What is the dedicated cryptocurrency data terminal, and why is it crucial for informed market analysis?

A dedicated platform for accessing real-time cryptocurrency market data offers a comprehensive overview of various digital assets. This terminal provides detailed information, including price charts, trading volumes, and market capitalization. This functionality extends to individual coin performances, empowering users to monitor trends effectively and anticipate market fluctuations. Crucially, these data points can be visualized in various ways to understand relationships across the market and across asset classes. For instance, users might see how Bitcoin price movements correlate with Ether price movements over a specific period, illustrating the interplay of major cryptocurrencies.

The utility of such a terminal is undeniable. It allows users to make more informed decisions regarding trading, investment, and diversification strategies. The platform facilitates real-time analysis, enabling quicker reactions to market shifts and maximizing potential profits. Historical data access allows users to recognize patterns and anticipate market behavior, providing valuable insight into past trends and potential future outcomes. Its existence is essential for anyone actively involved in the cryptocurrency market. Accessibility to this data and the ability to analyze it directly impacts the overall trajectory of trading choices.

Moving forward, this article will explore the specifics of various data aggregation techniques employed by such platforms, highlighting their strengths and limitations.

CoinGecko Terminal

CoinGecko's terminal, as a comprehensive data source, offers critical insights into the cryptocurrency market. Understanding its key facets is essential for informed decision-making.

- Real-time data

- Price charts

- Market capitalization

- Trading volumes

- Historical data

- Cryptocurrency analysis

- Market trend identification

- Portfolio management

Real-time data, price charts, and market capitalization provide immediate market assessments. Historical data allows for trend analysis, aiding in predicting future price movements. Cryptocurrency analysis tools help evaluate individual coin performance. The platform's comprehensive nature supports portfolio management by visualizing and evaluating asset positions across different cryptocurrencies. Understanding trading volumes provides a sense of market activity. Identifying market trends can aid in informed trading decisions. By facilitating all these aspects, the terminal becomes an invaluable resource for anyone engaging in the cryptocurrency market.

1. Real-time Data

Real-time data is fundamental to a cryptocurrency market data terminal. Its immediacy provides a crucial link between market events and potential investment opportunities. A terminal like CoinGecko's, which gathers and displays real-time data, allows for immediate reactions to market fluctuations and assists in recognizing significant shifts in market trends.

- Price Fluctuations and Immediate Response

Constant price updates enable swift adaptation to market changes. A sudden surge or dip in a cryptocurrency's price can lead to significant gains or losses, and real-time data allows for quick reactions. This immediacy is crucial for traders who need to execute trades promptly in response to evolving conditions.

- Market Volatility Analysis

Real-time data facilitates the assessment of market volatility. Tracking rapid price changes and volume shifts helps to gauge market sentiment and potentially anticipate future price movements. A terminal can visualize this volatility, enabling users to identify periods of heightened risk or opportunity.

- Order Execution and Trading Strategies

Real-time updates of market prices and order books are integral to executing trades. The immediacy allows for precision in executing buy and sell orders, and adjusting strategies in response to evolving conditions, whether related to a specific currency or the broader market.

- Trade Volume and Liquidity Assessment

Real-time trade volume data reveals the degree of liquidity in a market. High volume, often corresponding with significant price movements, can indicate higher trading activity. Understanding these real-time patterns of buying and selling is crucial for assessing liquidity in various cryptocurrency markets. This insight is crucial for investors and traders.

In summary, the integration of real-time data within a cryptocurrency terminal, such as CoinGecko's, allows for responsiveness to immediate market conditions, impacting trading decisions and strategies. It is a critical component for navigating the dynamic nature of the cryptocurrency market.

2. Price Charts

Price charts, a fundamental component of cryptocurrency market data terminals, visualize the historical and real-time price movements of digital assets. Within a terminal like CoinGecko, these charts become instrumental in analyzing market trends, identifying patterns, and making informed trading decisions. Their role in conveying historical price action and current market dynamics is pivotal.

- Trend Identification

Price charts visually represent price trends, whether upward (bullish), downward (bearish), or sideways (ranging). Analyzing these trends, often discernible over various timeframes, allows for the identification of potential future movements. For example, a sustained upward trend in a cryptocurrency's price over several weeks might suggest continued growth.

