's stock price. Positive outcomes in clinical trials, successful regulatory submissions, robust manufacturing capabilities, and strong IP portfolios are crucial factors that underpin investor confidence and drive stock value. Conversely, setbacks or delays in any of these areas can directly impact the perceived risk and reward associated with investments in Celsion stock, making product development analysis a crucial component of a thorough evaluation.

5. Regulatory Factors

Regulatory factors exert a profound influence on Celsion stock. Favorable regulatory environments foster confidence and potentially lead to increased investment, driving stock valuations upward. Conversely, adverse regulatory actions, such as delays in approvals or stringent new regulations, can cause investor concern and negatively affect stock prices. The interplay between regulatory decisions and Celsion's operational success directly affects the stock's trajectory. For example, positive clinical trial results, coupled with expedited FDA approval pathways, typically translate into higher stock prices. Conversely, significant setbacks in regulatory submissions can result in a decline in investor interest and stock depreciation.

The significance of regulatory factors extends beyond immediate stock fluctuations. A company's ability to adapt to regulatory changes demonstrates resilience and strategic planning. If Celsion can demonstrate successful navigating regulatory hurdles, investors interpret this as a sign of strong management and a potential for future success. Conversely, recurring regulatory issues might signal operational challenges, potentially impacting investor confidence. This underscores the vital role of compliance in sustaining long-term investor trust and confidence, which, in turn, impacts stock value. The FDA's scrutiny of innovative cancer therapies, and the speed and rigor with which those therapies are assessed, significantly impacts investment in firms like Celsion. Historical precedents demonstrate that companies struggling with regulatory compliance often see their stocks underperform or experience significant declines.

Understanding the connection between regulatory factors and Celsion stock is critical for investors. A thorough analysis of the regulatory landscape within the oncology sector and Celsion's specific compliance history provides crucial insights into the company's potential for future growth and profitability. Investors should consider the potential impacts of regulatory changes, especially regarding the company's product pipeline and anticipated clinical trial outcomes. A robust understanding of these factors enables a more nuanced assessment of Celsion stock, allowing investors to make informed decisions considering potential risks and rewards associated with the regulatory environment within which Celsion operates.

6. Competitive Analysis

Competitive analysis is integral to evaluating Celsion stock. A thorough understanding of the competitive landscape in the oncology sector is crucial for assessing Celsion's market position, pricing power, and potential for future growth. Direct and indirect competitors influence investor perception of Celsion's products, development strategies, and financial performance. A robust competitor analysis provides valuable insight into the market dynamics and Celsion's ability to compete effectively. For instance, if a major competitor launches a significantly improved cancer treatment, investor confidence in Celsion might wane if Celsion's products lack comparable advantages. Conversely, a strong competitive position could enhance investor optimism and positively affect Celsion stock value.

Several aspects contribute to a comprehensive competitive analysis. Evaluating competitors' product portfolios and clinical trial data reveals the innovation levels and potential threat to Celsion's products. Analyzing marketing strategies and financial performance offers insights into competitor strengths and weaknesses, allowing for comparisons with Celsion's standing. Assessing market share and pricing strategies of competitors provides a crucial context for evaluating Celsion's market penetration and profitability potential. Direct competitors, those offering similar therapies, necessitate a focused analysis to understand the relative efficacy, safety, and market acceptance of their products. Indirect competitors, offering alternative treatment approaches, also require consideration, given the broader treatment options available. A company's ability to adapt to and counter the strategies of these competitors is a significant factor in the success of Celsion stock. A clear understanding of the evolving competitive pressures and Celsion's response to them is critical for investor decisions.

In summary, competitive analysis provides a critical lens through which to view Celsion stock. This analysis allows investors to assess the company's strengths, weaknesses, opportunities, and threats (SWOT analysis) within the oncology market. It clarifies the potential impact of competitor actions on Celsion's product development, market share, and financial performance. A detailed and up-to-date competitive analysis informs a more realistic valuation of Celsion stock, allowing investors to make more informed decisions regarding investment risk and potential return. This analysis directly connects to the fundamental economic principle that supply and demand are influenced by competition, a key consideration for Celsion's long-term viability and the resulting impact on stock performance. Without a thorough understanding of these competitive pressures, the full picture of Celsion stock is incomplete.

7. Investor Sentiment

Investor sentiment plays a pivotal role in determining the price of Celsion stock. This sentiment, encompassing the collective feelings and beliefs of investors regarding the company's future prospects, can significantly influence trading volume and stock valuation. Understanding the dynamics of investor sentiment is crucial for assessing the potential risk and reward associated with investments in Celsion stock.

- Market-Wide Moods and Trends

Broad market trends, often influenced by economic conditions and broader investor confidence, exert a substantial influence on specific stocks. A positive overall market sentiment usually translates to increased investment across sectors, including biotechnology. Conversely, a negative sentiment often leads to reduced investment and lower stock prices. For Celsion stock, the overall tone of the market directly affects the perceived risk-reward profile. For example, during periods of high market optimism, Celsion stock might see increased demand, leading to price appreciation; conversely, a downturn could lead to a decrease in interest and a drop in the stock's value.

- Company-Specific News and Events

Specific news regarding Celsion's operations, including clinical trial results, regulatory approvals, or financial reports, significantly impacts investor sentiment. Positive news, like a successful clinical trial outcome, typically boosts investor confidence and raises the stock price. Conversely, negative news, such as a regulatory setback or disappointing financial results, can lead to investor apprehension and a decline in the stock's value. The immediacy and perceived significance of this news often drive short-term stock price fluctuations, demonstrating a direct correlation between company-specific events and sentiment.

