What is this online platform for managing financial accounts and transactions? How does it enhance financial control and efficiency?

This platform facilitates online access to financial records, enabling users to view account balances, track transactions, and manage payments. It often provides tools for budgeting, financial planning, and bill pay. For instance, users can log in to view their checking account balances, pay bills, transfer funds, and generate financial reports.

Such a system offers significant advantages. Users gain a comprehensive overview of their financial activities, fostering better budgeting and financial management. Real-time transaction visibility allows for swift identification of potential discrepancies or unauthorized charges. Features like automated bill pay minimize late fees and streamline administrative tasks, leading to overall financial efficiency. Historical data access enables trend analysis, assisting in future financial planning and decision-making.

Further exploration would require specifics on the platform. This general description encompasses the function, but further details depend on the context.

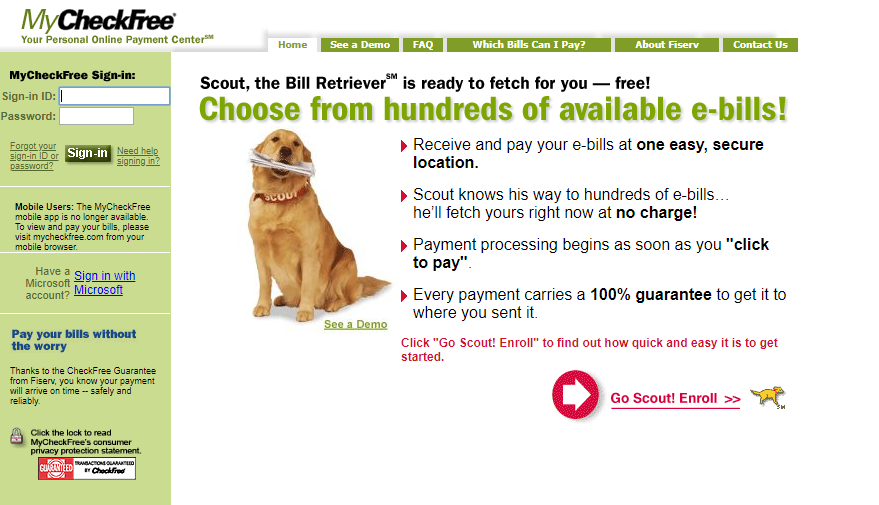

mycheckfree

Understanding the key aspects of this online financial management platform is crucial for maximizing its benefits. This system facilitates financial control and efficiency through various interconnected functions.

- Account access

- Transaction tracking

- Payment management

- Budgeting tools

- Bill pay automation

- Financial reporting

Account access provides users with a centralized view of their financial standing. Transaction tracking allows for detailed record-keeping. Payment management simplifies bill and expense handling. Budgeting tools enhance financial planning. Bill pay automation minimizes administrative tasks. Financial reporting generates insights from transactional data. These functionalities combine to offer a comprehensive financial management solution, allowing users to better control and understand their finances.

1. Account access

Account access within a financial management platform is a fundamental element. This feature empowers users to interact with their financial accounts directly, impacting their ability to manage funds effectively. The specifics of account access, as offered by a particular platform, directly influence its utility and user experience.

- Real-time Balance Information

Instantaneous access to current account balances is crucial for informed financial decisions. This feature allows for swift identification of available funds, aiding in budgeting and expense tracking. In a platform like mycheckfree, this would mean users can view savings, checking, or investment account balances without delay, providing a clear picture of their financial position.

- Transaction History Review

Detailed transaction records are essential for reconciliation and identifying potential discrepancies. Access to comprehensive transaction history permits users to review all financial activity, from deposits to withdrawals and payments. For mycheckfree, this would allow the tracing of each transaction, validating payments and enabling robust accounting.