- Support and Resistance Levels

Charts often highlight support and resistance levels. These are price points where the price has historically reversed direction, indicating potential barriers or turning points. Understanding these levels within a CoinGecko terminal assists in evaluating areas where a price might find buying or selling pressure, respectively. Recognizing support/resistance can be a vital element in constructing effective trading strategies.

- Volume Analysis Integration

Effective analysis integrates volume data with price charts. Increased volume often accompanies significant price changes, lending credence to the strength of a trend. Price charts within a terminal can overlay volume data, allowing a more comprehensive evaluation of market dynamics. Observing the interaction of price and volume provides a more nuanced understanding of market activity.

- Pattern Recognition

Price charts can reveal various patterns, like triangles, head-and-shoulders, and double tops. Recognizing these patterns can assist in anticipating potential reversals or continuations of existing trends. Analyzing these patterns through a CoinGecko terminal can identify potential opportunities to enter or exit positions. However, pattern recognition requires careful interpretation and should not be the sole basis for investment decisions.

Price charts within a cryptocurrency terminal like CoinGecko provide a visual representation of historical price action and market activity. By integrating different facets such as trend identification, support/resistance, volume analysis, and pattern recognition, users gain a comprehensive understanding of the market's evolution and can make more informed decisions. These visual tools serve as crucial components for successful navigation within the often-fluctuating cryptocurrency landscape.

3. Market Capitalization

Market capitalization, a crucial metric reflecting the total value of a cryptocurrency, is intrinsically linked to a terminal like CoinGecko. The terminal displays this data, enabling users to assess the overall size and health of the cryptocurrency market. Market capitalization, represented as the total value of all outstanding coins, provides a critical perspective on a cryptocurrency's relative importance within the market. High market capitalization often suggests greater stability and established presence, while lower figures indicate potentially higher risk and volatility.

The terminal's presentation of market capitalization facilitates comparisons between different cryptocurrencies. Users can quickly identify which cryptocurrencies command significant market share and which are relatively minor players. This data, within the context of the terminal, allows for strategic investment decisions. For instance, a user might choose to prioritize investments in cryptocurrencies with a demonstrably larger market capitalization, potentially viewing them as more resilient to short-term fluctuations. Conversely, some traders might focus on smaller-cap coins, anticipating the potential for greater price appreciation due to their higher growth potential, although this also entails a greater risk. Real-world examples abound: Bitcoin, historically possessing a large market capitalization, has demonstrated greater stability compared to newer, smaller-cap cryptocurrencies.

In summary, market capitalization, as presented within a CoinGecko terminal, acts as a crucial indicator of a cryptocurrency's market weight and potential. It empowers informed decision-making by providing a context for evaluating relative risk and opportunity. However, market capitalization, while valuable, shouldn't be the sole factor influencing investment decisions; other aspects, such as utility, technological innovation, and project development, also deserve consideration. Ultimately, the display of market capitalization within a terminal like CoinGecko is a tool to help understand market dynamics and aid in strategic investment planning.

4. Trading Volumes

Trading volume, a critical indicator of market activity, is integral to a cryptocurrency market data terminal like CoinGecko. It reflects the overall buying and selling pressure on a particular cryptocurrency. High trading volume often correlates with significant price movements, offering insights into market sentiment and potential future price action. The terminal's representation of this data allows for a comprehensive understanding of the market's dynamics, essential for informed trading strategies.

The significance of trading volume lies in its ability to signal market strength or weakness. High trading volume during a price surge suggests robust buying interest, potentially supporting the upward trend. Conversely, low volume during a price movement could indicate indecision or a lack of strong conviction, potentially hinting at a weakening trend. Analyzing trading volume alongside price charts helps distinguish genuine market movements from fleeting price fluctuations. For example, a cryptocurrency experiencing rapid price swings with low trading volume might be considered less significant than a cryptocurrency with similar price movements but substantial trading volume. This disparity in volume indicates a difference in market conviction, with the latter suggesting a stronger trend and potentially higher likelihood of sustained price action.