- Analyst Ratings and Recommendations

Analyst ratings and recommendations heavily influence investor sentiment toward Celsion stock. Positive ratings and buy recommendations can encourage more investment, leading to price increases. Conversely, negative ratings or sell recommendations can trigger investor selling, causing a decrease in stock value. The consensus view among financial analysts carries significant weight in shaping investor perceptions and can influence their investment decisions on Celsion stock.

- Social Media and Online Discussion

Social media and online discussions can significantly impact investor sentiment, often reflecting real-time reactions to news or events impacting Celsion stock. Positive or negative online commentary can quickly spread, influencing public perception and individual investment decisions. While not always reliable, the volume and tenor of social media conversations offer insights into the current sentiments about Celsion, providing a dynamic view of its perceived potential. This dynamic information may offer an early warning sign of forthcoming, company-specific changes in investor sentiment.

In conclusion, investor sentiment is a multifaceted force driving Celsion stock's price fluctuations. A thorough comprehension of market trends, company-specific announcements, analyst evaluations, and public discussions regarding the company is crucial for investors to effectively assess potential investment risks and potential returns. Understanding the interplay of these components aids in developing a more comprehensive and accurate outlook on Celsion stock's probable future movements.

Frequently Asked Questions about Celsion Stock

This section addresses common inquiries regarding Celsion stock, providing concise and informative answers to promote a better understanding of the investment landscape.

Question 1: What factors primarily influence Celsion stock prices?

Celsion stock prices are influenced by a complex interplay of factors, encompassing the company's financial performance, market trends, industry developments, product pipeline progress, and overall investor sentiment. Specific events, such as clinical trial outcomes, regulatory approvals, and competitive activity, directly impact investor perception and subsequent stock price movements.

Question 2: How does the oncology industry affect Celsion stock?

The oncology industry's trends and developments are directly correlated with Celsion stock. Advancements in cancer treatments, shifts in regulatory approvals, the emergence of competitors, and changes in market demand all impact Celsion's market position and, consequently, its stock price. Understanding the dynamics within the oncology sector is crucial for assessing Celsion stock's long-term potential.

Question 3: What is the significance of clinical trial results for Celsion stock?

Clinical trial outcomes represent a critical determinant of Celsion stock value. Positive results bolster investor confidence, leading to price increases. Conversely, unfavorable results can diminish confidence and cause price drops. The success or failure of clinical trials directly influences the market perception of Celsion's product pipeline and its potential for future revenue generation.

Question 4: How do regulatory changes affect Celsion stock?

Changes in regulations surrounding cancer therapies can directly impact Celsion. Stricter regulations or delays in approvals can create uncertainty and negatively affect investor sentiment, leading to stock price declines. Conversely, streamlined processes and favorable regulatory outcomes can enhance investor confidence, driving up the stock's value.

Question 5: What role does competitive activity play in Celsion's stock price?

The competitive environment within the oncology sector significantly influences Celsion stock. The introduction of new and improved therapies from competitors impacts market share and Celsion's perceived value. The ability of Celsion to adapt and innovate in response to competitive activity is vital for maintaining its market position and stock performance.

In summary, understanding Celsion stock requires a comprehensive approach, analyzing the company's financial performance, the evolving market trends, industry-wide developments, product pipeline progress, and prevailing investor sentiment. The combination of these factors creates a complex dynamic, driving fluctuations in the stock's value.

The following section provides a more detailed analysis of Celsion's financial performance and market positioning.

Conclusion

Celsion stock's performance reflects a complex interplay of factors. Financial results, market trends, industry developments, and product pipeline progress are critical determinants. Clinical trial outcomes, regulatory approvals, and the competitive landscape all influence investor sentiment and, consequently, stock price fluctuations. A thorough evaluation necessitates a deep understanding of the company's financial health, product development trajectory, and responsiveness to industry changes. Regulatory hurdles, competitive pressures, and market trends within the oncology sector significantly impact investor confidence and Celsion's potential for long-term growth.

Investors considering Celsion stock must meticulously analyze the company's financial reports, product development milestones, and regulatory environment. A comprehensive understanding of market dynamics and the competitive landscape is essential to gauge the potential risks and rewards. While the oncology sector presents substantial opportunities, it also involves considerable inherent risks. Investors should carefully consider their risk tolerance and conduct thorough due diligence before making investment decisions. The future trajectory of Celsion stock hinges on the company's ability to navigate the complex oncology market, adapt to evolving industry trends, and effectively execute its product development strategy. Sustained financial performance, regulatory success, and product approvals remain paramount for the stock to achieve long-term value appreciation.

Detail Author:

- Name : Dr. Raymond Runolfsson III

- Username : huels.clemmie

- Email : ashlynn.lynch@gmail.com

- Birthdate : 1991-02-02

- Address : 308 Harmony Tunnel Suite 502 Eltamouth, NY 34027

- Phone : 231-786-8923

- Company : Koepp, Rodriguez and Barton

- Job : Waitress

- Bio : Ducimus est quia sed nostrum illum. Ab veritatis est rerum ab illum sit. Eum laudantium sapiente possimus sunt possimus. Facere ut et ex. Asperiores ducimus atque officia ea soluta.

Socials

tiktok:

- url : https://tiktok.com/@donna.gorczany

- username : donna.gorczany

- bio : Aspernatur id aspernatur eos nulla voluptatem.

- followers : 3708

- following : 124

instagram:

- url : https://instagram.com/dgorczany

- username : dgorczany

- bio : Qui sit quaerat modi. At hic recusandae voluptatem sint accusamus quis.

- followers : 2208

- following : 332

twitter:

- url : https://twitter.com/gorczany2010

- username : gorczany2010

- bio : Et laudantium sunt minus illo nihil rem. Laborum quasi recusandae soluta neque dolorum accusantium. Totam velit eos itaque aut et.

- followers : 3533

- following : 1882