- Security Measures and Authentication

Robust security measures are paramount when handling sensitive financial data. Account access systems must utilize secure authentication protocols (e.g., multi-factor authentication) to prevent unauthorized access. Ensuring the security of mycheckfree user accounts is paramount, protecting user financial information from theft and misuse.

- Accessibility Across Devices

The ability to access accounts from various devices (computers, smartphones, tablets) enhances flexibility. This feature allows users to manage finances wherever and whenever convenient. This feature of mycheckfree would enable users to manage their finances in real time and respond to transactions or financial needs in a timely and efficient manner.

The effectiveness of account access in a financial management platform, like mycheckfree, hinges on these core functionalities. By providing clear, secure, and accessible views of account details, such platforms empower users to control their finances effectively. The quality of account access directly impacts the platform's value and user experience.

2. Transaction tracking

Transaction tracking, as a core component of financial management platforms, is crucial for maintaining financial integrity and control. Its effectiveness is directly linked to the overall utility of such a platform. A platform like mycheckfree must offer robust transaction tracking to facilitate accurate financial record-keeping. Failure to accurately record and categorize transactions can lead to significant inaccuracies in financial reporting and subsequent planning.

Accurate transaction tracking allows for real-time financial visibility. This visibility is essential for prompt identification of potential discrepancies, fraud, or errors. For example, the platform should allow for sorting and filtering transactions based on various criteria (date, category, merchant, amount). This capability enables users to quickly identify unusual or potentially fraudulent transactions. Furthermore, detailed transaction records provide a historical record of financial activity, vital for budgeting and financial planning. Users can analyze spending patterns over time, identifying areas for potential savings or adjustments to spending habits. Precise categorization of transactions, for example, differentiating between personal and business expenses, is crucial for accurate financial reporting and tax compliance.

Effective transaction tracking within mycheckfree, or similar platforms, is essential for informed financial decision-making. The comprehensive and easily accessible nature of the tracking system is paramount. It fosters a deep understanding of financial activities, enabling users to make informed choices about their finances. Robust transaction tracking directly impacts the reliability of financial information and the overall usefulness of the platform. Consequently, a platform like mycheckfree must prioritize accurate and comprehensive transaction tracking to maintain user trust and optimize its value proposition.

3. Payment management

Payment management within a financial platform like mycheckfree is a critical component, impacting efficiency, accuracy, and overall financial well-being. The capability to manage payments directly influences the platform's value proposition. Effective payment management encompasses various functions, such as scheduling bill payments, tracking payments made, and reconciling transactions. This facilitates timely and accurate financial record-keeping, streamlining the process of managing financial obligations.

The integration of robust payment management tools within mycheckfree allows users to automate bill payments. This automaticity minimizes the risk of late payments, mitigating potential penalties and fees. Automated bill payments also reduce the administrative burden on users, freeing up valuable time for other financial tasks. Real-world examples demonstrate the practical advantages of such automation. Automating mortgage payments, for instance, prevents late payment penalties that can accrue significant interest charges. Similar benefits extend to utility bills and other recurring expenses. Beyond automation, payment management can involve tracking payments made and comparing these with scheduled payments or projected balances. This comparative process aids in early detection of potential issues or errors, empowering proactive financial management.

In summary, effective payment management is indispensable for a comprehensive financial management platform. Its integration into mycheckfree, or similar platforms, offers significant advantages, including reduced risk of late payments, minimized administrative burden, and enhanced financial control. By enabling automation, tracking, and reconciliation, payment management directly contributes to the platform's utility. Understanding the significance of these functions is paramount for optimizing financial performance and ensuring the smooth operation of financial transactions.

4. Budgeting tools

Budgeting tools within a financial management platform like mycheckfree are essential components, impacting financial planning and decision-making. Integration of budgeting tools is vital for optimizing platform utility. The platform's ability to support and facilitate budgeting directly enhances its value proposition.