Understanding the relationship between trading volume and price movements within a CoinGecko terminal enables traders to refine their strategies. It allows for more nuanced interpretation of market signals, helping avoid impulsive decisions based solely on price fluctuations. Consequently, this analysis can inform risk assessment and resource allocation within trading portfolios. A trader observing low volume alongside a price increase might perceive a lower likelihood of a sustained bullish trend compared to a scenario involving high volume. This understanding, accessible through the terminal, enhances the overall effectiveness of a trading strategy by improving decision-making, promoting more calculated risk assessments, and potentially increasing profitability. In conclusion, the representation of trading volume in a cryptocurrency terminal is an indispensable tool for assessing market depth and understanding market dynamics.

5. Historical Data

Historical data within a cryptocurrency terminal, exemplified by CoinGecko, plays a critical role in market analysis and prediction. This data, encompassing past price movements, trading volumes, and market capitalization, provides a crucial context for understanding current trends and potential future price action. Without historical data, it is challenging to accurately identify patterns, predict future price movements, and evaluate the long-term health of a cryptocurrency. This analysis goes beyond mere recording; it allows for the formulation of hypotheses about future behavior based on past patterns.

The significance of historical data is multifaceted. Analyzing past price fluctuations allows for the identification of support and resistance levels. These levels, observed in past market behavior, can indicate areas where a price might find buying or selling pressure, potentially reversing direction. Further, historical data on trading volumes can illuminate patterns in market activity, revealing times of increased or decreased trading interest. High volume during a price surge suggests robust buying interest, potentially indicating the strength of an uptrend. Conversely, low volume during a price movement might suggest a weaker trend. For example, periods of unusually high trading volume during a particular cryptocurrency's price increases can offer insights into its market strength, whereas low trading volume often precedes downtrends and reflects diminished market confidence. By combining historical price data with volume information, users can build a more sophisticated understanding of market movements.

In conclusion, historical data within a cryptocurrency terminal is indispensable for informed analysis and prediction. Its value stems from the ability to recognize patterns, identify potential support and resistance levels, and evaluate the strength of market trends. However, relying solely on historical data for investment decisions is insufficient. Investors should use historical data as one component of a broader analytical framework, incorporating other factors, such as fundamental analysis and news sentiment, for a comprehensive and balanced perspective on the market. Accurately interpreting historical data, as presented within a platform like CoinGecko, significantly aids in navigating the complexities of the cryptocurrency market.

6. Cryptocurrency analysis

Cryptocurrency analysis is a crucial component of a dedicated cryptocurrency data terminal. The terminal's value proposition hinges on the quality and comprehensiveness of the analytical tools integrated within its platform. Effective analysis draws upon historical price data, market capitalization, trading volume, and other relevant metrics. A terminal like CoinGecko, by providing readily accessible data, empowers users to execute insightful analyses. Robust analysis allows users to identify trends and potential market shifts. For instance, a terminal revealing a sustained increase in trading volume alongside a price surge in a particular cryptocurrency suggests growing investor confidence and a potential continuation of the upward trend. Conversely, declining volume alongside price decline might signal weakening support and potential reversal.

The practical significance of understanding this interplay between analysis and terminal data is profound. Successful cryptocurrency traders and investors often leverage these insights to make informed decisions. By recognizing patterns in historical data and interpreting current market dynamics, informed forecasts become possible. This analytical capacity facilitates the development of effective investment and trading strategies. The quality and accuracy of this analysis, as facilitated by the terminal, directly impact the likelihood of successful trading decisions. Consider a trader using the terminal to detect a pattern suggesting impending price consolidation. This recognition, derived from analysis of historical data, can guide the trader toward adjusting their strategy, potentially mitigating potential losses or maximizing gains.

In conclusion, effective cryptocurrency analysis is intrinsically linked to the utility of a specialized data terminal. The terminal's function as a comprehensive data aggregator empowers users to conduct in-depth analyses. This, in turn, allows for the identification of trends and patterns, ultimately leading to better-informed investment and trading choices. However, it's essential to remember that no analytical tool guarantees future success; proper risk management and diversification remain crucial. A terminal like CoinGecko serves as a powerful tool, but human judgment and careful consideration of risk factors are essential components of successful cryptocurrency engagement.

7. Market Trend Identification

Market trend identification is a critical function facilitated by a platform like CoinGecko. Accurate trend identification, reliant on comprehensive data aggregation and analysis, is essential for successful navigation within the cryptocurrency market. CoinGecko's terminal provides the necessary tools and data points for this process, including historical price data, trading volumes, market capitalization, and other relevant metrics. Identifying trends allows for better-informed investment strategies. For example, a sustained increase in trading volume alongside a rising price suggests growing investor confidence and a potential continuation of the bullish trend. Conversely, a decline in both price and volume may signify weakening market interest and a potential trend reversal.

The practical significance of trend identification is substantial. Recognizing a prevailing bullish trend allows investors to potentially capitalize on rising prices by strategically allocating capital to assets exhibiting this upward momentum. Likewise, identifying a bearish trend enables proactive adjustments to investment portfolios. Real-world examples illustrate this principle: the 2017 Bitcoin bull run, marked by a pronounced upward trend in price and volume, contrasted starkly with the 2018 bear market, which saw significant price drops and plummeting volume. These historical trends, as displayed in a CoinGecko terminal, offer valuable insights for understanding market cycles and adapting investment strategies accordingly.

In conclusion, market trend identification, facilitated by a comprehensive data terminal like CoinGecko, offers a crucial element for effective navigation in the cryptocurrency market. Recognizing these trends allows for more strategic decision-making, potentially increasing the likelihood of favorable outcomes. However, it's crucial to acknowledge that trend identification is not foolproof. Market analysis necessitates careful consideration of multiple factors beyond price and volume fluctuations. This includes examining fundamental aspects of cryptocurrencies, relevant news, and overall market sentiment. A terminal like CoinGecko acts as a valuable tool for observing trends, but discerning investors should integrate this information with comprehensive market analysis for more informed decisions.

8. Portfolio Management

Portfolio management, a critical aspect of cryptocurrency investment, benefits significantly from the data available through a dedicated cryptocurrency terminal like CoinGecko. A robust terminal provides the necessary tools to track, analyze, and optimize holdings, thus facilitating informed and strategic decision-making. Effective portfolio management, in this context, hinges upon the insights derived from real-time and historical data within the platform.

- Asset Tracking and Valuation

The terminal facilitates meticulous tracking of individual asset holdings. Users can monitor the current market value of their cryptocurrencies, their proportional allocation within the portfolio, and their overall performance. Real-time updates provide a clear picture of changes in portfolio composition and value over time, directly informing any required adjustments.

- Diversification Analysis

Analyzing portfolio diversification is crucial for risk mitigation. The terminal offers tools to assess the relative exposure to different cryptocurrencies and potential correlations. This enables users to identify imbalances in their portfolio and rebalance accordingly, spreading risk across various asset classes to minimize potential losses in the event of a market downturn. Visualizations within the terminal aid in assessing diversification effectively.

- Performance Monitoring and Analysis

Monitoring portfolio performance over time is vital for assessing the effectiveness of investment strategies. The terminal's historical data allows for comparative analysis. Users can track the evolution of their investments, understand trends, and compare returns across various periods. This facilitates informed decisions on the future allocation of resources within the portfolio based on observed performance.

- Risk Management Assessment

Cryptocurrency markets are inherently volatile. A robust terminal aids in evaluating and managing risk proactively. The terminal facilitates analysis of historical volatility patterns and market trends, allowing for more strategic risk management. This includes real-time monitoring of market conditions and a comprehensive view of potential risks associated with specific investments and their impact on the portfolio as a whole.

Ultimately, a specialized terminal like CoinGecko empowers informed portfolio management. Data-driven decisions derived from the platform's detailed insights allow for optimized portfolio allocation and risk management, enhancing the potential for success in the dynamic cryptocurrency market. The insights provided through the terminal promote a proactive and data-informed approach to cryptocurrency portfolio management, increasing the likelihood of a well-structured and strategically sound investment strategy.

Frequently Asked Questions (CoinGecko Terminal)

This section addresses common inquiries regarding the CoinGecko terminal, providing clear and concise answers to ensure a better understanding of its functionalities and applications.

Question 1: What is the primary function of the CoinGecko terminal?