Effective budgeting tools empower users to establish and track financial goals. Real-life examples demonstrate the practicality of budgeting. Consider a household budget: meticulously tracking income and expenses through a budgeting tool enables informed spending decisions. This avoids overspending in areas like entertainment or dining. With a detailed overview of financial inflows and outflows, users can adjust spending habits to align with their financial objectives. Furthermore, budgeting tools within mycheckfree, or similar platforms, enable users to identify areas for potential savings. For example, identifying unnecessary expenses like streaming subscriptions allows for reallocation of funds towards higher priorities. The platform's capabilities extend beyond simple recording to allow for analysis, enabling prediction of future financial needs. This is demonstrably crucial for large financial transactions like home purchases or investments.

In conclusion, budgeting tools are integral to a robust financial management platform. By providing features for expense tracking and income monitoring, the platform empowers users to achieve financial stability and make informed financial decisions. The insights gleaned from these tools empower users to adjust spending patterns effectively. A platform like mycheckfree that incorporates robust budgeting tools significantly enhances user empowerment and financial acumen, enabling better overall management of personal finances.

5. Bill pay automation

Bill pay automation, a key feature within financial management platforms, plays a significant role in optimizing financial workflows. This automated system significantly impacts the efficiency and reliability of managing recurring payments. In the context of a platform like mycheckfree, bill pay automation enhances the overall user experience and reduces the risk of missed payments.

- Automated Recurring Payments

This feature allows users to schedule and automatically deduct funds from their accounts on predefined dates. Utilities, rent, loans, and subscriptions are common examples. This automation significantly reduces the risk of late payments, which can result in penalties and fees. For mycheckfree, this aspect ensures timely bill payments, minimizing potential negative impacts on credit scores and maintaining financial stability.

- Enhanced Transparency and Control

Automation provides real-time visibility into payment status. Users can track payments made, upcoming payments, and associated transaction details. This transparency allows for proactive management of financial obligations. Within mycheckfree, this capability reinforces user confidence in their financial management by providing a clear view of all scheduled and completed transactions.

- Minimized Administrative Burden

Automated bill payment systems streamline administrative tasks. Manual payment processes are time-consuming and prone to errors. This automation frees up users' time, allowing them to focus on other financial priorities. Within the platform mycheckfree, this automated approach optimizes user time and reduces administrative headaches related to recurring bill payments.

- Reduced Risk of Late Payments

The automated nature of the system significantly reduces the likelihood of late payments. This proactive approach minimizes the risk of associated penalties, maintaining financial discipline. For mycheckfree users, automated bill payments can contribute to overall financial responsibility and improved credit standing.

In conclusion, bill pay automation within a platform like mycheckfree is a valuable tool. It streamlines financial workflows, reduces administrative burdens, and minimizes late payment risks, ultimately contributing to financial well-being. This functionality is a key element for users seeking a reliable and convenient approach to managing their financial obligations.

6. Financial Reporting

Financial reporting, a crucial component within platforms like mycheckfree, provides a structured summary of financial activities. This structured data allows for insightful analysis and informed financial decision-making. The platform's reporting capabilities are integral to the overall functionality, offering users a comprehensive view of their financial health. Comprehensive financial reporting is essential for identifying trends, understanding spending patterns, and monitoring progress toward financial goals. For instance, a detailed monthly report might reveal recurring expenses, highlighting opportunities for cost reduction or reallocation of funds.

The practical significance of financial reporting within mycheckfree, or similar platforms, extends beyond basic transaction summaries. Sophisticated reports can categorize transactions, allowing users to segment expenses by category (e.g., housing, food, entertainment). This segmentation provides deeper insights into financial behavior, facilitating identification of areas for optimization. Further, generating custom financial reports, spanning specific time periods, allows users to monitor progress toward financial targets. For example, a user might create a report highlighting savings achieved over a year, thereby motivating continued savings behavior. The platform's reporting features, when coupled with budgeting tools, enhance the user's ability to formulate and meet financial goals.