The CoinGecko terminal serves as a comprehensive platform for accessing real-time cryptocurrency market data. It aggregates and presents crucial information, including pricing, trading volumes, market capitalization, and historical performance of various cryptocurrencies, facilitating informed decision-making within the cryptocurrency market.

Question 2: How accurate is the data provided by the CoinGecko terminal?

Data accuracy is a critical concern. CoinGecko employs diverse data sources, ensuring a degree of reliability and accuracy. However, the user should understand that market fluctuations and potential data discrepancies necessitate exercising caution and due diligence in using the information. External validation is recommended for critical investment decisions.

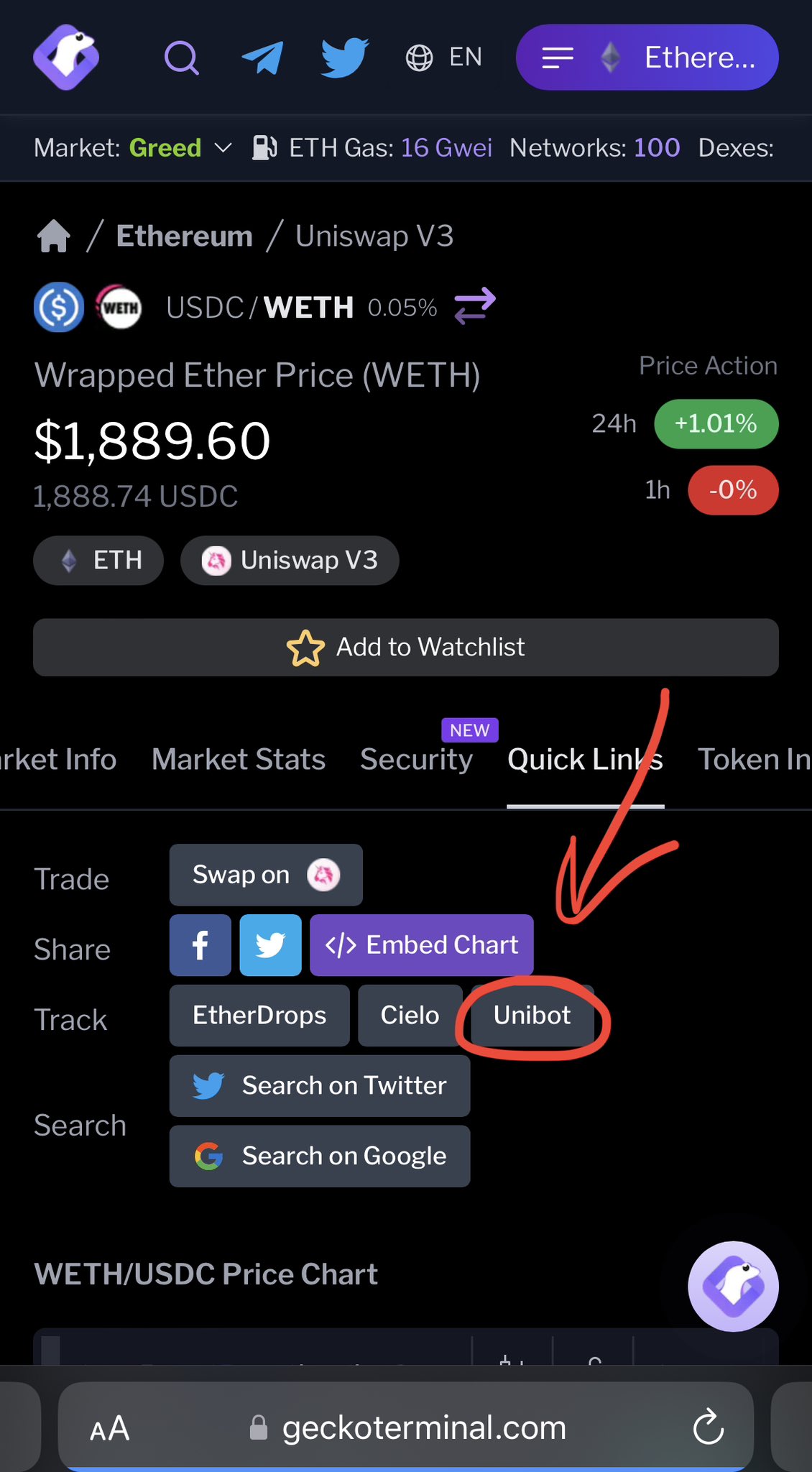

Question 3: What types of data visualizations are available in the CoinGecko terminal?

The terminal provides a wide array of data visualizations. This includes interactive charts for price movements, market capitalization trends, trading volume analysis, and other key metrics. These visualizations aid in pattern recognition, trend identification, and assessing market sentiment.

Question 4: Is the CoinGecko terminal suitable for both novice and experienced users?

The platform's design and presentation cater to a broad spectrum of users. Novice users find it easy to navigate and grasp fundamental market insights. Experienced users, however, will find the platform valuable for in-depth analysis of intricate market movements and complex relationships between various cryptocurrencies.

Question 5: What are the potential limitations of using the CoinGecko terminal?

While the terminal provides extensive data, it is crucial to remember its limitations. Real-time data can be affected by network latency or market fluctuations. The terminal's analytical tools are based on available data and, as such, should not be considered infallible. Users should exercise caution in relying solely on this information for investment decisions. External verification of data is always recommended for critical investments.

Understanding these aspects of the CoinGecko terminal empowers informed decision-making and a comprehensive understanding of its capabilities within the dynamic cryptocurrency market.

The following section will delve into specific applications and use cases for the CoinGecko terminal within different trading strategies.

Conclusion

The CoinGecko terminal, as a comprehensive data aggregation platform, offers a wealth of information for navigating the cryptocurrency market. Its real-time data, historical records, analysis tools, and visualizations equip users with crucial insights for understanding market trends, assessing risk, and making informed investment decisions. The platform excels in providing visualizations like price charts, allowing for the identification of patterns and potential turning points. Crucially, the terminal facilitates the analysis of market capitalization, trading volumes, and individual cryptocurrency performance, helping to establish a nuanced understanding of the market's overall health and individual asset viability. The detailed historical data presented supports in-depth trend analysis, allowing for potential prediction of future price movements. However, relying solely on any one data source without supplementary analysis and research is inadvisable.

While the CoinGecko terminal provides a powerful tool for market analysis, the cryptocurrency landscape is inherently complex. The platform itself cannot guarantee investment success. Users must carefully interpret data, integrate multiple perspectives, and maintain a proactive approach to risk management. The terminal should be viewed as a valuable tool augmenting, not replacing, independent market research and due diligence. Investors should not isolate the terminal's insights but should continuously strive to broaden their understanding of the cryptocurrency market through diverse information sources. Continued learning and adaptation to market dynamics remain essential for successful engagement in the evolving world of cryptocurrencies.

Detail Author:

- Name : Ramon Ebert

- Username : sonia.stiedemann

- Email : treutel.tom@yahoo.com

- Birthdate : 1980-05-02

- Address : 75868 Sydnee Keys East Eulalia, ME 72044-4074

- Phone : (234) 315-9582

- Company : Rau, Reilly and Murray

- Job : Structural Metal Fabricator

- Bio : Numquam consequatur omnis ut non deleniti. Atque necessitatibus itaque velit ipsum. Esse quisquam iste illum sapiente et aut fugit et. Perferendis non sunt accusamus sit.

Socials

tiktok:

- url : https://tiktok.com/@herman2020

- username : herman2020

- bio : Magni aut dignissimos nemo eum suscipit voluptates et excepturi.

- followers : 241

- following : 1665

twitter:

- url : https://twitter.com/kennith.herman

- username : kennith.herman

- bio : Blanditiis nisi mollitia mollitia aspernatur animi. Suscipit voluptatum impedit vero odio quod facere ut. Iure ut repellat consequatur.

- followers : 4702

- following : 2825

facebook:

- url : https://facebook.com/hermank

- username : hermank

- bio : Laboriosam iure fugit doloribus qui consequatur. Non eum omnis accusamus.

- followers : 1914

- following : 1730

instagram:

- url : https://instagram.com/hermank

- username : hermank

- bio : Quibusdam similique quas provident qui. A sit iusto sit qui. Sed praesentium accusantium fuga.

- followers : 6536

- following : 2891