In conclusion, financial reporting within platforms like mycheckfree is more than just a summary of transactions. It's a powerful tool for understanding and managing personal finances. Comprehensive reports, encompassing various segments of financial activity and allowing for custom analysis, enable informed decision-making. The integration of reporting functionality fosters greater financial awareness and, ultimately, contributes to greater financial well-being and goal achievement.

Frequently Asked Questions (mycheckfree)

This section addresses common questions about mycheckfree, a platform designed to enhance financial management. Clear and concise answers are provided for improved understanding.

Question 1: What is mycheckfree?

mycheckfree is an online platform that provides tools for managing personal finances. Key features include account access, transaction tracking, payment management, and budgeting capabilities. The system facilitates financial control and transparency through various features.

Question 2: How secure is my financial data on mycheckfree?

Data security is paramount. mycheckfree employs robust security measures, including encryption and multi-factor authentication. These measures protect sensitive financial information from unauthorized access. Maintaining data integrity is a core principle of the platform.

Question 3: What types of accounts can I link to mycheckfree?

mycheckfree supports a range of accounts, typically including checking, savings, and investment accounts. Specific account types might vary depending on the platform's offerings. Comprehensive account support is a significant aspect of the platform's design.

Question 4: Is mycheckfree compatible with various devices?

mycheckfree is designed for use across multiple devices, including computers and mobile devices. Users can access and manage their finances through various devices, optimizing flexibility.

Question 5: What are the costs associated with using mycheckfree?

Pricing structures for mycheckfree can vary. Users are encouraged to review the platform's pricing information and relevant terms of service directly on the website for detailed information regarding costs and access.

In summary, mycheckfree aims to streamline financial management by providing clear access to financial data, facilitating informed decisions. This user-friendly platform is designed to promote greater financial transparency and control. By addressing these FAQs, a clearer understanding of the platform's functions and benefits has been elucidated.

For comprehensive usage instructions and to explore the platform's specific functionalities, please refer to the official mycheckfree user documentation or contact customer support.

Conclusion

The exploration of mycheckfree reveals a platform designed for comprehensive financial management. Key functionalities, including account access, transaction tracking, payment automation, budgeting tools, and reporting features, collectively contribute to an integrated system for financial control. The platform's ability to consolidate financial data, streamline processes, and provide actionable insights enhances user understanding of financial activities. Accurate record-keeping and automation of tasks like bill payments contribute to efficient management of financial obligations.

Ultimately, mycheckfree's success hinges on effective user engagement and integration within existing financial strategies. The platform's robust features are designed to empower informed financial decisions. Users should carefully evaluate their personal financial needs and tailor platform usage accordingly. Continued development and updates are essential for maintaining the platform's relevance and efficacy in a dynamic financial landscape. Prospective users are advised to thoroughly evaluate platform features and functionalities to ascertain alignment with individual financial management priorities. The platform's long-term viability depends on continual refinement and adaptation to evolving user expectations and financial demands.

Detail Author:

- Name : Prof. Athena Blick

- Username : alphonso34

- Email : lorn@spencer.com

- Birthdate : 2000-10-02

- Address : 2775 Nader Fall Suite 184 East Kassandra, HI 38263-2850

- Phone : 352-394-4952

- Company : Hintz-Koelpin

- Job : Adjustment Clerk

- Bio : Rerum rerum alias quia optio. Sit et sint unde qui earum. Quisquam magnam officiis ducimus eaque.

Socials

twitter:

- url : https://twitter.com/nicolasg

- username : nicolasg

- bio : Et ut eveniet dolores. Accusamus delectus cum iste reprehenderit. Odio doloribus fuga nobis.

- followers : 5815

- following : 468

facebook:

- url : https://facebook.com/golden_nicolas

- username : golden_nicolas

- bio : Quis laudantium consequuntur dignissimos quia at iure quidem suscipit.

- followers : 4811

- following : 1505